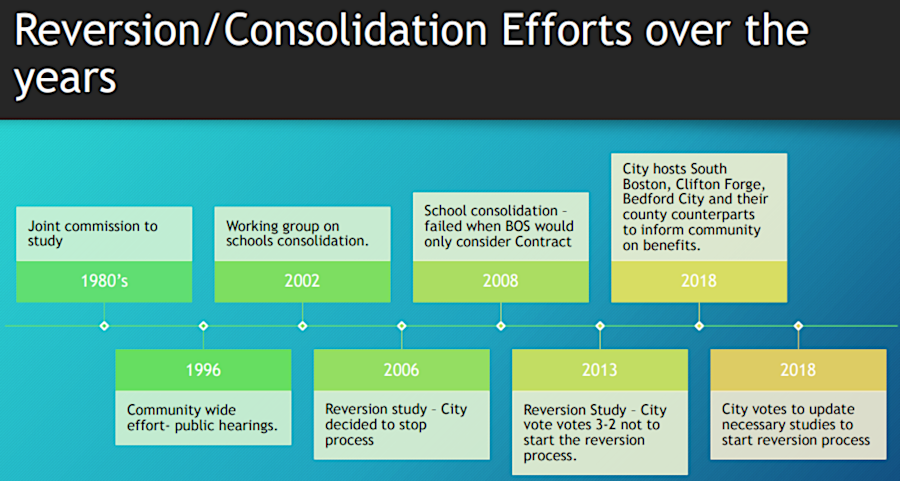

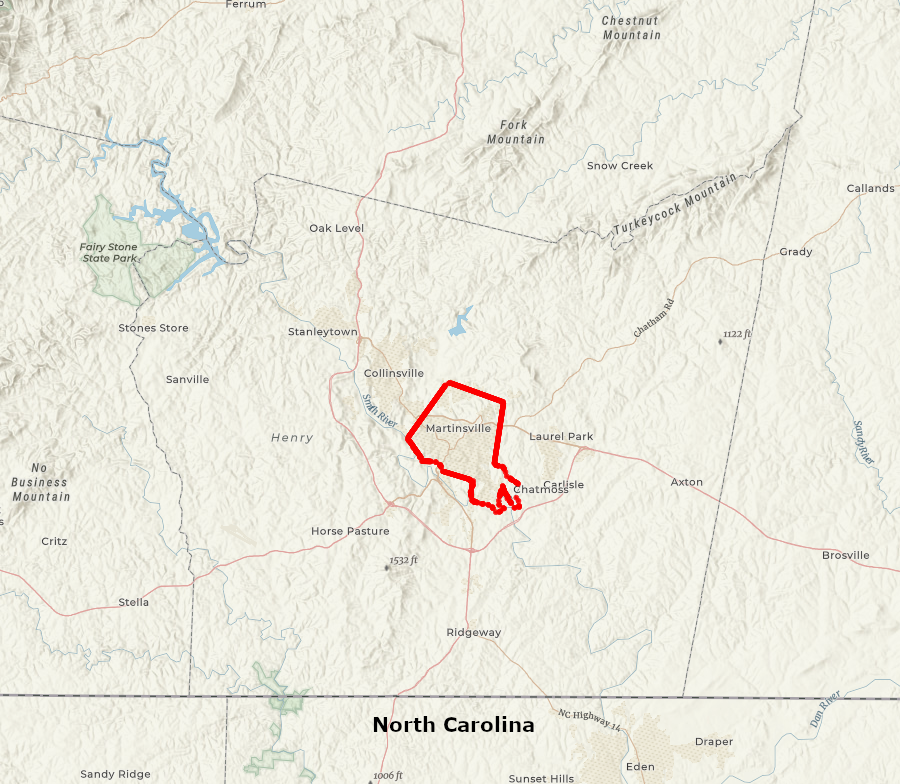

Martinsville and Henry County have considered reversion since the 1980's

Source: City of Martinsville, Reversion Study Presentation November 19 2019 Council Meeting

Martinsville and Henry County have considered reversion since the 1980's

Source: City of Martinsville, Reversion Study Presentation November 19 2019 Council Meeting

In 2005, 2013, and 2016 Martinsville officials considered reversion to town status, anticipating it would result in substantial reductions in taxes. Another reversion effort ended in 2023, leaving Martinsville as an independent city surrounded by Henry County.

The city and surrounding Henry County maintain independent school systems, limiting opportunities to minimize costs for administration and maintenance. Local charitable organizations contributed half of the $40,000 cost for a study to consider consolidating them, but talks ended when Henry County insisted that the study examine only the option of Martinsville contracting with the county for operation of the city school system.

Martinsville's mayor asked Henry County officials in 2017 to discuss cooperative measures to reduce costs, but the county supervisors were not willing to talk until the city developed specific proposals. County residents were reluctant to increase their taxes by having Martinsville revert to town status, and city residents were reluctant to dilute their political authority by merging with the county. The local paper reported a response by the mayor to a citizen's question that provided a lot of wiggle room for changing the city's status:1

That changed in 2019. Despite opposition from Henry County supervisors, who proposed restarting discussions on merging school systems, the Martinsville City Council voted 5-0 to initiate the process of reverting to a town. The mayor said:2

Bill Wyatt in the Martinsville Bulletin reported that at the time, the Henry County property tax rate was $0.555 cents per $100 of assessed value. The tax rate for property within the Martinsville city boundaries was almost double at $1.0621 per $100 of assessed value. An analysis by Martinsville stated that if the city reverted to town status and the county had to provide the same level of services already being received by city residents, then Henry County taxes would have to rise by $0.05 per $100 of assessed value.

City real estate taxes would become town taxes, and they would drop by $0.60 per $100 of assessed value. However, town residents would have to pay county as well as town taxes, so reversion would increase taxes of Henry County property owners by 10% but leave town residents paying the same amount as before reversion. In addition, the city's initial financial assessment did not include the transfer of costs to the county for maintenance and operation of the city's jail.

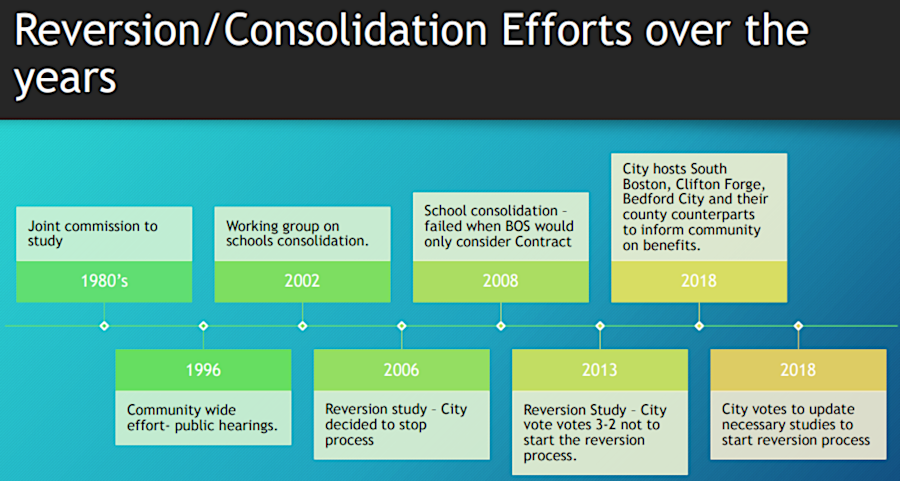

A key factor was the city's higher cost for operating its school system. The number of students in Henry County was projected to decline slightly between 2019-2025, but the city was expected to lose 25% of its school population during that time period. The number of students in Martinsville would drop from 1,942 to 1,407, and operating costs per student would become unsustainably high for the city.3

the number of students in Martinsville was predicted to drop much faster than in Henry County

Source: Troutman Sanders report to City of Martinsville, Transition from City to

Town Status (p.12)

Pushback against reversion and an alternative solution came from the Martinsville Commissioner of Revenue. She emphasized in 2020 that the city was not broke, or at risk of having expenses exceed revenue. The three cities which had reverted to towns, Clifton Forge, Bedford and South Boston, all had populations less than half that of the almost 13,000 residents in Martinsville. In 2020, eight cities and 22 counties had smaller populations, and they were managing to stay solvent.

The Commissioner of Revenue, who had been elected first in 2001, claimed that businesses in Martinsville would have a higher tax rate if the city became a town even if the real estate tax rate was lower. She suggested the city/county could address their financial hardships by consolidating the separate school systems, but offered another alternative:4

If the two jurisdictions consolidated into a city, then her office would be retained and the position of Henry County Commissioner of Revenue would disappear.

After she spoke on December 10, 2019, the City Council voted 5-0 for the city to revert to town status. It adopted the City Manager's perspective that Martinsville was never going to have a tax base adequate to fund revitalization of the city:5

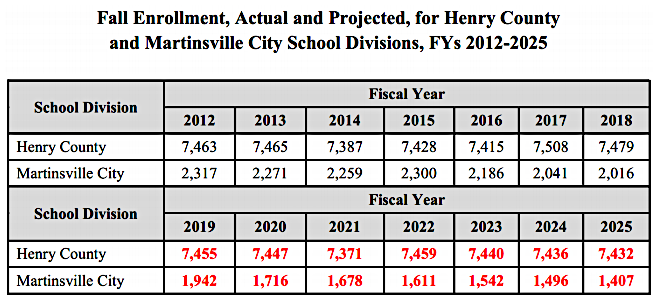

Martinsville is located in the center of Henry County

Source: ESRI, ArcGIS Online

In the 2020 General Assembly, bills proposed to give Henry County veto power over the reversion process. To ensure the new legislation would not be applied retroactively, the Martinsville City Council voted again unanimously in January 2020 approving a resolution memorializing the previous decision:6

As in 2006 and 2014, the General Assembly did not pass a bill that would require Henry County's approval before Martinsville could revert to town status. The city retained the capacity to act, and the county had only the opportunity to react. It created a website with relevant documents and a Frequently Asked Questions (FAQ) page which expressed the county's views, noting that a tax increase of $0.05 per $100 of assessed value to fund a larger school system, housing and managing more inmates, and other "services on which the City makes no money" would be a 10% tax increase for county residents.7

In 2020, the Henry County Board of Supervisors was told that the city's economic condition was strong. It had maintained 10% of its annual budget in reserve, and the four enterprise funds for electric, water, sewer and refuse disposal services had accumulated $6.5 million. The average debt per person was lower than the statewide average.

County officials speculated that the driving force for reversion to town status was the potential for a "Town" of Martinsville to annex land from the county. Cities were blocked from annexation by a statewide moratorium. If Martinsville reverted to town status, then it could expand town boundaries and impose property taxes on additional land starting just two years after the change of status.

City officials argued that their objective was to eliminate duplication of administrative overhead, eliminating some constitutional offices and streamlining operations of schools and the courts. County officials were advised that the county had a different priority:8

The two jurisdictions reached a Voluntary Settlement Agreement (VSA) in 2021 after extensive discussions and mediation. That ended the potential for a lengthy and expensive series of lawsuits.

Henry County agreed to support the conversion of Martinsville from a city to a town. The county decided that it could not block reversion legally or get the General Assembly to intervene, so it bargained instead. The two jurisdictions negotiated the first reversion deal that consolidated school systems. The county agreed to shared taxes from the Martinsville Industrial Park with the future town, and the city agreed not to annex any county property into the town for the next decade.

The attorney representing the city stated at the end of the process:9

The positions of constitutional officers in the city were to be eliminated. The schools, courts, sheriff and jail operations and property were to be transferred from the city to the county, though the county would have to pay rent if it wanted to use the existing courtrooms within the Martinsville Municipal Building. Henry County agreed to create a new magisterial district for the town to elect a member of the Board of Supervisors and the School Board.

The town would retain ownership of its utility system, and Henry County Public Service Authority agreed to continue as a customer. Martinsville would continue to fund its share of costs for regional groups such as the Blue Ridge Regional Library, the Economic Development Commission, the Blue Ridge Regional Airport Authority, and the 911 Communications Center.10

The last sticking point in the negotiations was the date of reversion. The city sought to complete the process in 2022, while the county proposed 2024. They agreed to allow the decision to be made by the Commission on Local Government, or by the three-judge panel appointed by chief justice of the Supreme Court of Virginia. The Commission on Local Government recommended July 1, 2023.11

The negotiated agreement collapsed in December, 2021. The Henry County Board of Supervisors had supported a negotiated deal for reversion by a 4-2 majority, but two members changed their mind and rejected the Voluntary Settlement Agreement in a 4-2 vote. That shifted the process to a contested reversion proceeding. In a lengthy and expensive contested reversion process, lawyers representing Martinsville and Henry County had to ask a panel of state judges to establish new terms for the reversion.

Martinsville immediately notified Henry County that it intended to force reversion through state court action. The letter made clear that the city viewed the Voluntary Settlement Agreement as its last effort to negotiate a deal, and in the upcoming legal process would drive a harder bargain. The city stated that in a contested revision it would retain the right to annex Henry County land two years after reversion, while in the Voluntary Settlement Agreement (VSA) Martinsville had agreed to wait ten years:12

Henry County sought to block reversion by getting new legislation passed by the 2022 General Assembly, SB 85, that would require city voters to approve the shift from city to town status in a referendum. Martinsville proceeded according to existing law, and in February filed a petition in Martinsville Circuit Court requesting the appointment of a three-judge panel to oversee the reversion. Lawyers for Henry County opposed the petition, saying that the county had never approved the Voluntary Settlement Agreement and that appointment of a special three-judge panel would be premature.13

The contested process led to the Supreme Court of Virginia appointing a three judge special court. The judicial process proceeded in parallel with the legislative process. When the three judge court was appointed, the governor was considering whether or not to veto the legislation that would require a vote by Martinsville residents to authorize reversion.

Governor Youngkin signed SB 85. That required the special court to delay a final decision until after the voters of Martinsville had responded to a referendum on the ballot in November, 2022. The General Assembly was specific in phrasing the question for the referendum:14

Martinsville asked the Virginia Supreme Court to rule that the mandate to hold a referendum and obtain city voter approval, as required by SB 85, was unconstitutional. The court rejected the request. Martinsville voters would be required to endorse reversion to town status before the three-judge panel could procede further.15

One sign of the dysfunctional relationship between Henry County and the City of Martinsville was a dispute over wastewater treatment. The Henry County Public Service Authority operated two wastewater plants until they were closed in 2005, when all county sewage was directed to the regional wastewater treatment plant operated by the City of Martinsville.

In 2016, the Virginia Department of Environmental Quality authorized a loan for Henry County to reopen its Lower Smith River Wastewater Treatment Plant. The city objected, claiming that diverting county wastewater away from Martinsville would force the city to increase rates by 25% as well as decrease water quality in the Smith River. In 2023, a judge dismissed the lawsuit bcause the city's claimed injury was too speculative.16

In the November 2022 election, two candidates opposing reversion won races for seats for City Council. That election flipped the 4-1 majority in support of reversion to a 3-2 majority which was opposed. On January 10, 2023, the Martinsville City Council voted 3-2 to end the effort to revert to town status. Highlighting the legal expnses to date, one of the members still supporting reversion argued unsuccessfully:17