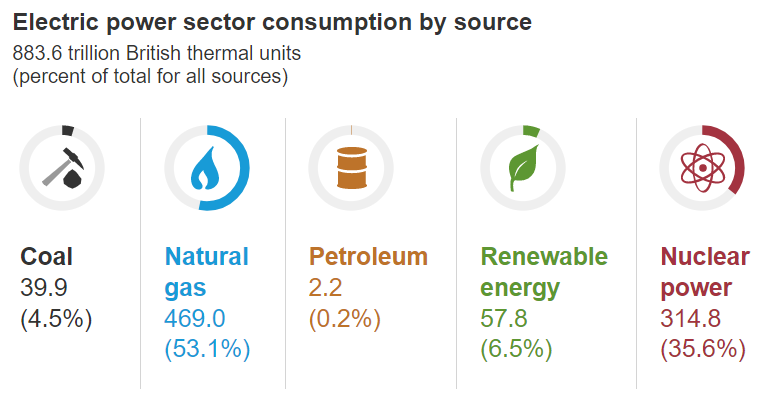

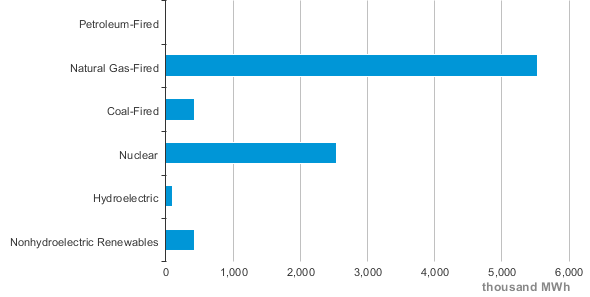

over 50% of electricity in Virginia was generated from natural gas in 2020

Source: US Department of Energy, Virginia

over 50% of electricity in Virginia was generated from natural gas in 2020

Source: US Department of Energy, Virginia

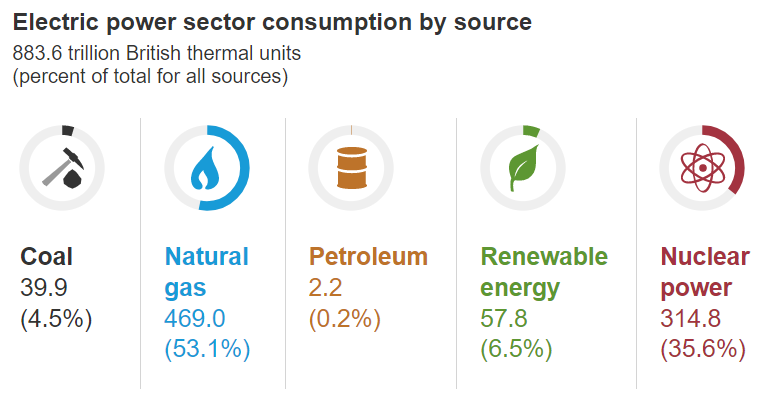

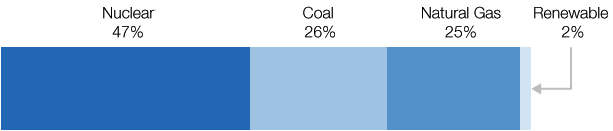

in 2018, the top three fuels for generating electricity in Virginia were natural gas, nuclear, and coal

Source: Energy Information Administration, Net Generation by State by Type of Producer by Energy Source (2018)

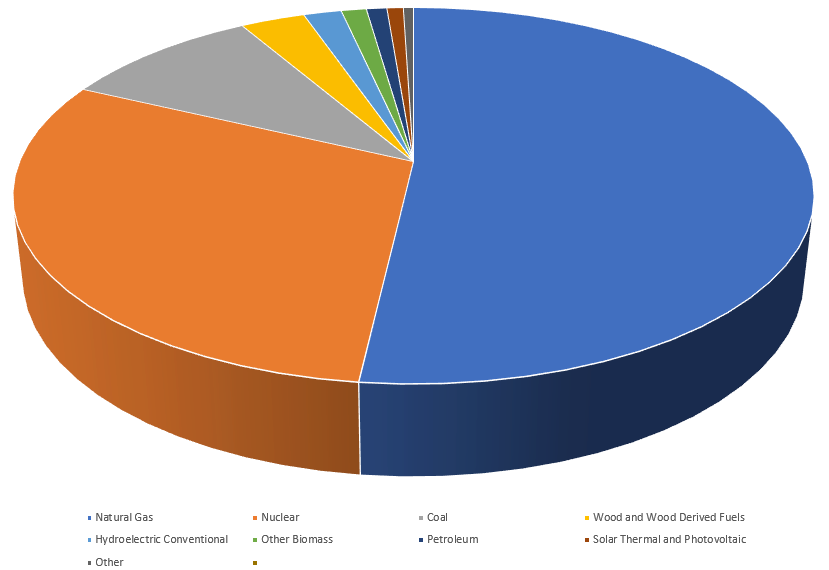

Electricity in Virginia is generated by investor-owned companies, publicly owned utilities, and cooperatives. The electricity is transmitted through a grid of interconnected wires and sold to commercial, industrial, and residential consumers. Government agencies, especially the Federal government's military installations, are major customers as well.

Investor-owned utilities are private, for-profit businesses. Investor-owned utilities sell stock to raise capital, and stockholders typically receive dividends. Stockholders can shape corporate policy through elections to the company board.

State regulatory agencies, such as the State Corporation Commission in Virginia, define the geographic area in which the utility will have a monopoly to provide electricity, minimizing the cost of building the distribution system and avoiding an unsightly tangle of excessive of power lines.

Publicly-owned utilities are managed by government bodies such as the City of Manassas. The government jurisdiction may issue bonds or use revenue from taxes to fund the initial start of a public utility. Typically the fees paid by electricity customers will fund the operating costs of the utility, and repay the initial start-up costs.

Publicly-owned utilities are operated as not-for-profit bureaucracies. Customers who consider the fees to be excessive or wish to redirect policies of the utility can appeal ultimately to elected officials. Unlike elections for the boards of investor-owned utilities, customers shape decisions of publicly-owned utilities through elections to city or town councils. Every voter has equal weight in such elections; there are no stockholder shares to be considered when votes are counted.

Cooperatives are not-for-profit membership organizations. In cooperatives, customers pay to buy/generate power and build a utility's infrastructure such as power lines. If electricity sales exceed a cooperative's costs to purchase/generate electricity, maintain/upgrade transmission infrastructure, and process customer bills, then the customers of the cooperative will get a reimbursement.

In Virginia, the State Corporation Commission serves as the public utility commission. To avoid a monopoly charging excessive prices in the absence of competition, the regulatory agency determines the maximum level of profit that an investor-owned utility and cooperatives may earn, while publicly-owned utilities are accountable to just the voters within their jurisdiction.

separate utilities have been granted a monopoly with the exclusive right to provide electricity within specific areas

Source: State Corporation Commission (SCC), Regulated Companies & Service Map

The State Corporation Commission uses a legal process to hold hearing for "rate cases." After those public proceedings, the three judges on the commission determine the authorized base rate based largely on the investment made in infrastructure, and also rate adjustment clauses (RAC's). Those clauses allow utilities/cooperatives to adjust rates to reflect variable costs such as purchase of fuel, and special costs for projects such as Dominion's Coastal Virginia Offshore Wind project in the Atlantic Ocean.

Minimizing duplication of transmission lines in the distribution of electricity creates a natural monopoly. Customers are captive to their electricity supplier and unable to bargain for a better price from an alternative supplier, so the state regulates the rates:1

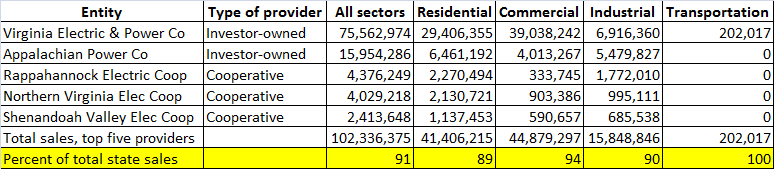

the top two generators of electricity in Virginia are for-profit investor-owned utilities, followed by three non-profit cooperatives

Source: US Energy Information Administration, Virginia Electricity Profile 2014, Table 3. Top Five Retailers of Electricity, with End Use Sectors, Virginia

Dominion Virginia Power (previously known as Virginia Electric Power or VEPCO) is the largest investor-owned utility in Virginia. Appalachian Power is the second-largest. In the mid-1900's, they generated most of the electricity needed to supply customers using coal. Dominion added four nuclear reactors to its generation mix in the 1970's. Their focus after World War II was to increase capacity to meet increased demand, as population and the economy both expanded. Baseload plants provided a guarantee of sufficient electricity 24 hours per day. Hydropower facilities, including pumped storage reservoirs that recycled water, were also utilized to meet the peak demand each morning and evening.

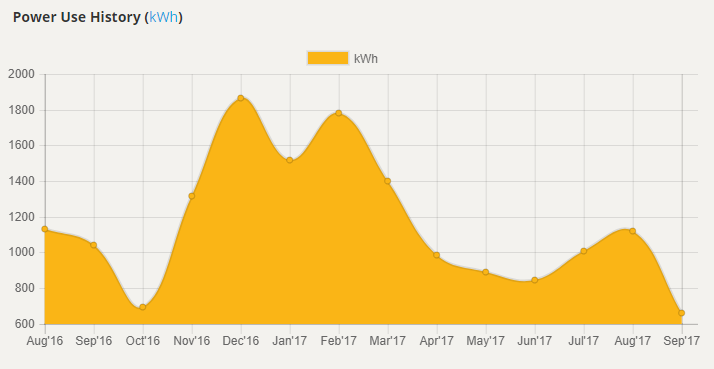

electricity demand varies by customers, with some requiring more to heat a house in the winter than to air condition it in the summer

Source: one customer's profile at Northern Virginia Electric Cooperative

Except in solar panels, all commercial electricity generation facilities in Virginia are designed to convert motion into electricity. Magnets are spun within a circle of wires to create an electrical current, with the spinning force provided by water, wind, or steam that is produced by coal, natural gas, biomass, or nuclear sources.

Transformers at substations located next to generating plants "step up" the voltage produced by spinning magnets. The alternating current can be transported long distances more efficiently at high voltage. In Virginia, there are 750kV, 500kV, 230kV, 138kV, 115kV, and even 69kV transmission lines. The State Corporation Commission (SCC) must issue a Certificate of Public Convenience and Necessity (CPCN) before a regulated utility (typically Dominion Energy or American Electric Power) can build a relatively expensive high-voltage powerline carrying more than 115kV.

Near customers, transformers at another substation "step down" the voltage for delivery to custommers via distribution lines. Distribution lines are not regulated by the State Corporation Commission

Until very recently, elctricity had to be used when it was generated. A grid of transmission wires Only in the 21st wqere batteries constructed that were capable of storing large amounts of electricity measured in megawatt-hours.

Generating plants were built in two types of locations in the last century. Some power plants were constructed near urban clusters with a large number of customers. Those plants were fueled by coal hauled to those facilities by train (such as the Potomac River Generating Station in Alexandria and the Chesterfield Power Station), or by coal and petroleum brought to the facility by barge (such as Possum Point in Prince William County and the Yorktown Power Station).

Other generating plants were constructed near the coal mines. About 1/3 of electricity used in Virginia is "imported," primarily from coal-fired power plants in West Virginia. For example, Dominion Virginia Power's coal-fired power plant at Mount Storm is located just across the state line in West Virginia, but transmits 1,600 megawatts (MW) of electricity almost exclusively to customers in Virginia.2

in 2012, Dominion generated 2% of its electricity from renewable resources - far short of the Renewable Portfolio Standard of 15% (excluding nuclear)

Source: Dominion, 2012-2013 Citizenship & Sustainability Report

Nationwide there is a surplus of electrical generation capacity, in part due to regulatory requirements to ensure an adequate supply at times of peak demand and in part due to energy efficiency measures to reduce demand. New generation capacity from renewable power sources, especially wind and solar, is disrupting the traditional pattern of supply and demand in electricity.

Until the 21st Century, utilities traditionally estimated future demand based on models of population and economic growth, then constructed new facilities to meet that projected demand. The new Secretary of Energy announced in 2001 after the Bush Administration took office:3

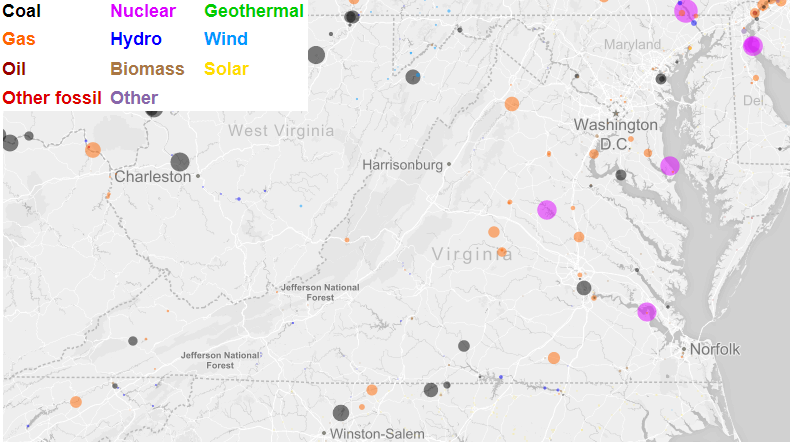

location of facilities that generated electricity in 2016, before large solar facilities were built

Source: Daniel V. Schroeder, Weber State University

That crystal ball, like so many others in the energy business, was cracked. The 1973 OPEC oil embargo had stimulated new energy efficiency efforts, breaking the old link where economic growth required additional energy. Better-insulated buildings, more-efficient computerized machinery in factories, and EnergyStar appliances changed the pattern. Demand for electricity no longer increases automatically as population grows; implementation of energy efficiency measures has reduced per-capita use significantly.

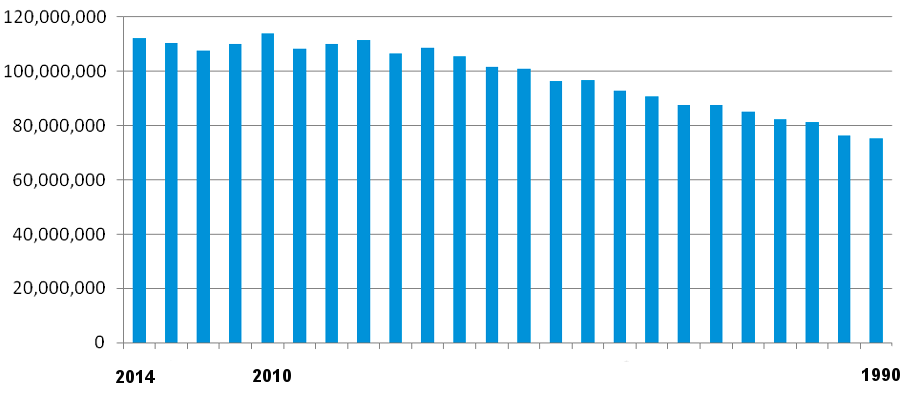

total electric industry retail sales in Virginia peaked in 2010, and sales have flattened despite population growth and economic recovery after the 2008 recession

Source: US Energy Information Administration, Virginia Electricity Profile 2014, Table 10. Supply and disposition of electricity, 1990-2014 (million kilowatt hours)

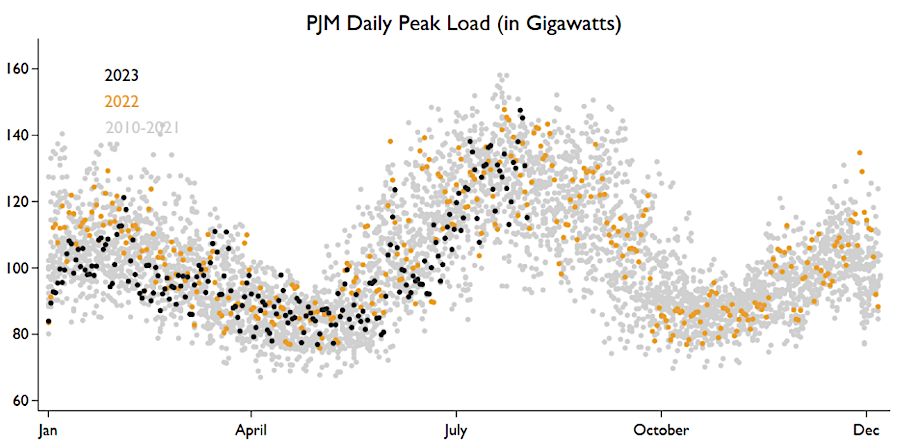

In Virginia, the demand for electricity will grow as data centers are built and as cars/trucks convert from use of fossil fuels to elcricity. The steady demand a data centers and the potential for recharding electric vehicles during the night could affect the pattern of peak daily demand, based on when people use appliances in the morning getting ready to commute to work and in the evening when heating/air conditioning demand increases between 5:00-9:00pm.

Even the seasonal pattern of peak demand could be affected. The percntage of overall demand caused by households will drop, as the percentage of demand increases from data centers and transportation.

demand for summer air conditioning creates a peak in August

Source: Energy Institute Blog, UC Berkeley, Are Record Temperatures Causing Record U.S. Electricity Consumption? (by Lucas Davis, July 31, 2023)

Solar panels on individual rooftops could depress demand from centralized power plants in the future, but generation from wind turbines is already affecting prices. Texas utilities generated so much electricity from windpower in 2015 that customers received it for free, but transmitting that surplus electricity to Virginia was not feasible.4

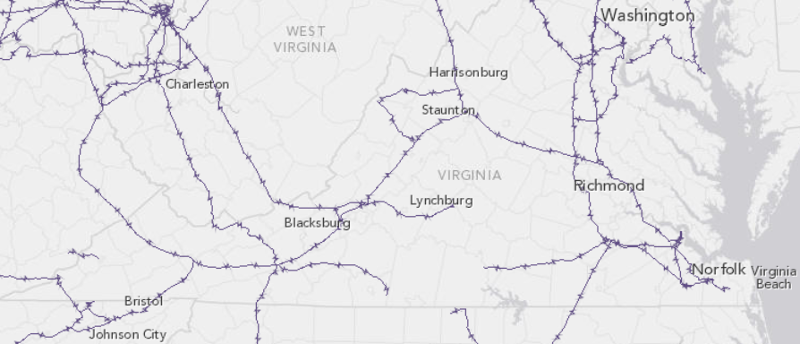

Moving electricity from generating plants in areas of surplus capacity to customers requires an extensive network of wires. Long-distance transmission is done at high voltage to reduce loss from the natural physical resistance of wires. Importing electricity into Virginia from Texas is not cost-effective.

Virginia imports electricity since it uses more than it produces, through a grid that includes high-voltage power lines at 345kV or greater

Source: US Energy Information Administration, U.S. Energy Mapping System

Dominion Virginia Power and Appalachian Power prefer to control costs by building their own power plants, matching generating capacity with projected demand over the next 20 years, rather than purchasing electricity from third parties on shorter-term contracts that might need to be renewed when prices have hit a peak. When investor-owned utilities plan to build new generating plants to meet projected demand, the utilities must obtain approval of the State Corporation Commission (SCC), a state regulatory agency with three commissioners elected by the General Assembly for six-year terms.

The major capital costs of building new transmission networks also requires state approval, since the rates charged to customers are based in part on an investor-owned company's costs to provide reliable service.

"Ratepayers" are customers of the utility who are paying for electricity services. Taxpayers do not fund infrastructure investments by investor-owned utilities or cooperatives. Municipal electrical systems theoretically could use local tax revenue for operations and capital costs, but elected officials responsible for municipal systems traditionally require the utilities to be self-supporting.

Requiring approval by the State Corporation Commission (SCC) for new infastrucure reduces the risk of an investor-owned utility over-building its infrastructure, and then over-charging its customers. The State Corporation Commission is not overseeing non-profit utilities. The review process is designed to ensure that rates charged by utilities will exceed the utilities' costs, generating a profit for the shareholders of the utility.

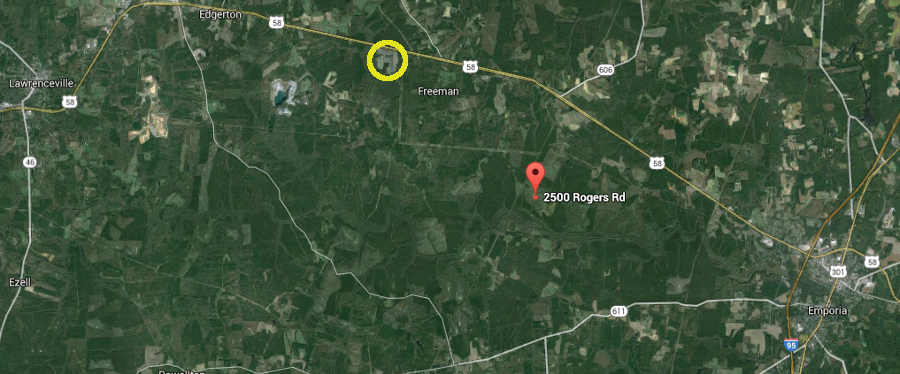

For example, in 2016 the State Corporation Commission approved Dominion Virginia Power's plan to construct a $1.3 billion facility in Greensville County that will use natural gas to generate 1,600MW of electricity. Together with that authorization came SCC approval for the utility to bill its customers an addition $0.75/month on average. That rate adjustment clause allowed Dominion Virginia Power to earn a 9.6% profit on the $1.3 billion invested in the Greensville County power plant.5

Dominion Virginia Power's 1,600MW power plant in Greensville County will be constructed five miles east of the 590-megawatt Bear Garden Power Station completed in 2011 (yellow circle)

Source: Google Earth

Construction of new data centers and the transition to electric vehicles (EVs), in addition to continuing population growth, will increase the need for new generation and transmission infrastructure both within Virginia and connecting to neighboring states. Enhanced insulation, energy-efficient appliances, and contruction of geothermal systems for space heating at individual buildings will not offset all of the increasing demand. Dominion Energy reported in 2023:6

Some additional electricity will come from solar panels installed by individual homeowners and businesses, but most will be provided by independent power producers and utilities. Those power plants may be located outside Virginia, with electricity transmitted to Virginia customers through the grid overseen by the PJM regional transmission organization (RTO).

The technology on the grid will have to be updated to manage distributed energy resources ("DERs") and targeted demand-side management ("DSM"). New transmission and distribution corridors will have to be carved through the landscape to deliver electricity to new "load centers," including EV charging stations in isolated areas that will replace gas stations.

In addition to the $9.6 billion Coastal Offshore Wind Project in the Atlantic Ocean near Virginia Beach, new generation will come from utility-scale solar facilities and perhaps small modular reactors (SMRs). The 2022 Update to Dominion Energy's 2020 Integrated Resource Plan (IRP) presumed small modular reactors would be available within a decade. Since they provide carbon-free and reliable "dispatchable" electricity (in contrast to wind and solar generation), small modular reactors were included in four of the five alternatives in the IRP. Planning assumed that one 285MW reactor could be completed per year, starting in 2034.

Three alternatives assumed the General Assembly would relax the requirement in the Virginia Clean Energy Act to eliminate generation from fossil fuels in 2045. Alternative A assumed new natural gas facilities would be constructed, while Alternatives B and C assumed that existing natural gas generation would continue past 2045.7

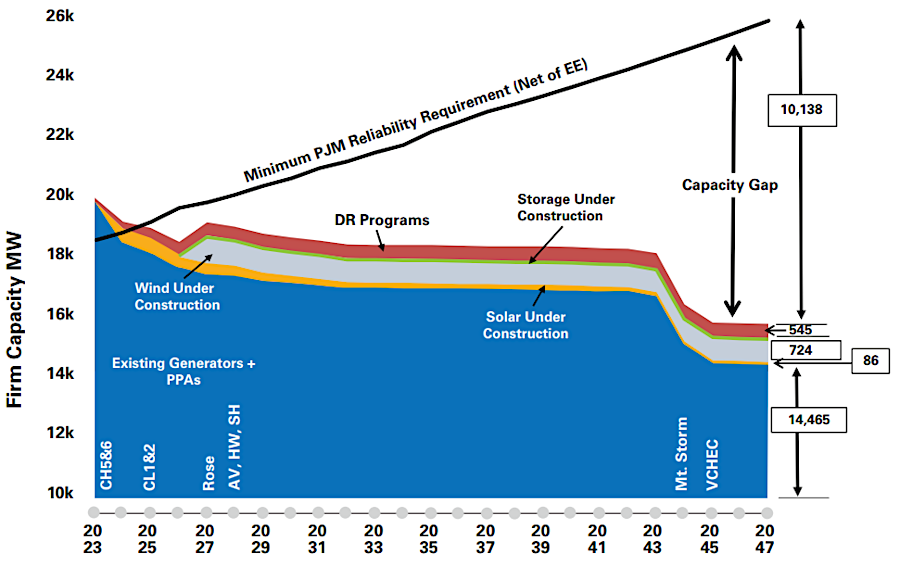

Dominion projected its need to acquire additional electricity from 2023-2047, accounting for increased demand and retirement of all generation facilities using fossil fuels by 2045

Notes: PPAs=power purchase agreements; DR=demand response; EE=energy efficiency; CH5&6=Chesterfield Units 5 & 6 (coal); YT3=Yorktown Unit 3 (oil); CL1&2=Clover Units 1 & 2 (coal); Rose=Rosemary (oil); AV=Altavista (biomass); HW= Hopewell (biomass); SH=Southampton (biomass); VCHEC=Virginia City Hybrid Energy Center (coal/gob/biomass)

Source: Dominion Energy, 2022 Update to Dominion Energy's 2020 Integrated Resource Plan (Figure 2.1.1, Current Company Capacity Position 2023 to 2047)

For decades, the State Corporation Commission, the successor to the Board of Public Works and the state railroad commission, has controlled the utility rates charged to customers. As part of the approval process, the State Corporation Commission required the utility companies to build enough generating plants to ensure customers would have a reliable supply of power. In exchange, the companies got exclusive rights to sell electricity in certain portions of Virginia. By design, the regulatory process authorizes rates high enough to ensure a steady dividend is paid to the investors in a for-profit utility company.

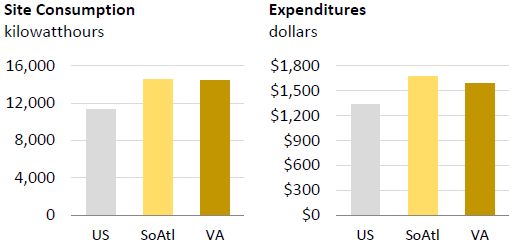

in 2009, the average Virginia household spent over $1,500/year on electricity, a lower amount than households in other South Atlantic states

Source: Energy Information Administration, Household Energy Use in Virginia

In the 1980's, the Federal Government and the State Corporation Commission encouraged purchase of power from non-standard sources rather than construction of new power plants. The "avoided costs" of not having to borrow money and build new facilities were incorporated into the contracts. By 1999, 20% of the electricity available to Virginia Power (now Dominion Resources) was from contracts with non-utility generators such as solid waste incinerators and pulp mills.

This approach appeared to minimize waste ("why put wood chips in a landfill if you can burn them for power?") and reduce the costs to rate-payers. However, it locked the utility company into long-term contracts for high-cost electricity. Proposals for deregulation threaten to change the rules of the utilities game.

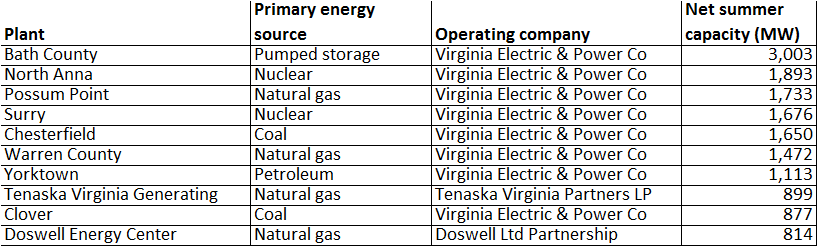

Virginia has a mix of energy sources for generating electricity, including a pumped storage plant that uses hydropower to generate electricity at periods of peak demand

Source: US Energy Information Administration, Virginia Electricity Profile 2014, Table 2. Ten largest plants by generation capacity, 2014

New investment in generating electricity from hydropower is unlikely. There are few remaining sites suitable for generating electricity by hydropower; the environmental impacts would be too high.

However, old coal mines might be used for a new pumped storage facility. The state already has two large pumped storage facilities. The Smith Mountain Project owned by Appalachian Power has a capacity to generate 636MW. The Bath County Pumped Storage Station owned by Dominion Virginia Power can produce 3,003MW.

Windpower is still marginally utilized in the state, compared to pre-Depression days when windmills were common on farms. Wind turbines could become "bird Cuisinarts," and Virginia is on the Atlantic flyway.

Co-generation associated with chip mills or paper mills is a source of power as well as way to reduce the wood waste. New industrial facilities that could generate electicity are rare, and far too little electricity would be available from that source to meet the predicted increase in demand.

Coal is plentiful in Virginia, and until the 1990's was the primary fuel for generating electrical energy as well as the preferred source for powering major industrial facilities. Today, utilities and other users of fossil fuels are reducing carbon dioxide emissions substantially to reduce global warming. The Obama Administration, after several court rulings, treated carbon dioxide as a pollutant to be regulated by the Clean Air Act restrictions along with ozone, particulate matter, carbon monoxide, nitrogen oxides, sulfur dioxide, and lead.

For 50 years after World War II, coal was the most popular fuel for new power plants in Virginia. Coal was cheap and plentiful, easily transported by rail from mines to power plants in urban areas. In 1949, a coal-fired power plant was built on the shoreline of the Potomac River in Alexandria, and 20-plus years later the Possum Point plant was constructed downstream in Prince William County. However, use of coal to generate electricity will be limited in the future, due to both CO2 pollution concerns and basic economics.

by June 2019, only 10% of the electricity in Virginia was generated by coal-fired power plants

Source: US Energy Information Administration, Virginia State Profile and Energy Estimates (September 2019)

After the development of shale gas resources, natural gas displaced coal as the low-cost source for generating electricity. Gas from the Gulf of Mexico and from shale beds in the Ohio River Valley is not as vulnerable to disruption due to overseas political conflicts. Most gas pipelines run from Texas and Louisiana through Virginia's Piedmont to New York, so new power plants east of the Blue Ridge can be supplied easily with natural gas. The 2014 "Integrated Resource Plan" of Dominion Resources, describing plans for future facilities, was blunt:8

in 2016, the State Corporation Commission approved plans by Dominion Virginia Power to build the $1.3 billion, 1,588-megawatt Greensville Power Station, designed to use natural gas to generate electricity

Source: ESRI, ArcGIS Online

Solar, wind, power and nuclear power plants offer the alternative fuel for utilities to generate electricity without carbon. It is harder to dispatch electricity reliably from solar and wind sites, but natural gas facilities might ramp up fast enough to maintain voltage on the grid. The spokesperson for the Panda natural gas plant near Leesburg observed in 2017:9

Nuclear energy is never going to be "too cheap to meter" as promised in the 1950's, but Virginia has two nuclear power plants. Their four nuclear reactors supply some of the cheapest power in Virginia now, and it is carbon-free.

in 2018, 36% of the electricity in Virginia was generated by nuclear power plants

Source: Energy Information Administration, Virginia

All the uranium used in thse four reactors comes from sources outside Virginia. The world was awash in cheap uranium when nuclear weapons were being decommissioned, and Virginia has a massive uranium deposit in Pittsylvania County at Coles Hill. The Three Mile Island disaster in 1979, Chernobyl in 1986, and the Fukushima meltdowns in 2011 have all contributed to public opposition to building more nuclear reactors.

Dominion Virginia Power has plans to construct a third reactor at North Anna in Louisa County. The utility is anticipating that the Federal government will finally construct a repository somewhere to store the radioactive waste, and that public fears of nuclear power can be overcome.

If the priority for building a new nuclear plant was to find a location downwind from population centers, then the Eastern Shore would be the most suitable site. However, nuclear plants have traditionally been sized to generate 800-1,000MW each, due to economies of scale. There is no demand for such a quantity of electricity on the Eastern Shore; it lacks urban centers and industry, and the transmission lines there could not send electricity to Hampton Roads.

Governor Youngkin's 2022 Virginia Energy Plan proposed building a small modular reactor in Southwest Virginia. That region also lacked demand, but the governor was trying to increase economic development and expand the property tax base for local governments there. The electricity from a nuclear reactor located on a former coal mine, or on the Eastern Shore, could be carried by transmission lines to customers connected to the grid.10

Customers seeking to purchase electricity generated from just renewable sources can purchase Renewable Energy Credits from utility providers. The largest utility in Virginia, Dominion, offers Green Power certificates that documented the company has purchased electricity generated from wind, solar, or biomass sources.

In 2016, the additional cost for Dominion Energy's Green Power certificates was 1.3 cents ($0.013) per kilowatt-hour (kWh). For the Northern Virginia Electric Cooperative (NOVEC), certificates cost $.015 per kWh.11

By 2023, however, it was questionable whether the Renewable Energy Credits approach actually stimulated faster investment on renewable generation facilities. There were concerns that sellers of REC's were compensated for developing solar/wind facilities that generated low-cost electricity - and would have been constructed anyway, due to standard capitalism market forces.12

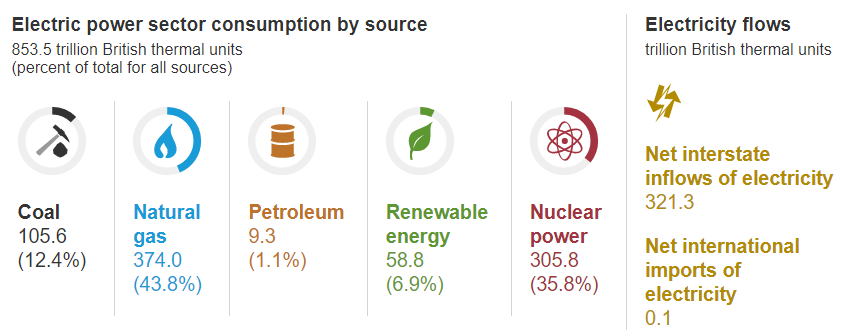

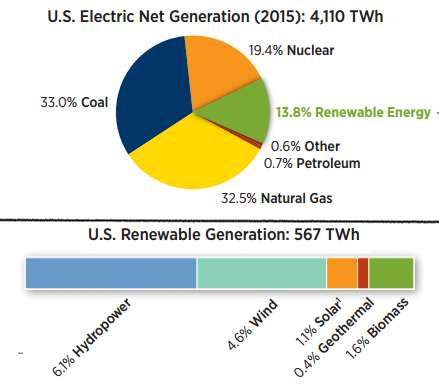

hydropower and wind generate most of the renewable electricity in the United States

Source: US Department of Energy, 2015 Renewable Energy Data Book (U.S. Electricity Nameplate Capacity and Generation)

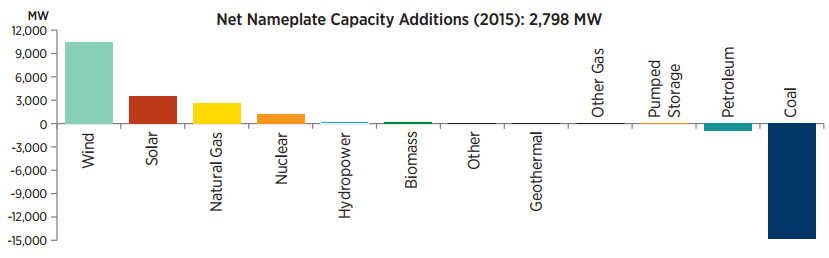

coal-fired power plants constructed after World War II are being retired and replaced with renewable energy facilities

Source: US Department of Energy, 2015 Renewable Energy Data Book (U.S. Electricity Generating Capacity Additions and Retirements)

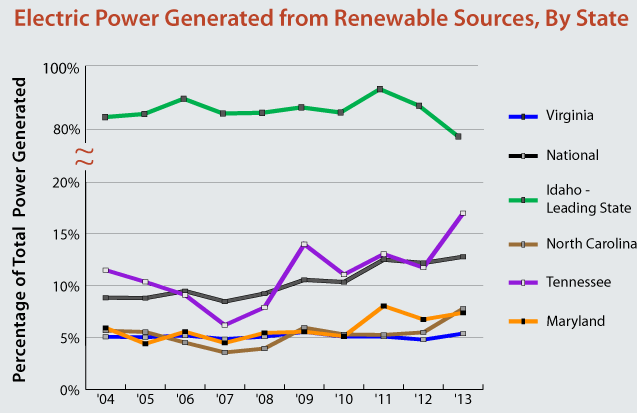

Virginia generates a lower percentage of electricity from renewable resources than the national average or the adjacent states of North Carolina, Tennessee, and Maryland

Source: Virginia Performs, Energy

Yorktown Power Station, with coal conveyor on left, air quality control equipment to manage fly ash/flue gases next to stack, and cooling canal in foreground

Source: Dominion Power, Yorktown Power Station

the Coastal Virginia Offshore Wind project is much larger than the five-turbine Block Island project

Source: US Department of Energy, Top 10 Things You Didn’t Know About Offshore Wind Energy (August 30, 2021)