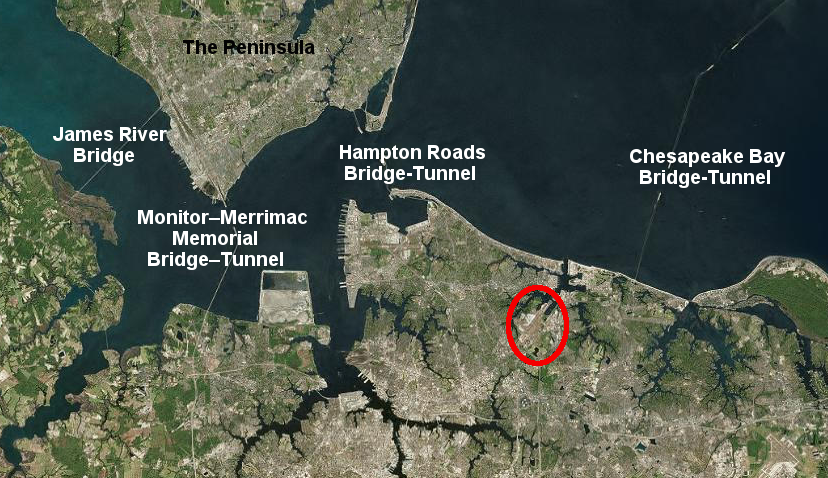

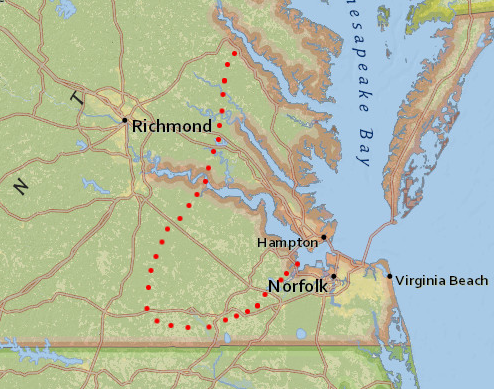

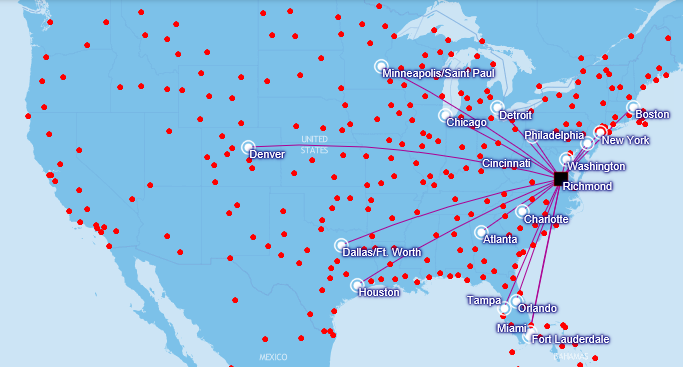

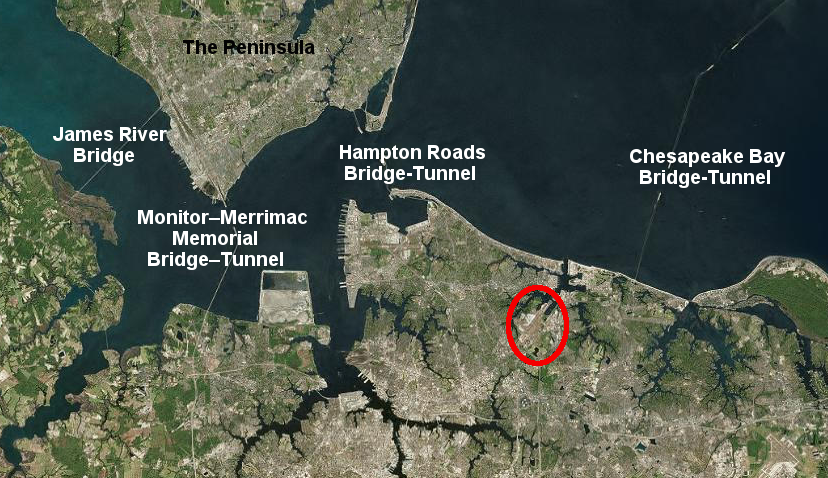

Peninsula residents who fly out of Norfolk International Airport (ORF) must cross the James River via congested bridges or bridge-tunnels

Source: ESRI, ArcGIS Online

Peninsula residents who fly out of Norfolk International Airport (ORF) must cross the James River via congested bridges or bridge-tunnels

Source: ESRI, ArcGIS Online

There is a fragmented rather than regional approach to airport development in the Richmond/Hampton Roads area. The three separate airports in Richmond, Newport News, and Norfolk are a one-hour drive from each other, with Newport News in the middle. The airports are managed by three different agencies, not a regional authority. Each airport is tied to the competing business communities of its local area.

The airport commissions that manage Richmond International Airport (RIC), Newport News/Williamsburg International Airport (PHF), and Norfolk International Airport (ORF) continue to fund upgrades of their separate facilities. They compete for business, and split the customer base between them.

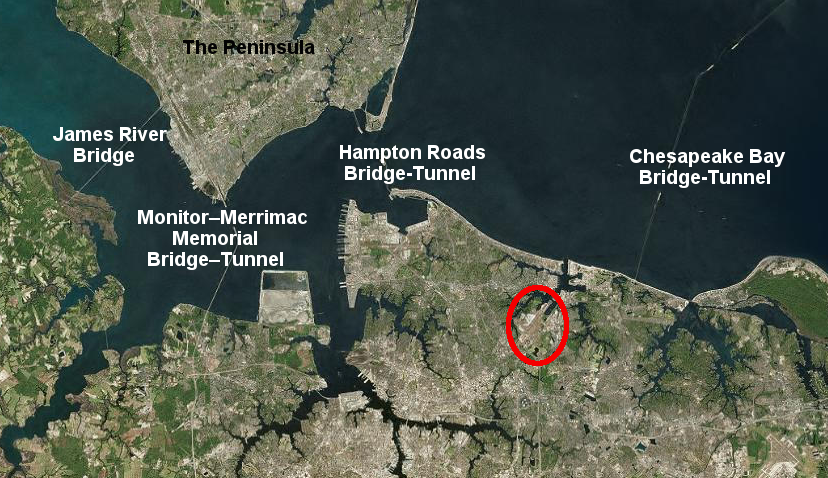

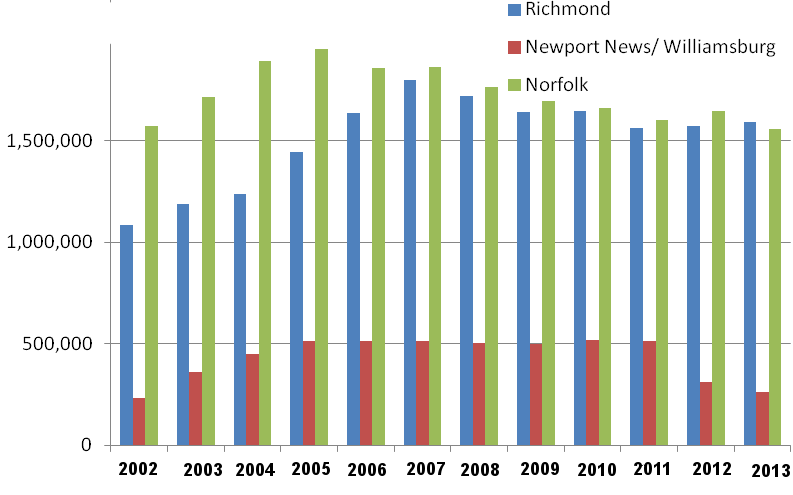

The Newport News/Williamsburg airport is 60 miles east of the Richmond airport and 30 miles north of the Norfolk airport, and local officials around each airport are focused on economic development of their separate jurisdictions. Richmond International Airport (RIC) has about 10-15% more passengers than Norfolk International Airport (ORF). Newport News/Williamsburg International Airport (PHF) has, by far, the least traffic of the three airports.1

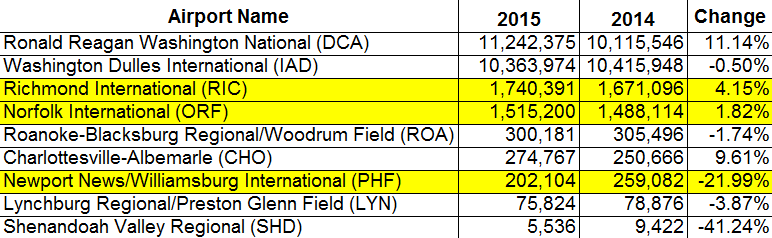

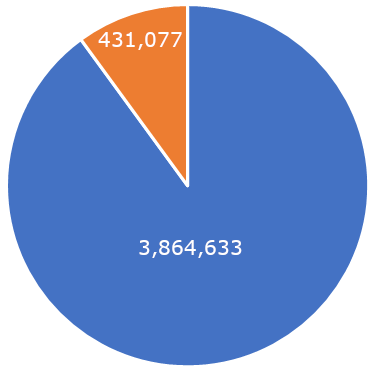

airports in Richmond and Norfolk have far more passengers getting aboard a scheduled flight (enplanements) that Newport News

Source: Federal Aviation Administration, Enplanements at All Commercial Service Airports (by Rank)

Economically, the I-64 corridor from Richmond to Norfolk might benefit if travel was concentrated at just two airports. Politically, there is no advantage for officials on the Peninsula to close the Newport News/Williamsburg airport in order to encourage more airlines to establish hubs in Richmond and Norfolk. Newport News would suffer economically in the long run if lacked scheduled airline services, even the limited connections to other cities that airlines will provide in such a fragmented market.

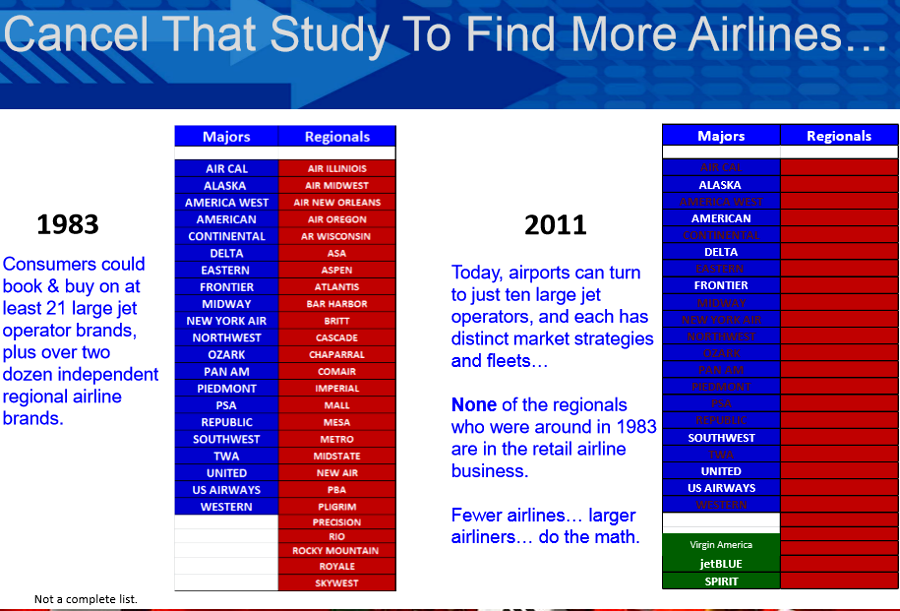

By 2016, airline consolidations had reduced competition and (nationwide) over 75% of passengers were carried by the four carriers servicing Norfolk - American, Delta, United, and Southwest. Richmond was serviced by those four major airlines, plus Jet Blue and Allegiant. The reduction in competition reduced the ability of Virginia airports to attract a new carrier, one who might force the airlines currently serving an airport to cut costs or improve service.2

The Virginia Secretary of Transportation noted in 2016 that the limited demand, due to fragmentation of the Hampton Roads/Richmond market by three airports, would always limit the service provided by the airlines in the Central Virginia and Hampton Roads:3

The biggest impact of dividing the market: because there is a small number of passengers leaving from any one of the three airports, community business leaders find it difficult to retain a low-cost airline.

the Newport News/Williamsburg airport has the fewest passengers in southeastern Virginia

Source: Bureau of Transportation Statistics, Transtats, Passengers All Carriers - All Airports

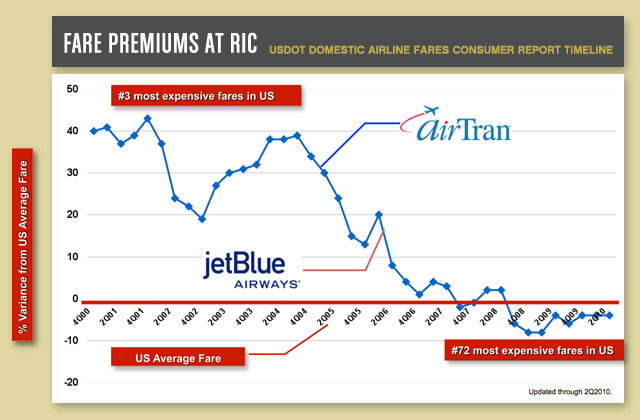

In 1999 Richmond lost its low-cost airline, AirTran. Between 1999-2005, the Richmond airport had some of the highest fares in the country. Newport News retained service, because unlike Richmond it was willing to provide an income guarantee as a subsidy to the private airline.

Starting in 2000, Richmond spent $50 million to upgrade the airport terminal and reduced landing fees by 20%.

The new terminal attracted more customers from Northern Virginia, who could use I-95 and I-295 to drive to Richmond easier than fighting traffic congestion to reach Dulles or Washington National. The lower landing fees also increased the potential for an airline to make enough profit to service Richmond.

Once Richmond convinced AirTran to provide service again, fares dropped substantially based on the "Southwest Effect." That airline was famous for providing new competition, forcing legacy carriers to adapt by lowering prices and/or improving service. The Virginia Department of Aviation had been campaigning to attract Southwest since 1999, when the Wall Street Journal described one lobbying campaign using a billboard on a highway near Southwest's Love Field headquarters in Dallas:4

The Wall Street Journal article also noted the response in 1999 by the airline's executive with primary responsibility of choosing where Southwest would expand:

In 2011, Southwest Airlines acquired AirTran, expanding the airline's service to include the Richmond, Newport News, and Norfolk airports. Southwest announced plans to cancel AirTran service at Newport News in 2012, but continued to fly from Norfolk and Richmond.

Southwest chose to continue flying to Richmond because it anticipated making a profit, not out of any sense of civic responsibility. The profit potential was enhanced by a very focused effort by the Richmond business community to steer customers to AirTran. In 2010, the Greater Richmond Chamber of Commerce launched the "Save Low Fares" campaign with a specific goal:5

Save Low Fares chart, highlighting impact of low-cost carrier competition to Richmond airfares

Source: Save Low Fares website

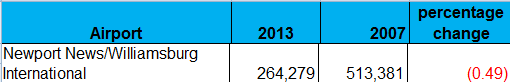

AirTran had been the dominant carrier at Newport News/Williamsburg International Airport, carrying almost 50% of all passengers. The impact of Southwest's decision to pull out was immediate. Total passengers at Newport News/Williamsburg had exceeded 1,000,000 annually from 2005-2011, but dropped to less than 650,000 in 2012.

between 2007-13, commercial passenger traffic at Newport News/Williamsburg International Airport declined by 49%

Source: Federal Aviation Administration (FAA), Passenger Boarding (Enplanement) and All-Cargo Data for U.S. Airports

The Peninsula Airport Commission's response to the loss of AirTran was to concentrate efforts on attracting a different low-cost airline. The executive director of the airport claimed there was sufficient demand, saying:6

The Peninsula Airport Commission did manage to attract two low-cost airlines to Newport News/Williamsburg International Airport between 2012-2014, but failed to retain them. In 2014 the airport also lost service that had been provided by Frontier since 2010.

Allegiant Air was the first to replace AirTran. Even before AirTran shut down operations in 2012, Allegiant Air announced plans to start flying between Newport News/Williamsburg International Airport and Orlando. Allegiant Air's business model was to operate seasonally, with no flights to Orlando between mid-August and mid-October. It served price-conscious vacation customers rather than business travelers.

Allegiant Air cancelled operations in 2014 after PeoplExpress, a competing low-cost airline, claimed it would offer all-year service from Newport News/Williamsburg. Allegiant moved its operations to the Richmond airport to fly to the Tampa/St. Petersburg area, rather than Orlando.7

PeoplExpress announced plans its in April 2012 to fly from Newport News to Pittsburgh, Newark, Providence (Rhode Island), Orlando and West Palm Beach. The airline finally started service in June 2014, so Newport News/Williamsburg International Airport had regular service from three major carriers (Delta Air Lines, Frontier Airlines and US Airways) plus PeoplExpress.

Frontier's service between Labor Day and May 1 was funded in part by a $500,000 annual subsidy from the Regional Air Service Enhancement (RAISE) Committee. That group received economic development funding from the jurisdictions of Hampton, Newport News, Poquoson, Williamsburg, Gloucester, York and James City. Flights to Denver were profitable, but at the end of 2014 Frontier announced it would stop servicing Newport News/Williamsburg due to the carrier's strategic shift to become an ultra-low cost airline.

PeoplExpress planned to use over $1.5 million in federal and regional grants (including $700,000 in RAISE funding from the cities of Newport News, Hampton, Williamsburg, Poquoson and the counties of Gloucester, James City, and York) to help finance the first year of service. Norfolk International Airport had tried to recruit PeoplExpress in 2011, but declined to provide the same level of incentives.

consultants advised Norfolk in 2011 to focus on slow growth rather than attracting a new airline

Source: BoydGroup International, Looking Ahead In A Cloudy Industry

Consultants advised Norfolk in 2011 that adding a new airline would not increase competition significantly. By then, the airline market was segmented by alliances, not by individual carriers.

Norfolk was served by at least one carrier from each of the three major alliances - American (oneworld alliance), Delta (SkyTeam alliance), and United (Star alliance). Assessing the potential for Newport News to find a new major carrier to replace AirTran, the consultant concluded:8

PeoplExpress lasted only three months at Newport News/Williamsburg International Airport (PHF). It operated only two leased Boeing 737's, and suspended service after one plane was damaged by a truck while on the ground in Newport News. In 2015, PeoplExpress was evicted from its office at the airport, after failing to pay it bills for utilities and trash service.

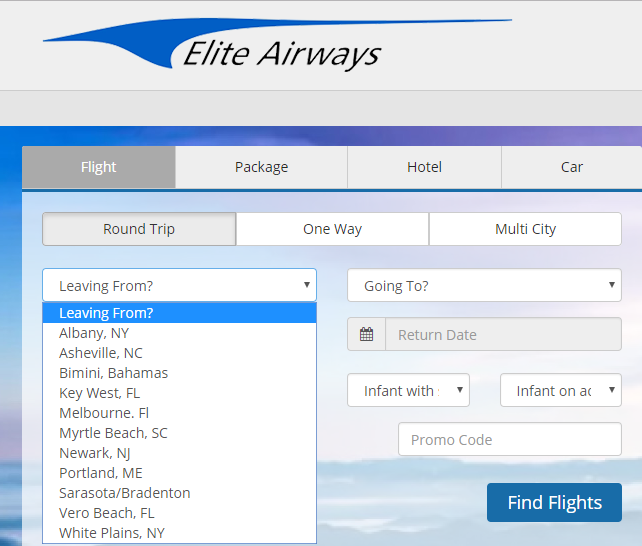

The Peninsula Airport Commission continued to try to "to fill the AirTran hole" by recruiting yet another low-cost airline. In early 2017, Elite Airways announced plans to offer flights to New York/New Jersey three times/week. Elite Airways had expanded the previous year from a charter/air taxi firm and begun to schedule passenger flights.

There were significant costs involved in attracting Elite Airways. The Regional Air Service Enhancement Committee, working through the Newport News economic development agency, agreed to provide $400,000 to support the new start-up. The committee also offered a guarantee that Elite Airways would get at least $500,000 in revenue in the first year. All airport fees, which could have reached $200,000, were waived. The deal provided the airline free ground equipment, including a jetway and items required for handling baggage, also thanks to funding from RAISE.

The executive director of the Peninsula Airport Commission said that the airport personnel would handle all the interactions with customers on the ground from ticketing to baggage claim, and:9

In 2017, persistent investigative journalism by the Daily Press revealed that the Peninsula Airport Commission had guaranteed a $4.5 million loan to PeoplExpress, with no public acknowledgement of that financial commitment. $700,000 in local Regional Air Service Enhancement (RAISE) Committee funds, $300,000 in Federal funds, and $3.5 million in state funds were used to repay the loan made by TowneBank to PeoplExpress.

Local jurisdictions froze their contributions to the RAISE Committee, the Virginia Department of Aviation threatened to withhold future grants, and the Peninsula Airport Commission fired its lawyer who had facilitated the non-public process used to make the loan. The City Manager of Newport News resigned, and Newport News and Hampton appointed new members to the Peninsula Airport Commission. After an audit by the state, the commission fired the Executive Director of the airport.

Elite quickly suspended its plans to start flying from Newport News/Williamsburg, as stories in the Daily Press about PeoplExpress led the state and members of the Regional Air Service Enhancement (RAISE) Committee to threaten to withhold funds.

Adding insult to injury, six months later Norfolk International Airport announced that it had successfully recruited Allegiant, which would offer low-cost flights to Florida. Allegiant had left Newport News/Williamsburg in 2014, triggering that airport's original efforts to recruit PeoplExpress as a replacement.

The 2017 audit for the airport noted:10

the Peninsula Airport Commission recruited low-cost carrier Elite Airways to fly from Newport News/Williamsburg International Airport (PHF)

Source: Newport News/Williamsburg International Airport (PHF)

Elite ultimately committed to start operations in April, 2018, but those plans were cancelled before flights started. In May, 2018, the new Executive Director at Newport News-Williamsburg International Airport announced a new strategy to improve service. He would focus on getting Delta and American, the two major airlines already using the airport, to add more flights and fly to more hubs. He would also try to get United to join them, starting service from the airport. Recruiting a low-cost airline to compete with the "big three" would become a lower priority.11

Elite Airways advertised no flights from Newport News/Williamsburg International Airport (PHF) in May, 2018

Source: Elite Airways

The low number of passengers flying on and out of Newport News/Williamsburg International Airport (PHF), the airport's location between the Richmond and Norfolk airports, and political reaction to the PeoplExpress dealings make the future of the airport unclear. Delta and US Airways (later acquired by American) have continued to fly from Newport News after AirTran left in 2012, Frontier offered seasonal service until 2014, and Allegiant and PeoplExpress briefly provided service, but after 2011 many potential customers have chosen to drive to competing airports in Norfolk, Richmond, and even Northern Virginia.

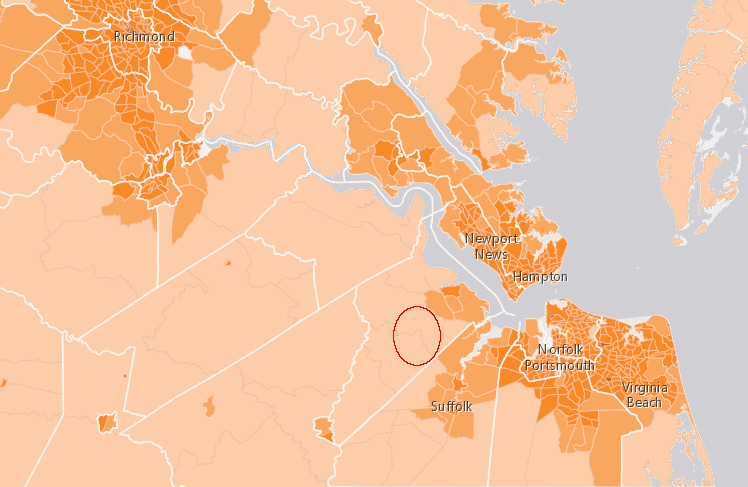

By 2016, the percentage of passengers from the airport's "capture area" (the Peninsula, the Middle Peninsula, and an area south of the James River between I-95 and the City of Suffolk) dropped from 53% to 20%. In other words, 80% of the passengers living close to Newport News/Williamsburg International Airport (PHF) chose to drive extra miles to a different airport. Those competing airports were served by more commercial airlines, offering a better choice of flights and/or better prices than Newport News.12

the Newport News/Williamsburg International Airport (PHF) attracts customers from the Middle Peninsula, Peninsula, and an area south of the James River west of the City of Suffolk

Source: ESRI, ArcGIS Online

Economics could cause American and Delta to abandon service to Newport News/Williamsburg International Airport (PHF). If the fleet of commercial aircraft shifts to larger planes, the cost-effectiveness of serving airports with few customers may spur airlines to concentrate their planes to serve places such as Charlotte and Atlanta. Low-cost airlines such as Spirit and Elite could continue to fly from Newport News/Williamsburg International Airport (PHF) even if major carriers left, but the airport in Newport News faces the greatest risk of losing scheduled passenger service.

Fragmenting the market and maintaining three airports with limited service affects the regional economy in Hampton Roads. In 2018, Atlanta tried to recruit one of the three Fortune 500 corporations headquartered in Hampton Roads, the railroad company Norfolk Southern. City officials emphasized how Atlanta Hartsfield-Jackson International Airport (ATL) offered far more direct flights, and how that would reduce headaches for corporate officials doing business in different locations.13

To increase the pool of potential passengers and retain the major carriers, southeastern Virginia could adopt a regional approach rather than maintain three competing airports. The Virginia Department of Aviation has studied consolidation of scheduled passenger service at one or two airports, so at least one of the existing airports would serve only General Aviation and cargo flights. The assumption is that consolidation would concentrate customers, and a larger pool of passengers would stimulate carriers to offer more and/or cheaper flights.

A 1991 feasibility study by a Massachusetts research firm had indicated earlier that a new, single airport to meet all of the regional demand would require 5,000 to 15,000 acres. None of the existing airports at Richmond, Newport News, or Norfolk could be expanded to that size. A mega-airport could provide all passenger service from Richmond to the east and become an international gateway, if scheduled passenger service stopped at all three existing airports in Richmond, Newport News, and Norfolk.

In 1994, the Eastern Virginia Airport Capacity Enhancement Plan identified how infrastructure at Newport News/Williamsburg International Airport (PHF) could be expanded to handle as many takeoffs and landings as the largest airports in the country. The Peninsula Airport Commission anticipated growth, but only to becoming a new connecting hub comparable to Pittsburgh and Raleigh-Durham.14

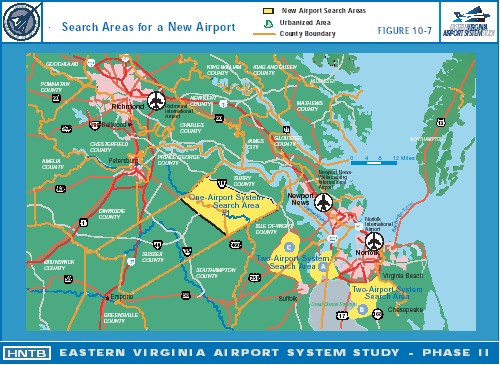

The Virginia Department of Aviation initiated the Eastern Virginia Airport System Study, which continued until 2001. Options examined were to build a single airport to replace the three in the region, to close Norfolk and consolidate at Richmond and Newport News, or to close both Norfolk and Newport News and transfer their business to a new airport between Suffolk and Petersburg. Norfolk and Newport News officials produced a rival analysis, the Hampton Roads Airport System Study, to justify retaining the two airports as separate facilities.

The Eastern Virginia Airport System Study considered building one new mega-airport near Waverly or Wakefield in Sussex County to serve the entire region, but rejected that option.

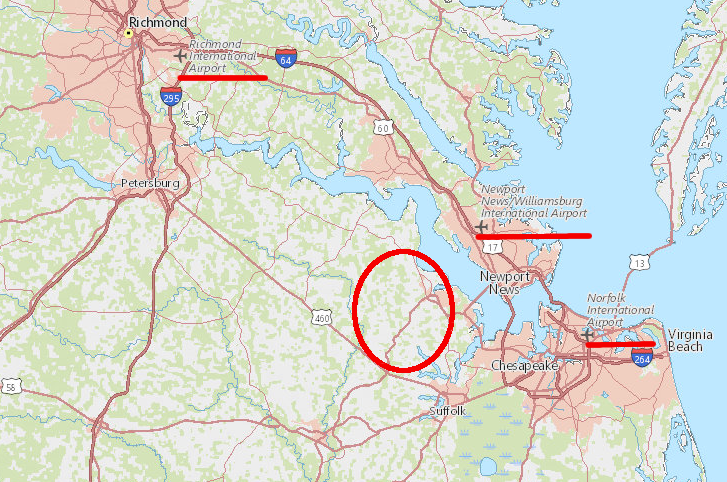

It concluded that a two-airport system would improve aviation service for customers and increase economic development, including local jobs. The study suggested retention of Richmond International Airport (RIC), and replacement of Newport News/Williamsburg International Airport (PHF) and Norfolk International Airport (ORF) with a single new regional airport.

the Eastern Virginia Airport System Study examined building a new mega-airport in Sussex County to replace three existing airports, and looked at three alternatives for consolidating just the airports at Newport News and Norfolk

Source: Analytical Support for the Statewide Multimodal Long-Range Transportation Plan (VTRANS 2025), Multimodal Investment Network (MIN) Statement - Eastern Virginia Airport

The location for the new airport would be south of the James River and west of the City of Suffolk. State officials focused on a five-square mile area in Isle of Wight County north of Windsor.

The new airport would have two 10,000-foot long runways, long enough for all international flights. Costs to acquire the land required for runways and safety zones would be relatively low in that area, though the distance from population centers would increase drive time to the airport for passengers.

Isle of Wight officials immediately recognized that a Dulles-type airport, together with plans to upgrade US 460 and bring high-speed rail to Norfolk, could dramatically transform their rural area. The new facility would create:15

Consolidating two airports was expected to attract more commercial carriers who would offer flights to more destinations, but would also eliminate existing jobs in Newport News and Norfolk and require the residents in those jurisdictions to drive a longer distance to the airport. Virginia Beach residents would have to drive 60 rather than 15 miles.

the 2001 Eastern Virginia Airport System Study suggested retaining Richmond International Airport (RIC) and building a new regional airport west of Suffolk

Source: ESRI, ArcGIS Online

The positive impacts of consolidation for the region were less significant for elected officials than the negative impacts on their local jurisdictions. There was no political advantage for Newport News or Norfolk officials, or for state legislators whose districts were concentrated in those cities, to endorse closing their airports to scheduled commercial airline traffic and transferring economic benefits to Isle of Wight County.

The director of the Virginia Department of Aviation recognized that there would be little support in Hampton Roads for consolidating rather than upgrading Newport News/Williamsburg International Airport (PHF) and Norfolk International Airport (ORF). He made clear when releasing the Eastern Virginia Airport System Study:16

the Eastern Virginia Airport System Study chose no specific site, but Isle of Wight officials anticipated a location north of the town of Windsor

Source: ESRI, ArcGIS Online

Cost of a new mega-airport was estimated at $1.4 billion. Federal and state funding, plus revenue generated at the new airport, was projected to cover only 80% of the cost. In addition to the $282 million funding gap, the new airport would need another bridge across the James River to provide access from the Peninsula, plus expensive upgrades to US 460 for passengers coming from Norfolk and Virginia Beach.

The Executive Director of the Newport News/Williamsburg International Airport (PHF) challenged the economic assumptions in the study. It included no loss of economic activity in Norfolk or Newport News from closing the airports, and calculated only the benefits of the new site. He complained:17

No action was taken on the Eastern Virginia Airport System Study released in 2001.

In 2016, a major developer in Virginia Beach suggested it was time to re-consider the issue as part of a "Richmond to the Oceanfront" mega-region initiative. He noted that local officials were willing to use regional entities to provide basic services for water and waste management, but became parochial and defensive when regional economic development plans were proposed.

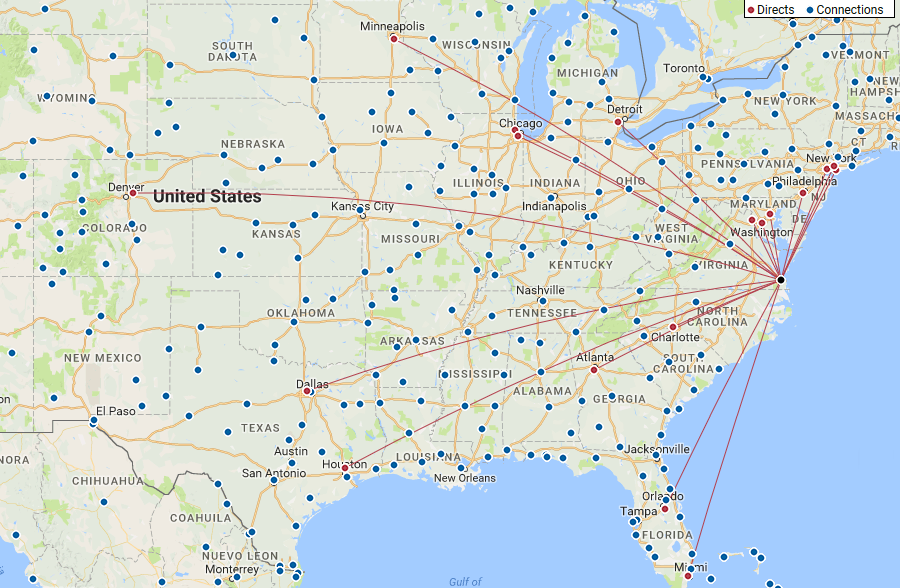

As a result of the fragmented market with three airports, no commercial airline serving Richmond, Newport News, or Norfolk offered a non-stop flight from Phoenix, Los Angeles, San Francisco, or Seattle. Passengers going from southeastern Virginia to many destinations, and all locations on the West Coast, had to transfer at hubs.

The limited number of non-stop flights made it harder to attract convention business and tourists to places in southeastern Virginia. In 2017, commercial airlines serving Richmond and Norfolk offered direct flights from just four destinations west of the Mississippi River: Minneapolis, Denver, Dallas/Fort Worth, and Houston. Newport News/Williamsburg International Airport (PHF) had direct flights to just Atlanta, Charlotte, and Philadelphia.18

in 2017, Richmond International Airport (RIC) had non-stop flights to four destinations west of the Mississippi River

Source: Richmond International Airport (RIC), Route Map

in 2017, Norfolk International Airport (ORF) also had non-stop flights to the same four destinations west of the Mississippi River: Minneapolis, Denver, Dallas/Fort Worth, and Houston

Source: Norfolk International Airport (ORF), Route Map

In 2017, a member of the House of Delegates proposed a new state study that would lead to establishment of one regional mega-airport. The proposed location for the airport was south of the James River, so it was not surprising that the delegate proposing the study represented Virginia Beach and Chesapeake rather than any district on the Peninsula.

The study, HJ 690, was tabled, and no update to the Eastern Virginia Airport System Study was initiated.19

A mega-airport to serve Richmond and Hampton Roads might provide the critical mass of passengers needed to spur commercial airlines to schedule non-stop flights to the West Coast, but a site in Sussex or Isle of Wight counties would increase the time required to drive to the airport. A consultant for the Norfolk airport, when discussing plans in 2016 for expanding that existing facility, commented:20

The chair of the Hampton Roads Transportation Planning Organization proposed a regional mega-airport again in 2018, suggesting a new facility could be located in Isle of Wight County. Other members of the regional transportation agency quickly responded with support for upgrading both Norfolk International Airport (ORF) and Newport News/Williamsburg International Airport (PHF). The Daily Press published an editorial offering an alternative to consolidating airports, proposing instead to consolidate their online presence so customers see a broader set of choices before booking flights.21

One possibility could force consolidation around the year 2030. Norfolk International Airport (ORF) has only one runway long enough to serve commercial passenger jets. The Federal Aviation Administration (FAA) has rejected requests to fund studies to add a second runway, citing excess capacity in the region with the under-utilized Newport News/Williamsburg International Airport (PHF) nearby.

Norfolk Airport Authority officials asserted in 2017 that they will need to stop all commercial passenger traffic in about a dozen years, and stay closed for the many months required to replace the existing runway. The worst-case scenario for Norfolk officials is that airlines would shift their flights to Newport News/Williamsburg International Airport (PHF), and some would never return to Norfolk.22

In 2019, the Daily Press and The Virginian-Pilot editorialized that it was time to consolidate management of the airports at Norfolk and Newport News. If flights needed to be diverted from Norfolk International Airport (ORF) to Newport News/Williamsburg International Airport (PHF), a unified airport authority could manage allocation of the landing fees and synchronize operations more easily. The editorial was blunt in its description of the primary reason for maintaining separate, competing airports:23

passenger travel through the Norfolk airport (blue) in 2019 far exceeded the number of passengers traveling through Newport News (orange)

Data Source: Virginia Business, The big dig

The US Department of Transportation concluded in 2020 that the Hampton Roads region could be served by just the Norfolk International Airport (ORF). To maintain the fundamental air transportation network after the 2020 coronavirus pandemic struck, the US Congress provided funding to commercial airlines which agreed to continue service to "any point" to which they had been flying just before the pandemic.

The US Department of Transportation defined the specific locations to which service must continue, in order for the airlines to qualify for a share of the $25 billion appropriated under the Coronavirus Aid, Relief, and Economic Security (CARES) Act. The Federal agency chose to classify Hampton Roads as one "point" which could be served by the six carriers flying in and out of Norfolk.

Delta Air Lines and American Airlines were not required to maintain flights to two locations just 30 miles apart, even though the airports were separated by the James River. The two carriers using Newport News/Williamsburg International Airport (PHF) also serviced Norfolk, and handled 10 times the number of passengers there. In 2019, there were 210,000 passenger enplanements at Newport News/Williamsburg International Airport (PHF) compared to almost 2 million enplanements at Norfolk International Airport (ORF).

A record number of passengers, 3.9 million, used Norfolk in 2019. However, in March 2020 at the start of the COVID-19 pandemic, traffic at that airport dropped by half and airlines cancelled many of their flights.

Of all the airports in Virginia with scheduled commercial passenger service, only Newport News/Williamsburg International Airport (PHF) was omitted from the final order by the US Department of Transportation. The Federal agency required continued service even to the Shenandoah Valley Regional Airport (SHD), which was 50 miles away from the Charlottesville Albemarle Airport (CHO) and on the other side of the Blue Ridge.

Officials on the Peninsula were blindsided by the decision, and feared how Delta Air Lines and American Airlines would react. The chair of the York County Board of Supervisors commented:24

Peninsula residents who fly out of Norfolk International Airport (ORF) must cross the James River via congested bridges or bridge-tunnels

Source: ESRI, ArcGIS Online

While service was dropped at Newport News in 2020, Jet Blue upgraded the destinations served from Richmond International Airport (RIC) and announced direct flights to Los Angeles and Las Vegas. For the first time, Richmond customers could fly to a West Coast airport without a transfer.

Jet Blue added the two cities because it expected the business to be profitable. At the time, the two destinations of the largest number of travelers from Richmond without a direct flight were Los Angeles and Las Vegas.25

In May 2021, as the travel industry began to recover from the pandemic, a new low-cost carrier announced plans to operate from Richmond and Norfolk and to construct its operations center in Norfolk. Breeze Airways determined that the market was not large enough to serve three airports so close together, and did not plan to offer service from Newport News/Williamsburg International Airport (PHF).26

By 2023, Newport News/Williamsburg International Airport (PHF) was struggling to continue to provide commercial passenger service. It had retained American Airlines through the pandemic, but Delta abandoned the airport.

Newport News/Williamsburg International Airport (PHF) failed to recruit Breeze and then Spirit Airlines. Avelo Airlines started flying to Florida in 2022, but it offered service for only six months before leaving. The airport was operating at an annual deficit which could be sustained for only a few more years. Unless it could generate more business and more revenue, it was at risk of having to covert into a general aviation airport without scheduled commercial passenger service.

In contrast, Norfolk International Airport (ORF) recovered fast from the COVID-19 pandemic. Norfolk had 4.12 million passengers in 2022, 7% more than the last pre-pandemic year in 2019. For at least 2022 it became the largest airport in Virginia outside of Northern Virginia, since Richmond International Airport (RIC) had 4.07 million passengers that year. In 2023 Norfolk was served by Delta, American, Southwest and United, plus the low-cost carriers of Allegiant, Breeze, Frontier and Spirit.

Norfolk's growth was due in part to having larger aircraft serving the airport. The president of the Norfolk Airport Authority said:27

By the end of 2024, the airports in Norfolk and Richmond had recovered from the COVID-19 pandemic. Richmond International Airport (RIC) hit a new high with 456,000 passengers in June, 2025 and anticipated finally reaching five million passengers per year. The airport began offering international flights again, with one to Bermuda, and started planning flights to Europe. It sought to capture the "leakage" to Dulles International Airport (IAD) for such flights.28

Newport News/Williamsburg International Airport (PHF) failed to recover. After COVID-19, American Airlines flew the only commercial passenger flights, airport expenses consistently exceeded revenue, and reserves were exhausted.

The Hampton Roads Air Study concluded that that it was unrealistic to attract new carriers and recover passenger traffic. Instead of trying to compete with Norfolk and Richmond for commercial passengers, the Newport News/Williamsburg International Airport (PHF) should shift to servicing new forms of aviation, including f maintenance and support facilities for electric Vertical Takeoff and Landing (eVTOL) aircraft and development of logistics hubs to support Unmanned Aerial Vehicle (UAV) package delivery and medical supply transport:29

The former Virginia Secretary of Transportation, Aubrey Layne, suggested that management of the three airports should be coordinated through a regional group. Potential competition between the two major airports in Northern Virginia, Dulles International Airport (IAD) and Ronald Reagan Washington National Airport (DCA), has been controlled by coordinating management under the Metropolitan Washington Airports Authority.

Layne noted the advantages created by combining the three major ports in Hampton Roads within the Virginia Port Authority were a guide for the three airports in the same region:30

low-cost carrier Breeze Airways bypassed the Peninsula when it launched operations from Richmond and Norfolk in 2021

Source: Breeze Airways, Breeze Airways Announces Debut Service From 16 Cities Including Tampa Bay, Charleston, Norfolk and New Orleans; 95% of New Breeze Routes Are Without Existing Nonstop Service

The mayor of Newport News advocated for creation of a regional airport authority to jointly manage Newport News-Williamsburg Airport (PHF), Norfolk International (ORF), and also the general aviation Chesapeake Regional Airport (CPK) managed by the City of Chesapeake. The mayor pushed in 2025 for a new "one region, one sky" perspective:31

The need to re-imagine operations at the Newport News airport was obvious. Less clear were the potential benefits to the other jurisdictions in the region, particularly Norfolk.