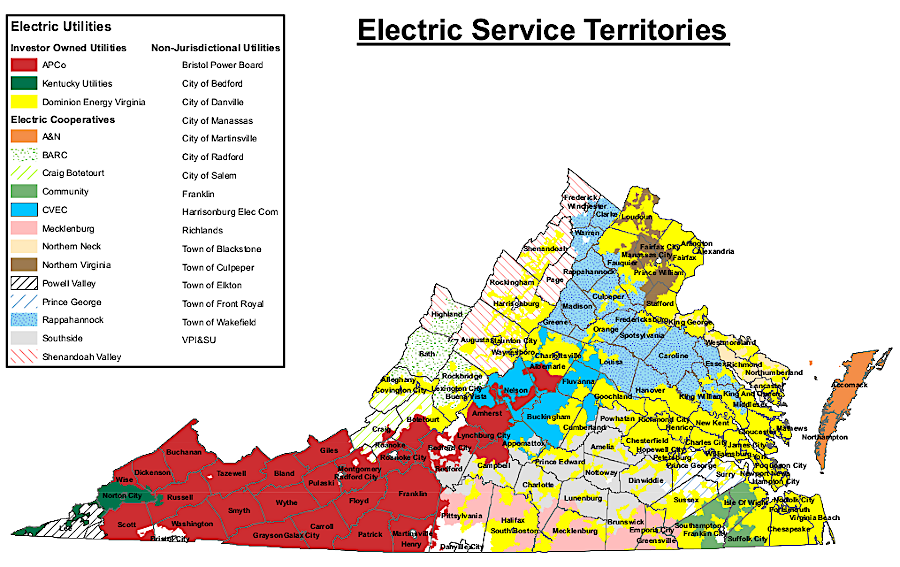

three investor-owned utilities and 13 electric cooperatives have a monopoly on serving most customers within defined geographic areas

Source: State Corporation Commission, Electric Service Territories

three investor-owned utilities and 13 electric cooperatives have a monopoly on serving most customers within defined geographic areas

Source: State Corporation Commission, Electric Service Territories

Three investor-owned utilities provide electricity within Virginia. All three are public corporations, owned by shareholders who buy and sell the stock of the utility companies based on expectations of profits. In contrast, municipal utilities are owned by local governments and electric cooperatives are owned by their customers.1

Dominion Energy, a subsidiary of Dominion Resources, provides electricity 2.5 million Virginia customers. Roughly 2//3 of all Virginia households purchase electricity from Dominion Energy.2

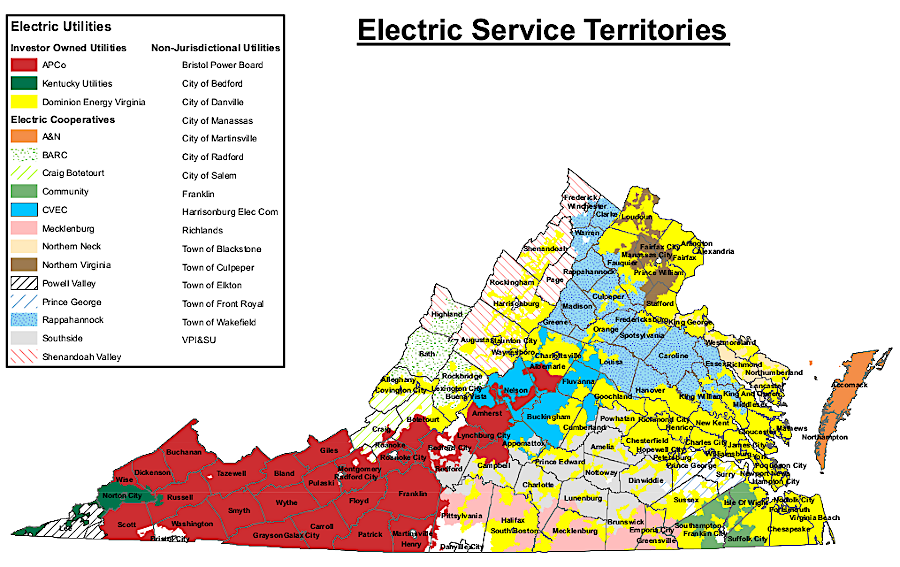

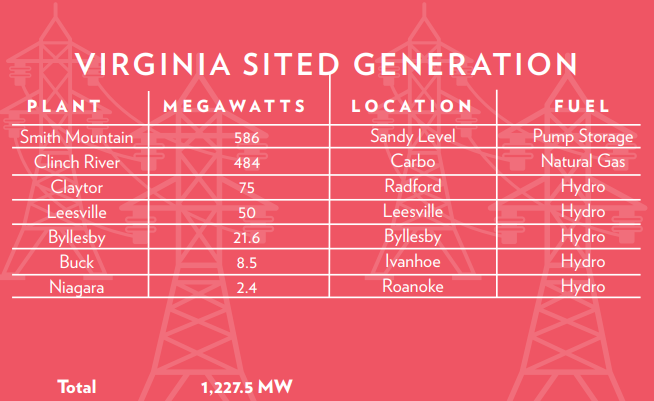

Appalachian Power, a subsidiary of American Electric Power, has over 530,000 customers in the state. In 2020, it had 7 generating facilities located in Virginia. Only one within the state relied upon fossil fuels, but the majority of the utility's generation came from coal-fired power plants in West Virginia.

Two of the generators at its last coal-fired power plant in Virginia, at Clinch River, were converted to natural gas in 2014 in order to meet Mercury and Air Toxics Standards (MATS) standards. The third generator there was retired. When the Clinch River plant first opened in 1956, former Governor John Battle noted that the investor-owned utility would pay taxes on the facility:3

three investor-owned utilities and 13 electric cooperatives have a monopoly on serving most customers within defined geographic areas

Source: Appalachian Power, Appalachian Power in Virginia

The smallest investor-owned utility in Virginia is Old Dominion Power, a subsidiary of Kentucky Utilities since 1926. It serves only 30,000 customers in Wise, Lee, Russell, Scott and Dickenson County, plus others in West Virginia and Tennessee. Kentucky Utilities is part of PPL Corporation, one of the largest regulated utility companies in the United States.

In 2025, Wise County officials proposed creating a local electric authority. It would be independent from Old Dominion Power. County leaders emphasized the benefits of having the ability to approve a new electricity generation plant in order to attract new industry. Voters rejected the proposition, citing a lack of clarity regarding the county potemtially supporting data centers or nuclear reactors.

The executive director of the Wise County Industrial Development Authority, a supporter of establishing a new electric authority, said:4

The State Corporation Commission (SCC) regulates the rates of the investor-owned utilities. The state agency must approve major capital investments, since rates are based on a percentage of utility infrastructure within Virginia for generation and transmission of electricity. In return, the State Corporation Commission has granted each utility a monopoly for serving almost all customers within a specific geographic region.

Even the total amount of solar-generated electricity from panels placed on houses is constrained by law in Virginia, in order to protect the market for the investor-owned utilities to sell their product. In 2020, the General Assembly raised the cap on the total amount of net metered solar electricity that could be generated within the state from 1% to 6%.

Legislators also increased the cap on third-party power purchase agreements (PPAs). New projects were not possible after the limit of 50MW within Dominion's territory was reached in 2019. A new cap within Dominion's monopoly was established at 500MW, plus another 500MW for schools and public facilities. The total cap within Appalachian Power's smaller territory was set at 40MW. No cap was defined for the area served by Old Dominion Power (Kentucky Utilities).5

When the three investor-owned utilities want to raise rates, they file the equivalent of a lawsuit. The three members of the State Corporation Commission are judges who make a legal decision. By law, they have nine months to act.

In 2020, as the coronavirus pandemic forced closure of most businesses, the State Corporation Commission acted on a rate hike request by Old Dominion Power just in time to meet the deadline. The judges reduced the requested increase in electricity rates by 30%, but still approved a new rate which would increase the average customer's bill by 15%. An SCC spokesperson explained:6

In addition to an increase in "base rates," utilities can file for a "rider," also known as a "rate adjustment clause" (RAC). A third factor which alters the monthly customer bill is called "fuel charges," which go up or down as market prices change for oil, gas, and coal primarily. Utilities make profits from base rates and riders, but not from changes in fuel charges. Fuel charges never change for electricity generated by solar panels and wind turbines.

Between 2000-2007, Virginia experimented with deregulating the electricity market. Companies generating electricity could compete, advertising for customers to make a choice of electricity suppliers based on price and service. he transmission and billing portions of the business remained basically unchanged. The experiment was not considered a success, and Virginia re-regulated that part of the business in 2007.

After re-regulation, Dominion Energy was authorized to set rates high enough to earn a 10% return on investment for building generation and transmission facilities, plus annual maintenance and operations costs. Adjustments to the base rates via an rate adjustment clause, typically for changes in its infrastructure, were also allowed to be high enough to earn a 10% profit.

When Dominion Energy has filed for a rate adjustment clause, much of the essential data to justify the increase is declared to be proprietary. The confidential information is shared only with those directly involved in the case, and kept from the general public. Reviewers not associated with an investor-owned utility have suggested that the process creates an incentive for the utility to shift costs from its base and be allowed to double-charge the public via the new rate adjustment clause. The result could be a 20% profit for actual environmental compliance costs, such as closing coal ash ponds.7

Chesterfield coal-fired power plant

Dominion Energy recruits large customers who will purchase electricity within its service area, by advertising high reliability and low cost

Source: Dominion Energy, Our Vision: Building a Clean and Sustainable Energy Future

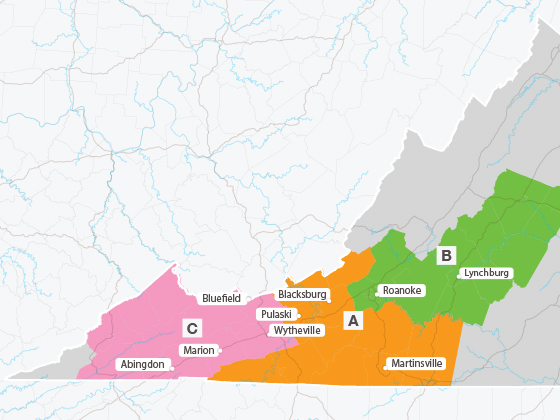

Appalachian Power had defined three regions within Virginia

Source: Appalachian Power, External Affairs - Virginia Service Areas