two six-megawatt turbines were installed for pilot testing at the Coastal Virginia Offshore Wind project in June, 2020

Source: Dominion Energy

two six-megawatt turbines were installed for pilot testing at the Coastal Virginia Offshore Wind project in June, 2020

Source: Dominion Energy

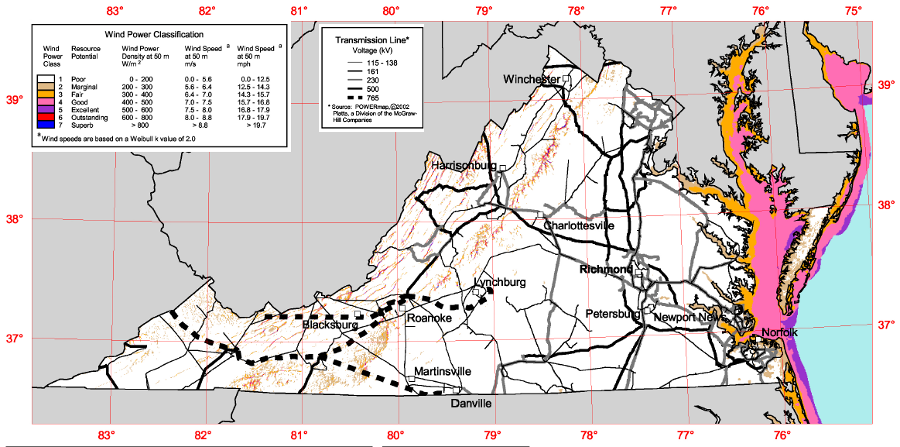

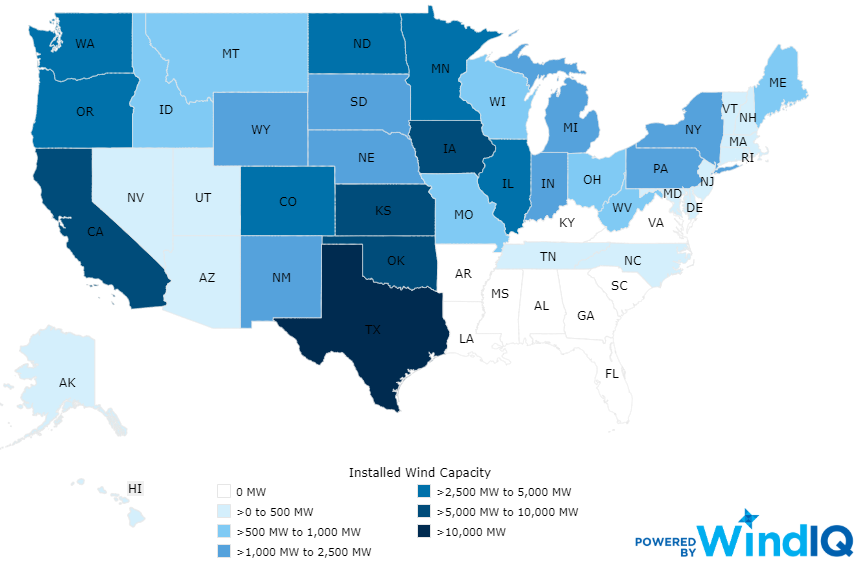

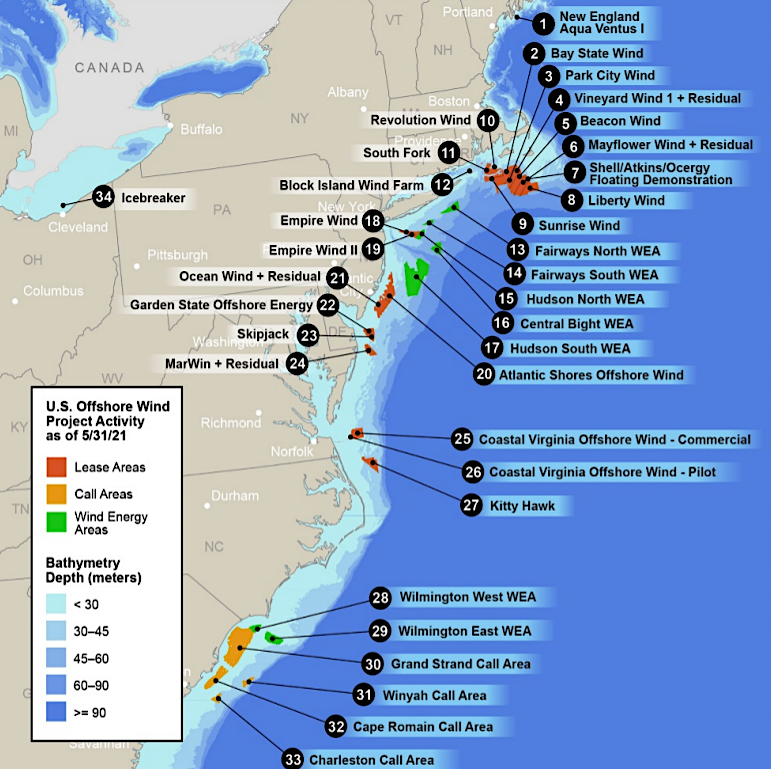

Wind-powered turbines can be located both onshore and offshore. Onshore projects are proposed in the mountainous regions of Virginia. Offshore, various projects have been proposed in the Chesapeake Bay and the Atlantic Ocean.

Dominion Energy obtained approval in 2018 to build two 6 megawatt (MW) turbines in Federal waters, east of the shoreline at Virginia Beach. They were the first electricity-generating wind turbines ever to be installed in federal waters.

A year later Dominion committed to spend $8 billion to build the 2,640MW Coastal Virginia Offshore Wind project, after the General Assembly directed the State Corporation Commission to authorize it despite relatively high costs to produce electricity. Coastal Virginia Offshore Wind became the second wind energy project authorized in Federal waters, following the 800-megawatt Vineyard Wind 1 project off Massachusetts.

The world's first offshore wind project, Vindeby, was completed by the Danish company Orsted in 1991. The first offshore wind project in the United States involved construction of five turbines at Block Island in 2016 to produce 30MW of electricity. The Block Island project was built in state waters of Rhode Island, less than three miles from the coastline.1

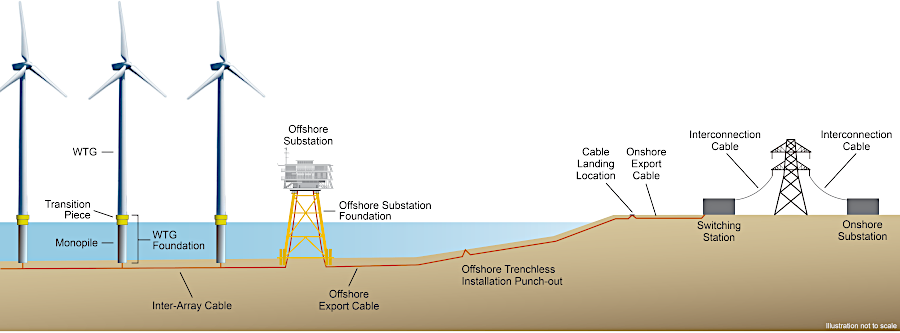

Local zoning restrictions do not apply to wind projects in Federal waters. However, once the cables transmitting electricity come onshore, the cables and the switching stations required for connecting to the grid still go through standard local land use planning approvals. In Virginia, utilities rarely fail to get whatever approvals are needed from local governments.

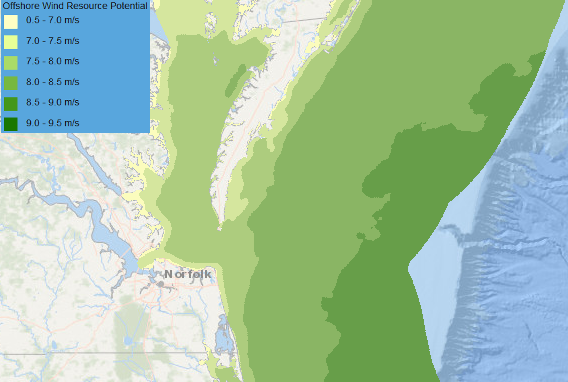

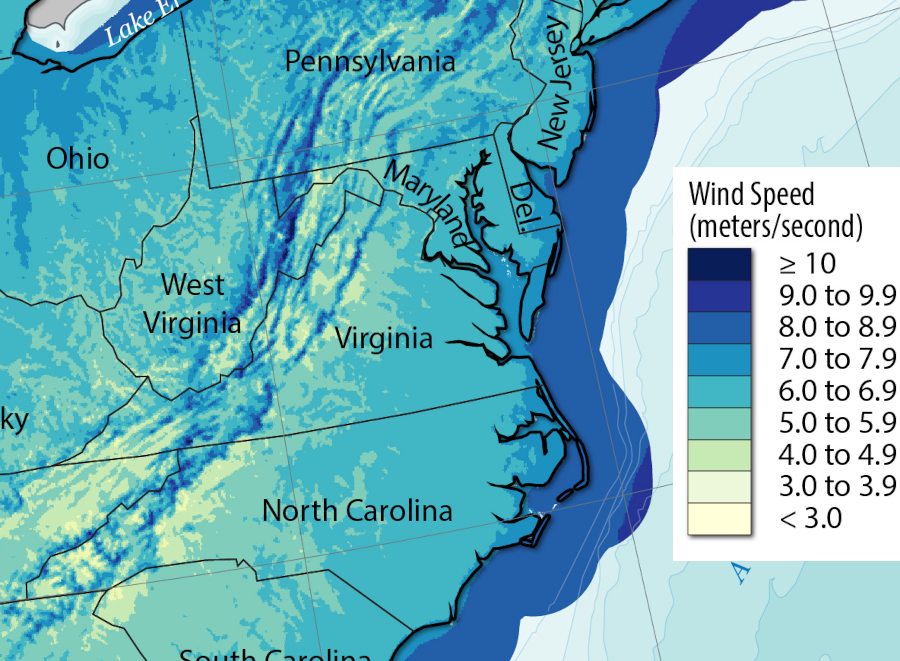

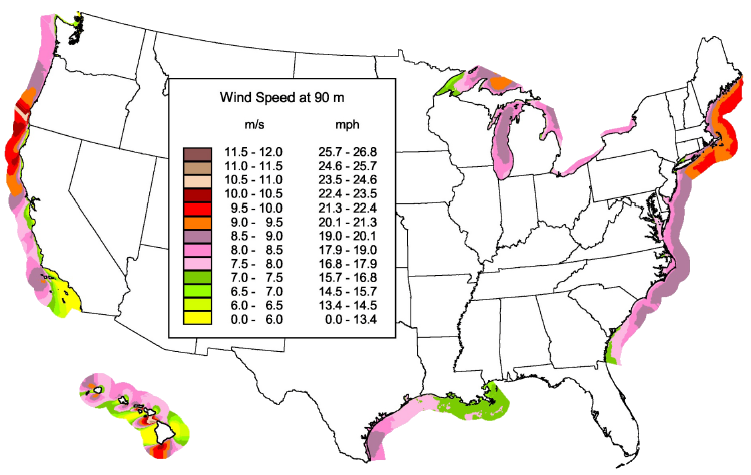

at 50m height, the fair-to-excellent locations for wind energy are offshore - where no transmission lines exist to distribute electricity, and where construction costs far exceed onshore wind locations

Source: US Department of Energy, Virginia 50-Meter Wind Map

Offshore locations are attractive locations physically because there are no forests, no trees to slow down the breeze. The absence of trees reduces public opposition; offshore projects create no visual scars by clearing a path through a forest for transmission lines.

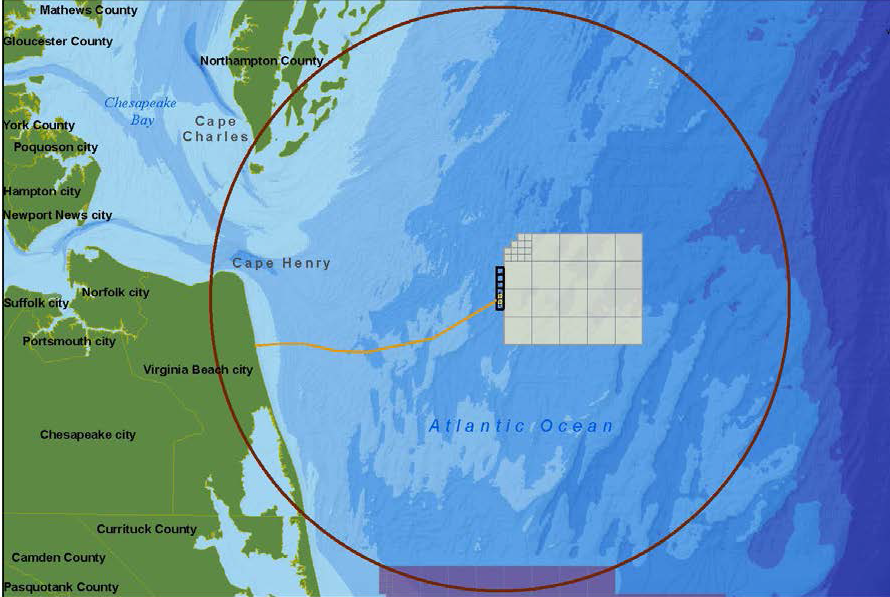

towers and turbines in the Federal lease area for offshore wind development might be seen 27 miles away

Source: Bureau of Ocean Energy Management, Virginia Offshore Wind Technology Advancement Project (Figure 16)

Sites for wind energy projects are chosen according to financial and political reasons, as well as by simple physical geography. From a venture capitalist point of view, offshore projects minimize the headaches involved in acquiring property rights to build turbines and transmission lines. The only landowners involved are the Federal government and, within three miles of the coastline, the state government. There are no delays to obtain local zoning and building permits for the towers.

Turbines are not cheap and "time is money," so investors look for places where the delays in getting authorization to build will be minimized. There are no private landowners offshore, no land to lease or buy. Offshore, companies can be assured of state/Federal support to get the rights to build towers with wind turbines and to install transmission cables.

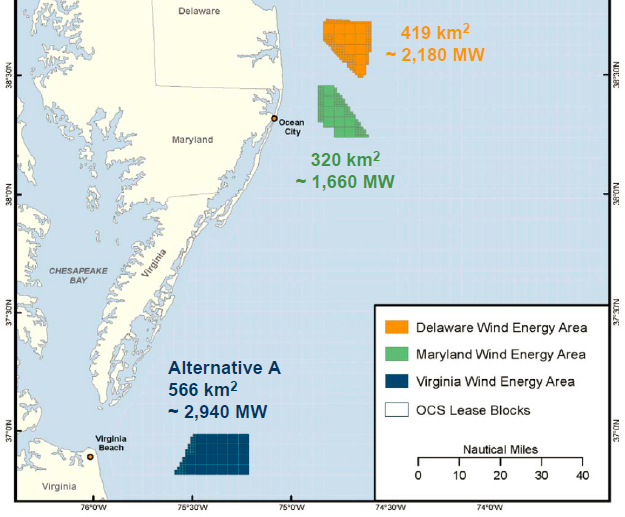

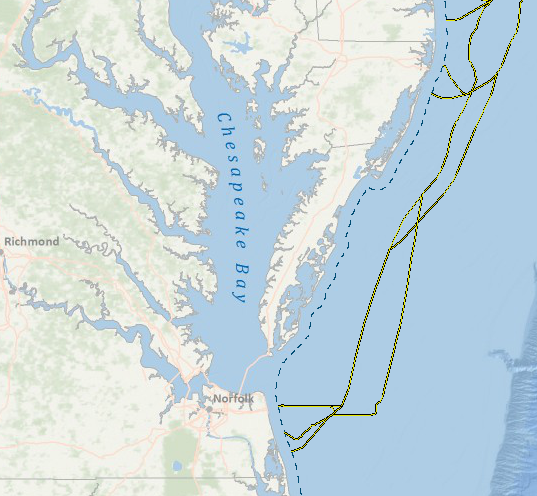

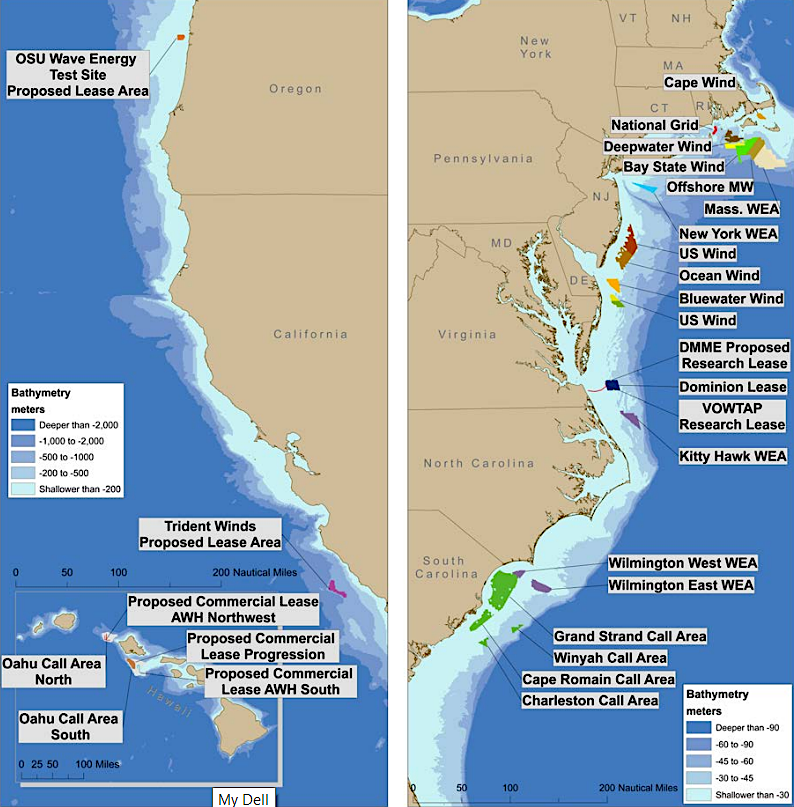

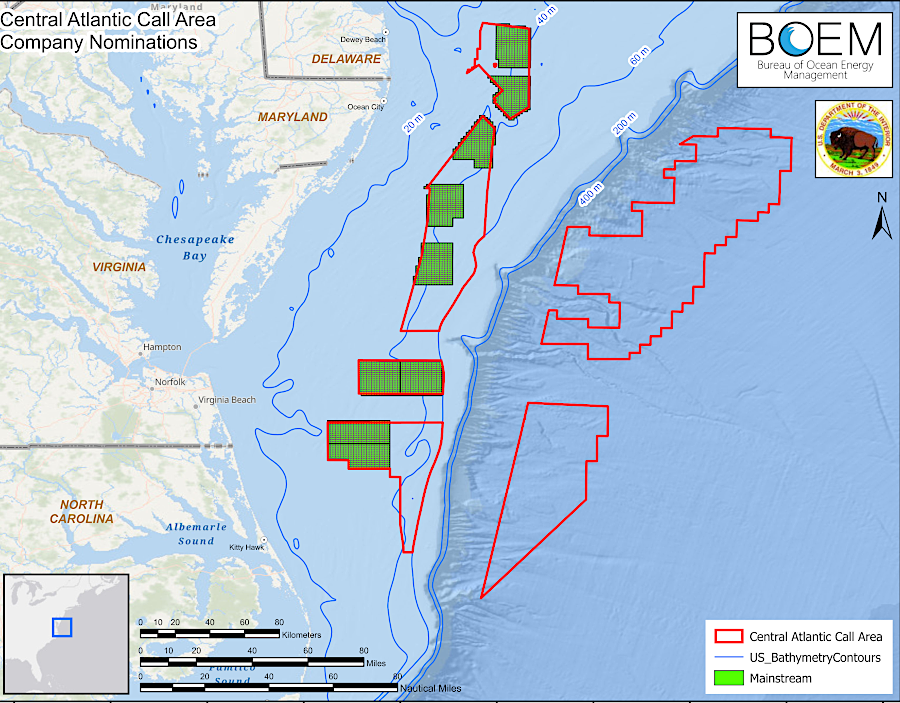

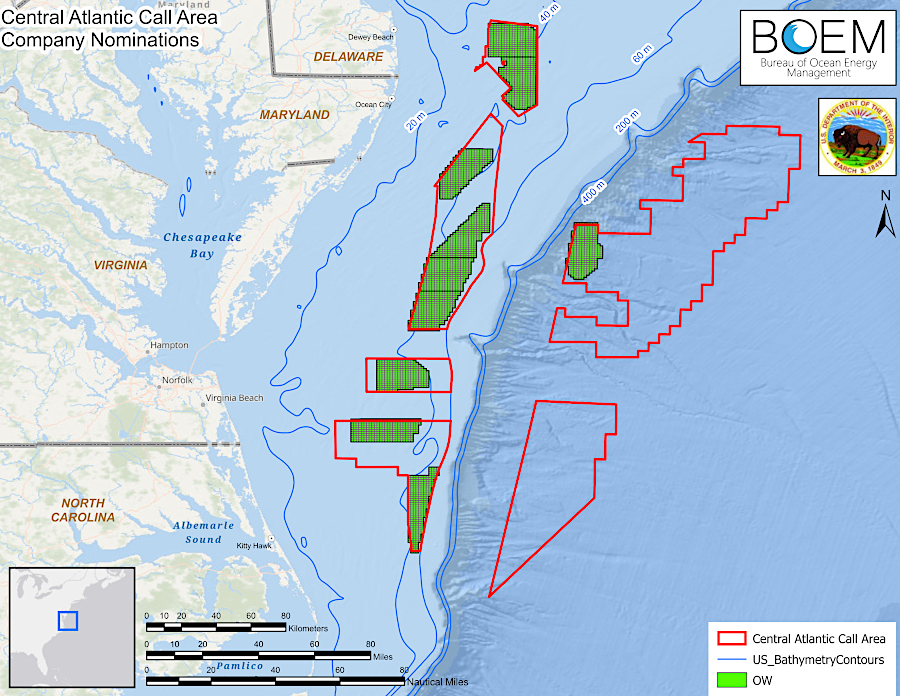

area offshore for potential wind energy lease sales

area offshore for potential wind energy lease sales

Source: Bureau of Ocean Energy Management, Call for Information and Nominations: Discussion of Possible Virginia Call Area

Federal permits are obtained from the Department of the Interior - Bureau of Ocean Energy Management, which was formerly known as the Minerals Management Service until 2010, and the US Army Corps of Engineers.

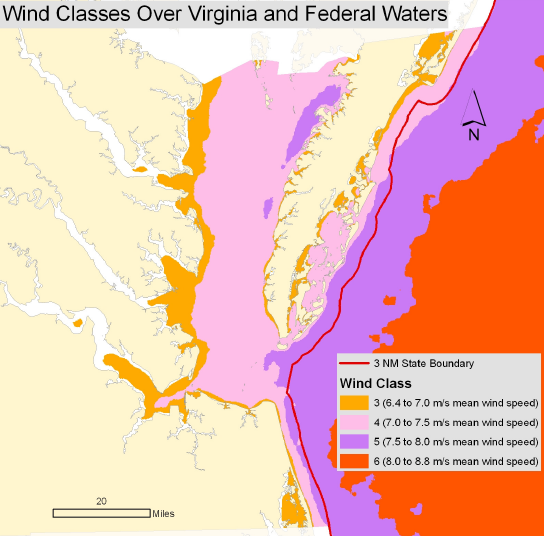

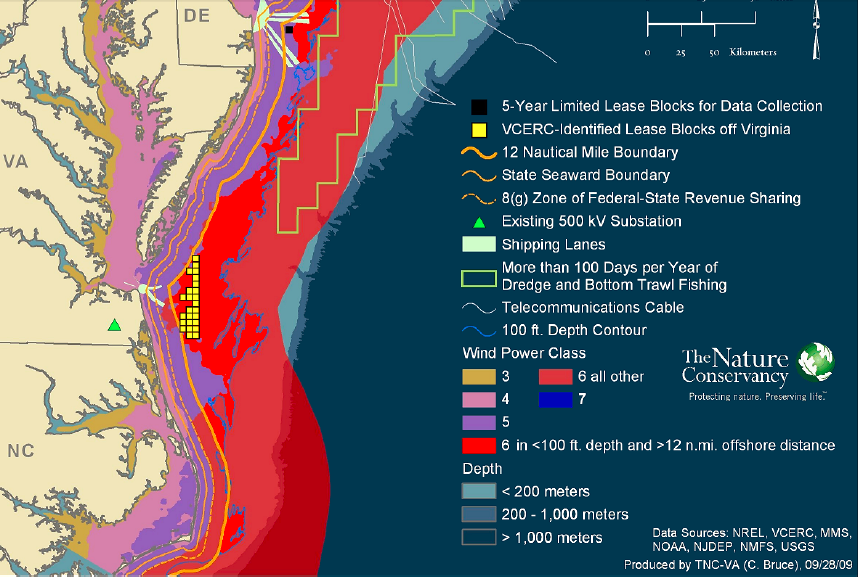

wind classes in Chesapeake Bay/Atlantic Ocean, showing greatest potential in Federal waters more than 3 miles offshore

Source: Virginia Marine Resources Commission, Opportunities for Offshore Wind Energy in State Territorial Waters

The Bureau of Ocean Energy Management has the responsibility, reflecting their offshore responsibilities for oil and gas drilling and mining from the ocean sea floor, to lease areas designated for offshore wind-powered facilities ("farms"). The Corps of Engineers issued permits to manage the creation of new obstructions to navigation.

proposed route on Outer Continental Shelf of high-voltage, direct-current, underwater electricity transmission system for Atlantic Wind Connection Project

Source: Bureau of Ocean Energy Management, Regulation, and Enforcement, Multipurpose Marine Cadastre

Federal permits are not automatic. They require an environmental analysis and a public comment process. The request for a Federal permit for the Cape Wind project near Nantucket Island in Massachusetts was delayed for a decade by political disputes, with local residents and tourists concerned that offshore towers would alter the scenic vistas that made Nantucket special. That long delay rippled throughout the wind industry, affecting the willingness of lenders to finance other projects, until the Federal government decided to approve offshore wind-powered facilities there.

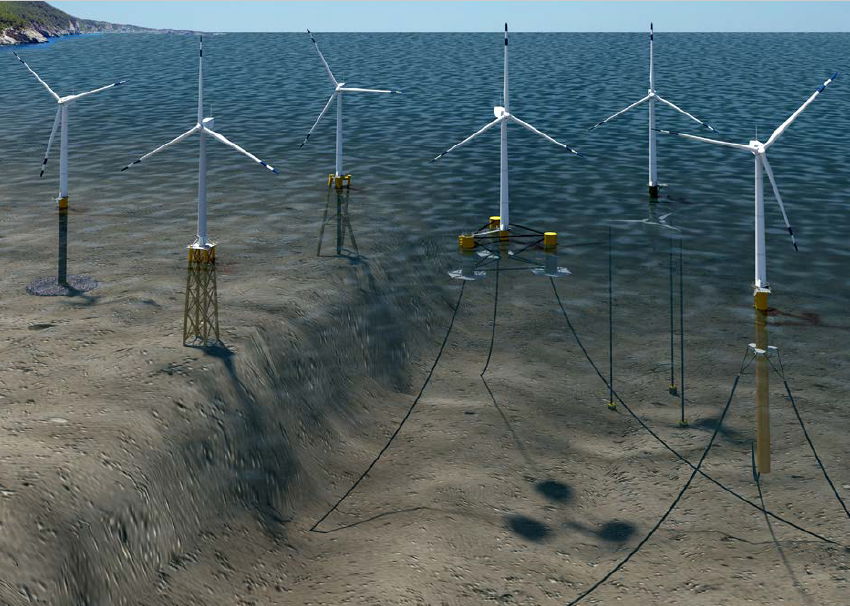

offshore wind turbines require construction of towers that rest on the bottom of the ocean

Source: US Department of Energy National Renewable Energy Laboratory, 2014-2015 Offshore Wind Technologies Market Report

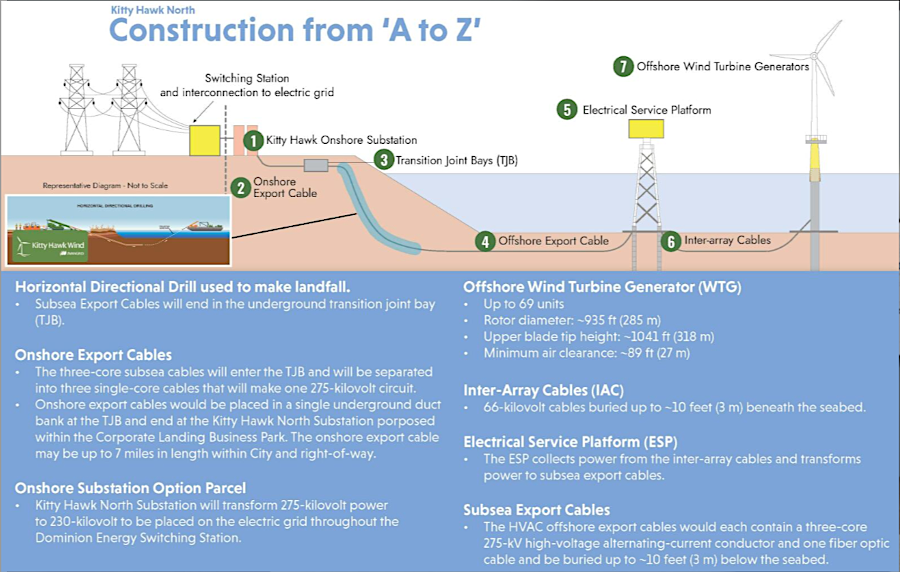

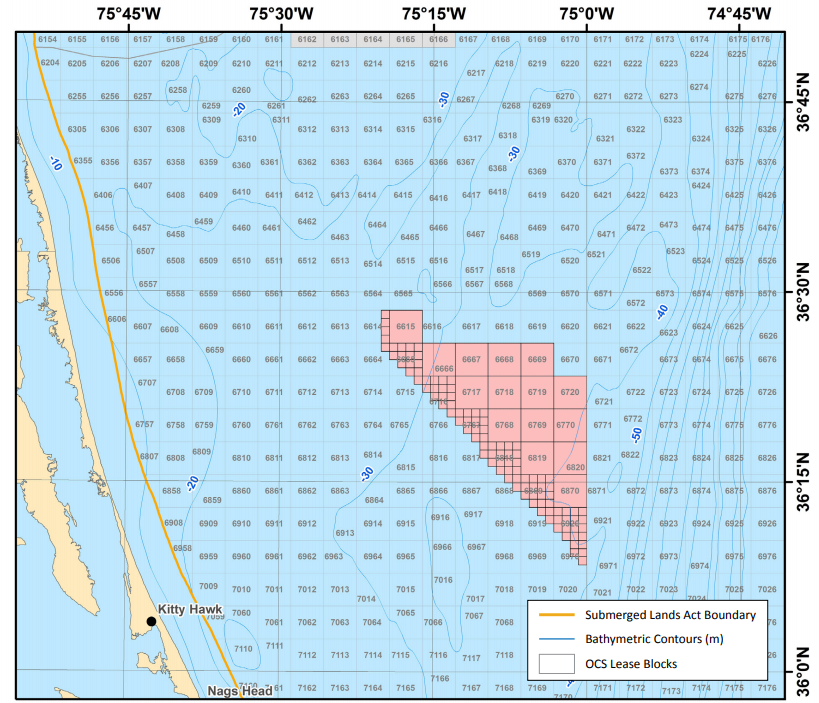

In 2013, North Carolina tourism officials were alarmed by a proposal to lease enough space for up to 1,000 turbines, with the potential that rows of industrial towers would be as close as six miles from the Outer Bank beaches. Vistas would be affected, especially at night when red aircraft warning lights would blink constantly. The Kitty Hawk Town Council made clear its opposition to any towers closer than 20 miles.

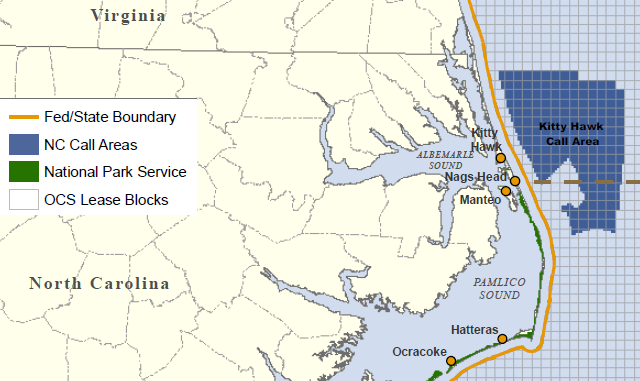

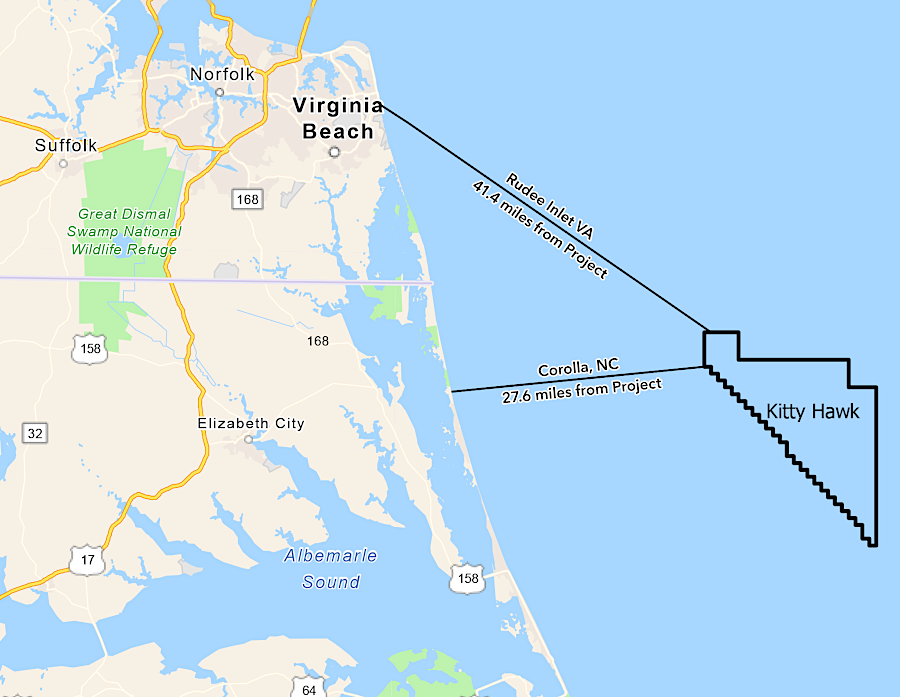

At the same time, the Virginia Port Authority requested any wind towers off the coast be located as close as possible to the coastline, to reduce the navigation challenges for 5,000 ships crossing the Outer Banks wind zone each year. The Kitty Hawk Wind project ultimately planned to build 176 towers more than 27 miles from the Outer Banks, and to bury six underwater cables in the seafloor to bring 3,500 megawatts (MW) of electricity onshore at Sandbridge. The electricity would go to a proposed transmission station in Corporate Landing Business Park, and the company claimed it would pay $270 million in real estate tax revenue to the city over a 30-year time period.

site of potential wind-powered facility off Outer Banks, within 6 miles of coastline

Source: Bureau of Ocean Energy Management, Map Showing the North Carolina Call Areas

the Kitty Hawk offshore project would deliver electricity to the grid at Virginia Beach

Source: Avangrid Renewables, Kitty Hawk Offshore

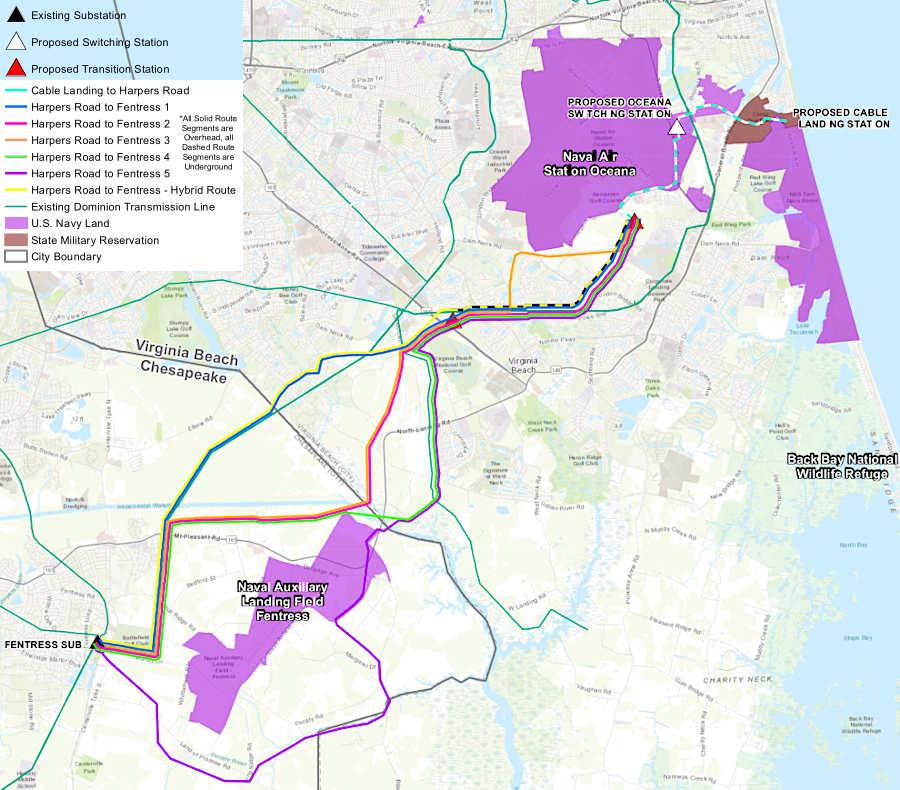

The cables were designed to connect to a substation in Corporate Landing Business Park near General Booth Boulevard. The cables would rise up from 40 feet deep to just three feet from the surface at Sandbridge's municipal parking lot. The energized cables would stay three feet underground stay for the five miles required to reach the substation.

Constructing transmission cables to Sandbridge involved a longer route than a direct path from the Kitty Hawk North Wind site into the grid in North Carolina. However, the landing on the Virginia shoreline would be at less risk from erosion and the inland transmission infrastructure was more robust in Virginia.

Sandbridge residents expressed opposition to the proposed cable landing site. Concerns included blocking access to offshore sand needed for future beach replenishment projects, impacts of electric and magnetic fields (EMFs) above the cables, and potential disruption to the tourist season by heavy equipment excavating the underground cable for unscheduled repairs. The basic assumption locally was that the construction would be too disruptive for the permanent residents in Sandbridge and the proposed industrial use of the land was inconsistent with the tourism-based rental home economy. The Sandbridge Civic League persistently opposed the cable plan, suggesting there had to be a better option.

The Virginia Beach City Council ultimately agreed with local voters rather than the company trying to develop the Kitty Hawk Wind Offshore Wind Projec (later renamed Kitty Hawk North Wind and then CVOW-South). In November 2023, city officials notified Avangrid Renewables that Virginia Beach would not authorize the cable landing at Sandbridge. One member of City Council said:2

cables buried in the ocean floor would bring electricity from wind turbines to the onshore grid

Source: Avangrid, Kitty Hawk Wind Project Overview

electricity generated at the Kitty Hawk Wind project was planned to come ashore at the parking lot of the Sandbridge Beach Facility

Source: ESRI, ArcGIS Online and Avangrid, Kitty Hawk Wind Project Overview

citizens at Sandbridge Beach objected to being the landing site for underwater transmission cables from the Kitty Hawk North Wind project

Source: Protect Sandbridge Beach

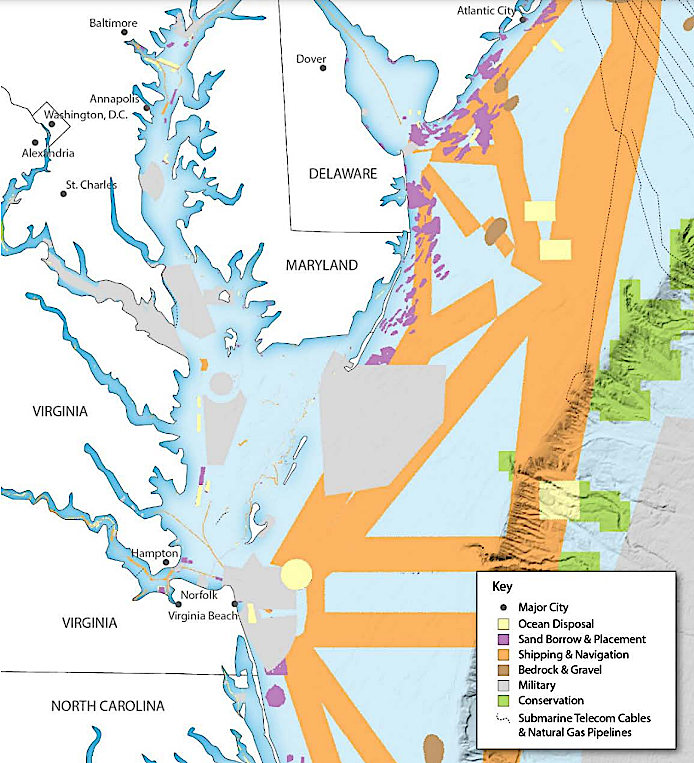

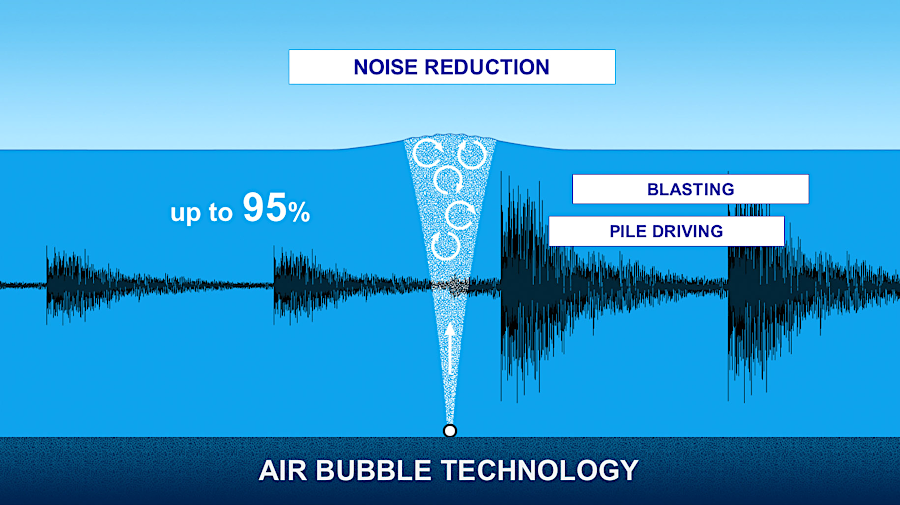

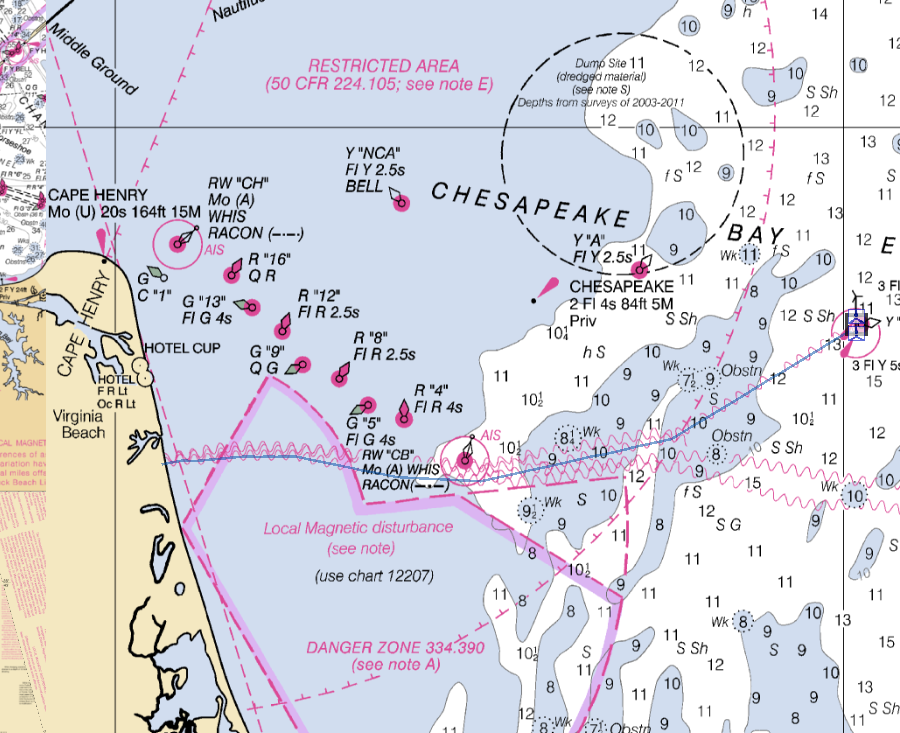

All proposals for wind-powered facilities in ocean waters create potential conflicts with shipping along the coast, including the slow-to-maneuver aircraft carriers base at Norfolk Naval Base. In addition, military radars on the coastline may be affected by wind turbine blades, though some companies are developing "stealth" turbines that would not block radar signals.

Locating a wind-powered facility off the Virginia coast is a complex challenge. One factor to consider is how to bring the electricity to market, onshore. An offshore facility near Virginia Beach/Norfolk would be closer to more customers than one located off Chincoteague, reducing costs for underwater transmission lines and upgrading power lines onshore.

the potential for wind-powered energy at speeds greater than 7.5 meters per second (over 16 miles per hour) increases away from the shoreline - but so does the cost for any underwater power transmission line

Source: Bureau of Ocean and Energy Management, Exploring Ocean Wind Energy

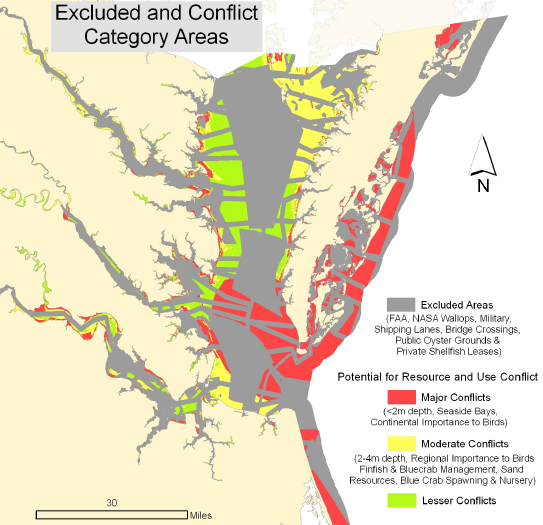

The most-suitable areas to lease can be identified using Geographic Information System (GIS) technology. Choice sites within the Chesapeake Bay are smaller than within the Atlantic Ocean, so the largest wind-powered facilities will be located offshore.

areas not suitable for wind-powered facilities in Chesapeake Bay/Atlantic Ocean, due to conflicts with shipping, birds, crabs, oysters, and military activities

Source: Virginia Marine Resources Commission, Opportunities for Offshore Wind Energy in State Territorial Waters

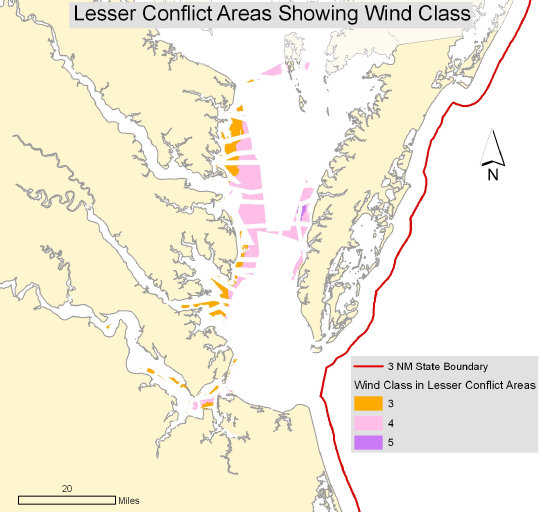

why we won't see large wind-powered facilities in the Chesapeake Bay: minimal wind energy in areas of low conflict

Source: Virginia Marine Resources Commission, Opportunities for Offshore Wind Energy in State Territorial Waters

In November, 2002, Winergy LLC proposed to build 271 wind turbines in the Atlantic Ocean, east of Accomack County at a site called Porpoise Banks 2. The company proposed to build enough turbines to generate 975 megawatts/hour, equivalent to the output from a nuclear power plant. When the Army Corps of Engineers advised that the location was sensitive to the military, Winergy shifted its area of interest to the ocean east of Smith Island, at the southern tip of the Eastern Shore.

Winergy proposed to locate the turbines three miles offshore, putting the structures in Federally-controlled waters 60 feet deep and spread out over 45 square miles. Winergy's primary interest was getting the authority, establishing a valuable permit that had passed through the legal and political process and then sell that permit to a company interested in building a facility and owning wind turbines. One company official stated:3

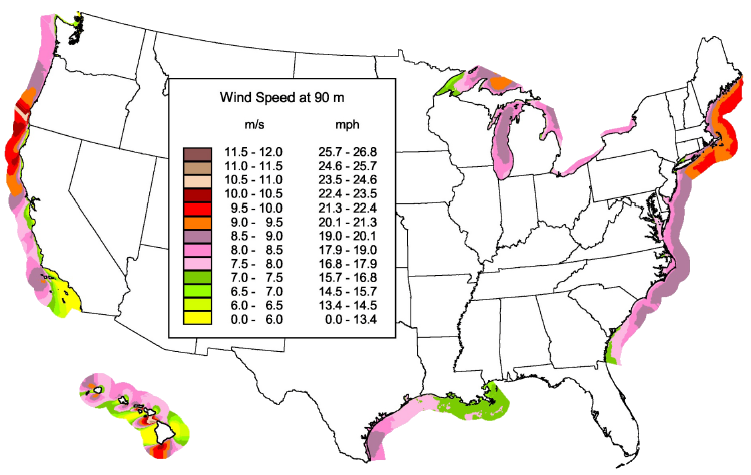

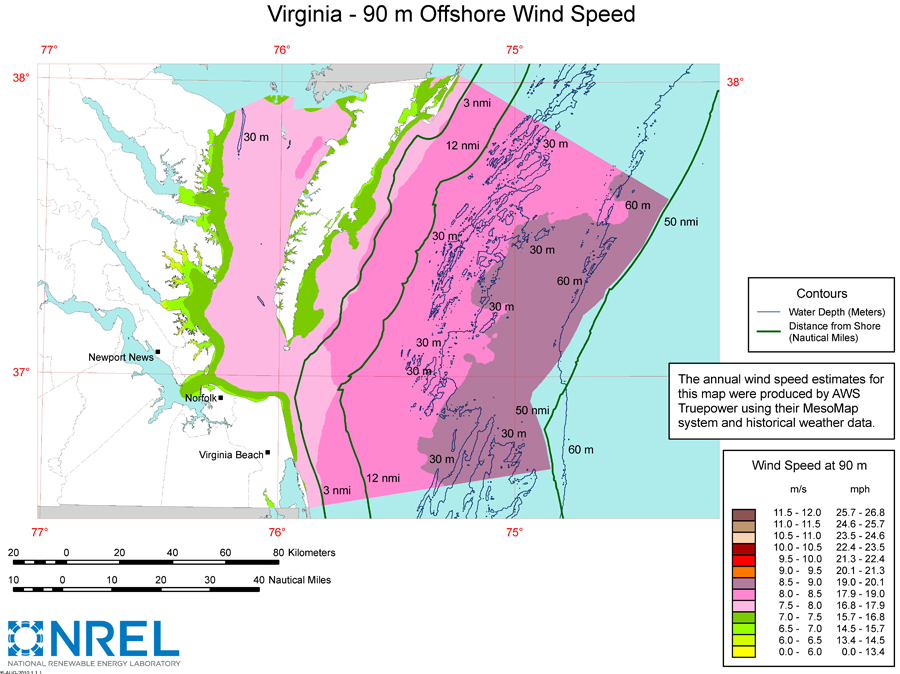

offshore wind resource at 90 meters above the surface

Source: National Renewable Energy Laboratory, Assessment of Offshore Wind Energy Resources for the United States (Figure B1)

Locating turbines out of sight, offshore of the Atlantic coastline of Virginia, does not eliminate conflicts over site locations.

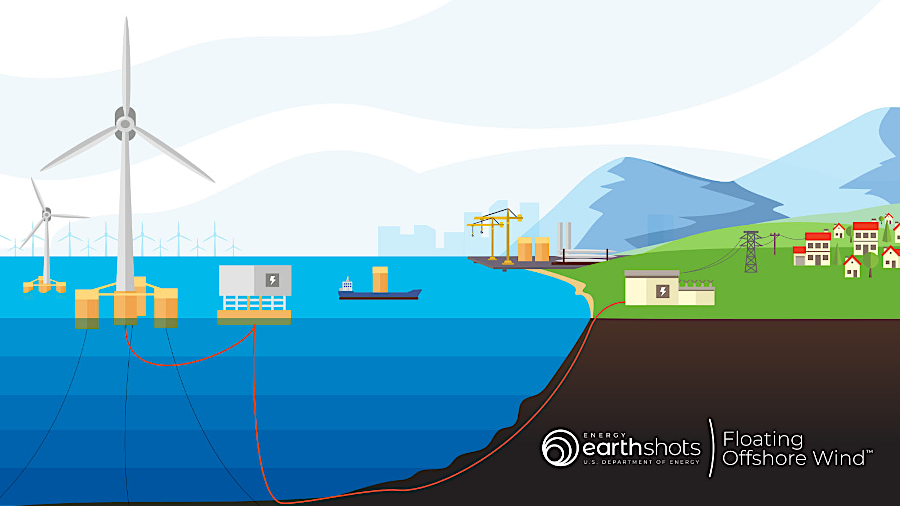

In addition to the constraints of finding a location in Virginia with sufficient wind energy to power turbines, the site had to be shallow enough for construction of towers from the seabed. Offshore towers could be built in waters up to 200 feet deep. Any deeper required construction of floating platforms with wind turbines sitting on top, a technique that will be required on the West Coast where waters are deeper near the coastline.

The US Department of Energy launched a Floating Offshore Wind Shot in 2022 to reduce the cost of electricity from offshore floating platforms by 70% by 2035. Shallow waters close enough for cost-effective transmission of electricity via underwater cable were common along the East Coast and in the Great Lakes, but the Federal agency calculated:4

the US Department of Energy launched a "windshot" in 2022 to cut the cost of electricity from floating offshore platforms

Source: US Department of Energy, Floating Offshore Wind Shot

The platforms could be anchored to the seafloor with mooring lines. The "spar buoy" option included a cylinder underneath the middle of the platform to providing ballast, lowering the center of gravity of the platform and minimizing tilting that might reduce the efficiency of the turbine's blades. Other options included tension leg platforms, with tight connections between the floating platform and anchors in the seabed, and semi-submersible platforms.

three primary floating platform design options

Source: US Department of Energy, Offshore Floating Vertical-Axis Wind Turbine Project Identifies Promising Platform Design

Two other environmental constraints limit the potential location of new wind-based operations - the visual impacts of the towers and blades, and tendency of the blades to kill birds and bats migrating through the area. Turbines could be "bird Cuisinarts," when a flock migrates through turbines. The Eastern Shore is a major stopping point on the Atlantic Flyway. The National Environmental Policy Act (NEPA) required the Federal government to consider the potential impact on migratory birds before granting a permit.

Research that started before construction included tagging whimbrels, a bird species which migrated from the Amazon to Canada and back each year. The data revealed that most whimbrels flew closer to the shoreline, not through the Coastal Virginia Offshore Wind site. Roughly 5% of the whimbrels using the flyway might go through the 782-foot diameter zone where the turbine blades rotate. Installation of all 176 monopoles with turbines was expected to create a visual deterrent that minimized the risk of a whimbrel colliding with a blade.

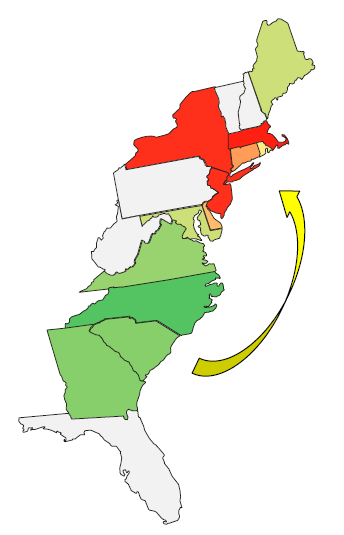

electricity costs more in the Northeast, so offshore wind-powered facilities could end up exporting energy to New York customers while affecting tourism of coastal communities in Virginia/North Carolina

Source: Southeastern Coastal Wind Coalition, Why North Carolina and the Southeast?

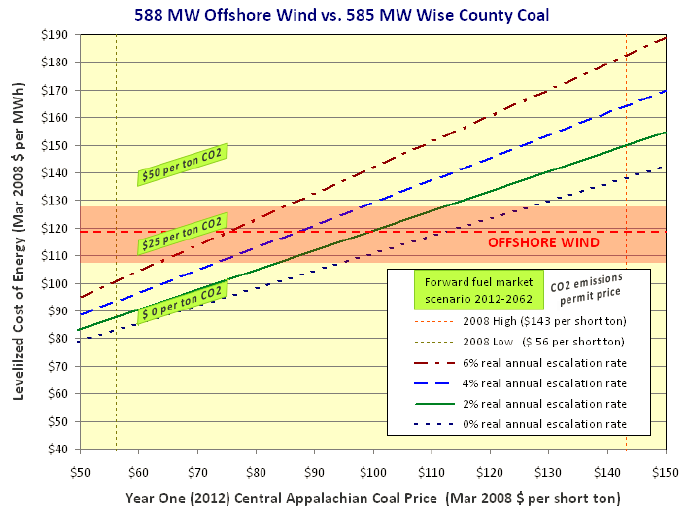

The Virginia Coastal Energy Research Consortium calculated that offshore wind-powered facilities could generate electricity at a rate competitive with coal-fired power plants, if the facilities using fossil fuel were required to implement carbon capture and sequestration to offset the global warming impacts of carbon dioxide.

In 2010 the estimated costs to build infrastructure to generate electricity at offshore wind farms vs. fossil fuel power plants were:5

Over a decade later, Dominion Energy was starting construction of its Coastal Virginia Offshore Wind project and the numbers had changed. In 2023, despite COVID-induced inflation and supply chain interruptions, the utility estimated the costs for offshore electricity would be $77 per megawatt hour.

projected costs of electricity generated from Wise County coal vs. offshore wind

Source: Virginia Coastal Energy Research Consortium, Virginia Offshore Wind Studies, July 2007 to March 2010: Final Report

Another way to assess the relative cost of wind energy is from a customer's perspective. Mary Doswell, senior vice president for alternative energy solutions at Dominion Power, stated in 2012 that Dominion was planning an offshore facility with up to 400 towers and had the transmission infrastructure onshore to distribute that electricity, but generation from offshore wind turbines would cost 130% more than electricity from existing sources:6

In 2018, offshore wind was projected to cost 22 cents/kilowatt hour, compared to 10-11 cents/kilowatt hour for electricity generated at nuclear or conventional coal/natural gas plants. Years later, in reference to the high initial costs for a project to generate "green" hydrogen, a Department of Energy official commented:7

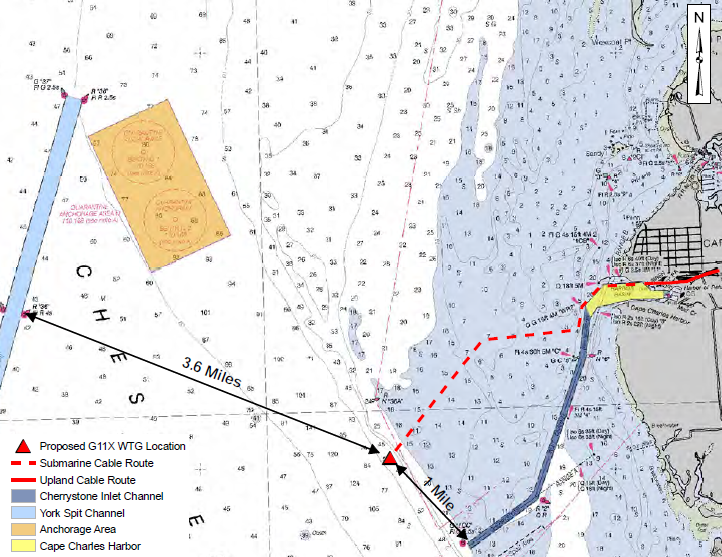

In March 2011, the Virginia Marine Resources Commission approved a site in state waters three miles west of Cape Charles for a 5MW offshore wind turbine prototype to be constructed by a Spanish energy company, Gamesa. A month earlier, the same company opened an offshore turbine factory in Norfolk. A competing firm, Poseidon Atlantic, also announced plans to build 10 test pads on the Eastern Shore to test and certify wind turbines on towers as much as 750' high, which was the maximum height authorized in Northampton County.8

However, 14 months later Gamesa abandoned its plans for Virginia's first prototype offshore windmill and chose instead to build in the Canary Islands. Though Virginia state agencies had green-lighted all permits quickly, the company may have been spooked by unclear Federal policy regarding subsidies for renewable energy and by the threat of competition from power plants fueled by low-cost natural gas.9

Gamesa planned to lease submerged land from Virginia and build its (now-cancelled) prototype offshore wind turbine in the Chesapeake Bay between Cape Charles and the middle Peninsula

Source: Virginia Joint Permit Application and Project Description for Gamesa G11X Offshore Wind Turbine Project

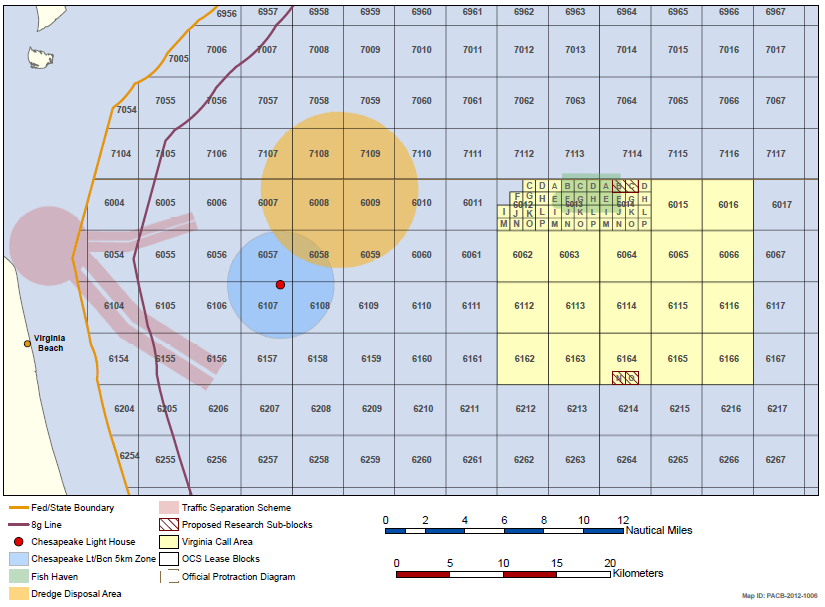

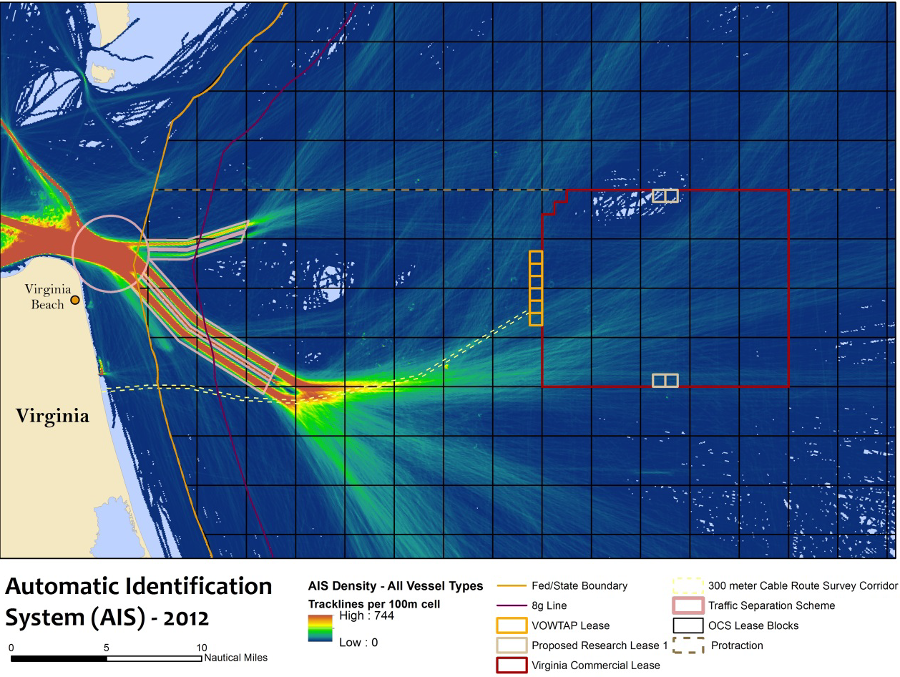

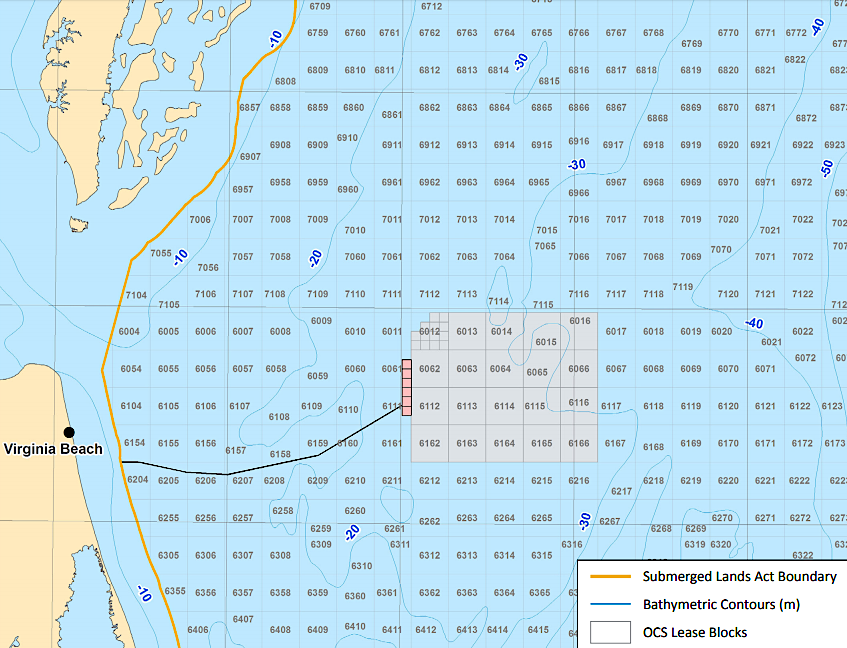

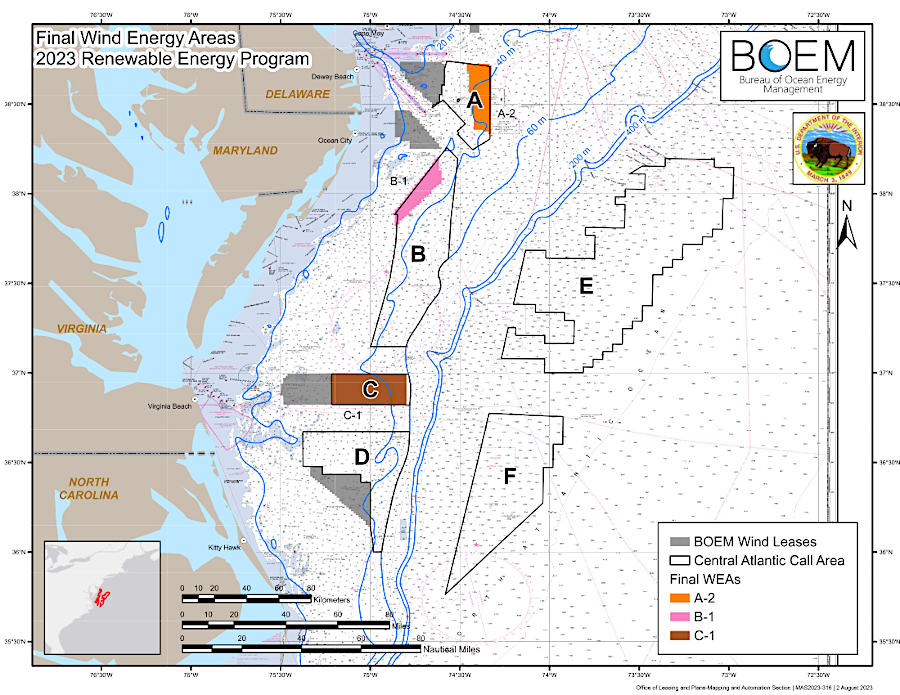

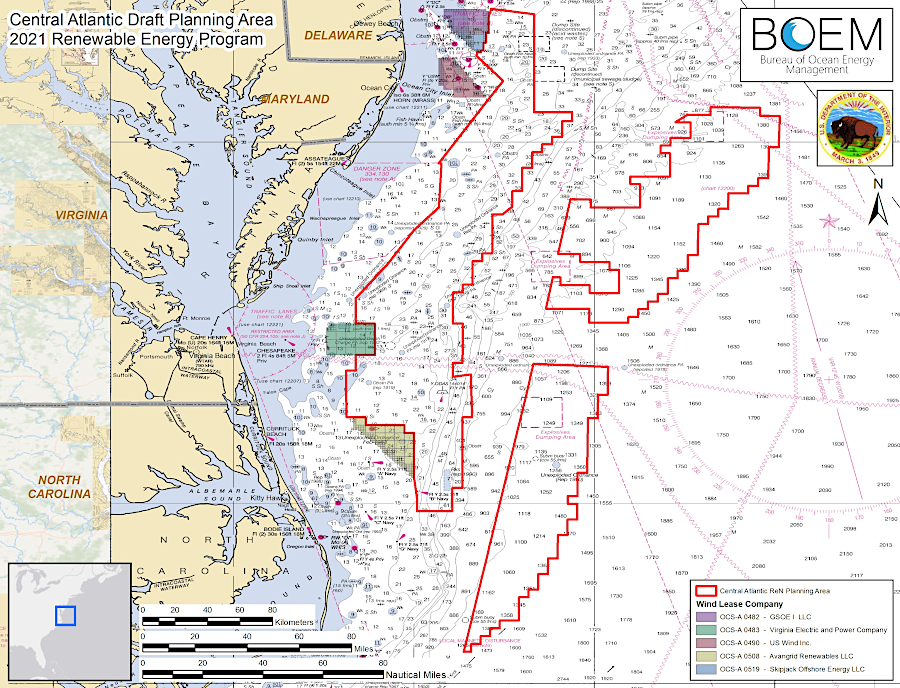

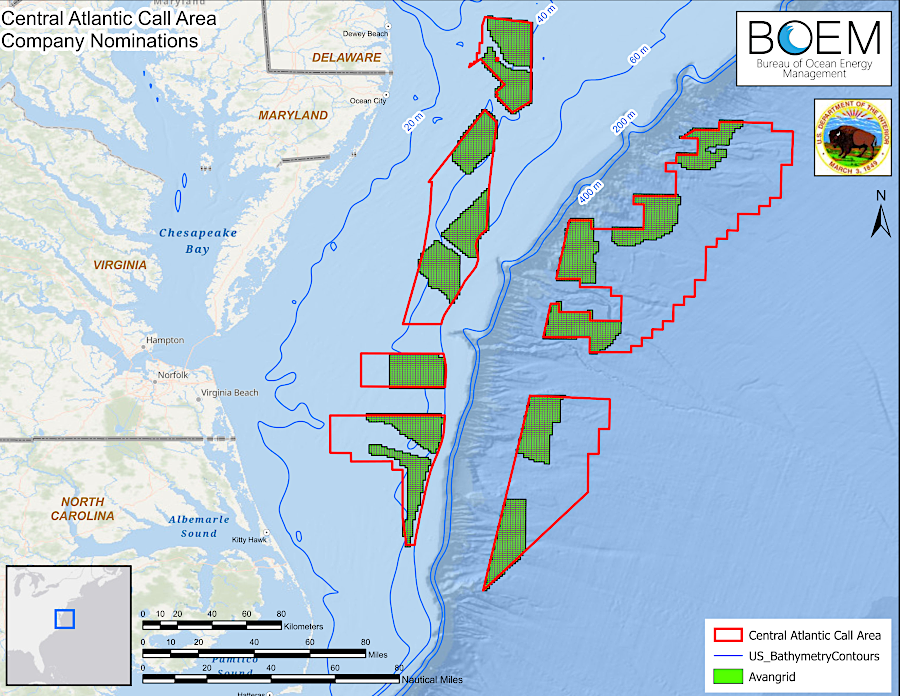

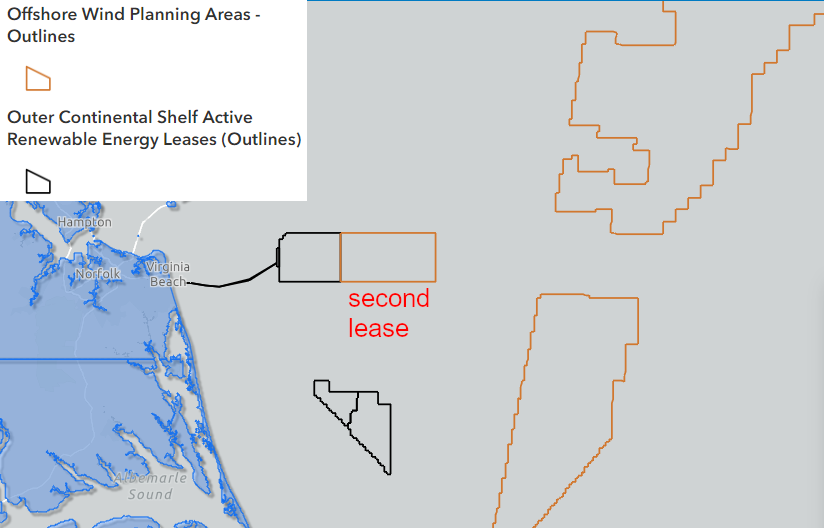

In 2012, the intergovernmental Virginia Renewable Energy Task Force identified 113,000 acres off the Virginia coast, defined in 32 specific blocks of ocean between 23.5-35.5 nautical miles east of Virginia Beach, as the prime area for future offshore leases. The initial Federal review started with 70 square blocks, 3 miles on each side.

The more powerful the wind, the lower the cost to generate electricity from wind turbines. Working from the shoreline near Cape Henry, NASA's Langley Research Center in Hampton has used Doppler LIDAR to map the wind speeds in the 20 different blocks in the area to be leased by the Federal government.

Class 6 wind power potential and possible lease blocks off Virginia coast

Source: Virginia Coastal Energy Research Consortium, Virginia Offshore Wind Studies, July 2007 to March 2010: Final Report

After excluding areas with potential conflicts with Department of Defense activities (including dredge disposal regulated by the U.S. Army Corps of Engineers), NASA operations from Wallops Island, and shipping paths (including the Coast Guard's Atlantic Coast Port Access Route Study) - but still including a fish haven/artificial reef - the Bureau of Ocean Energy Management narrowed the area of potential leasing to 19 complete blocks and 13 partial blocks. The site offered potential for installing enough turbines to generate 2,000 megawatts.

2012 Call Area identified by Federal government for potential offshore wind leases

Source: Bureau of Ocean Energy Management, Map Showing Virginia Call Area

multiple demands for ocean space limit locations where offshore wind facilities could be located

Source: US Department of Energy, Atlantic Offshore Wind Transmission Study (Figure 11)

Dominion Power, the dominant energy utility company in Virginia, received a US Department of Energy research grant in 2012 for the Virginia Offshore Wind Technology Advancement Project (VOWTAP). The utility partnered with the Virginia Department of Mines Minerals and Energy (now the Department of Energy), and the state agency submitted the formal grant application. The grant authorized up to $47 million in Federal funding.

The Bureau of Ocean Energy Management then approved a lease of six sub-blocks on the Outer Continental Shelf for building offshore wind towers on a non-competitive basis, after determining that no one else would respond to an opportunity to lease the site off Virginia Beach. In 2015, the Federal agency awarded the first wind energy research lease in Federal waters to the Virginia Department of Mines, Minerals and Energy.

image of possible wind farm off Virginia's shoreline

Source: Bureau of Ocean Energy Management, Call for Information and Nominations: Discussion of Possible Virginia Call Area

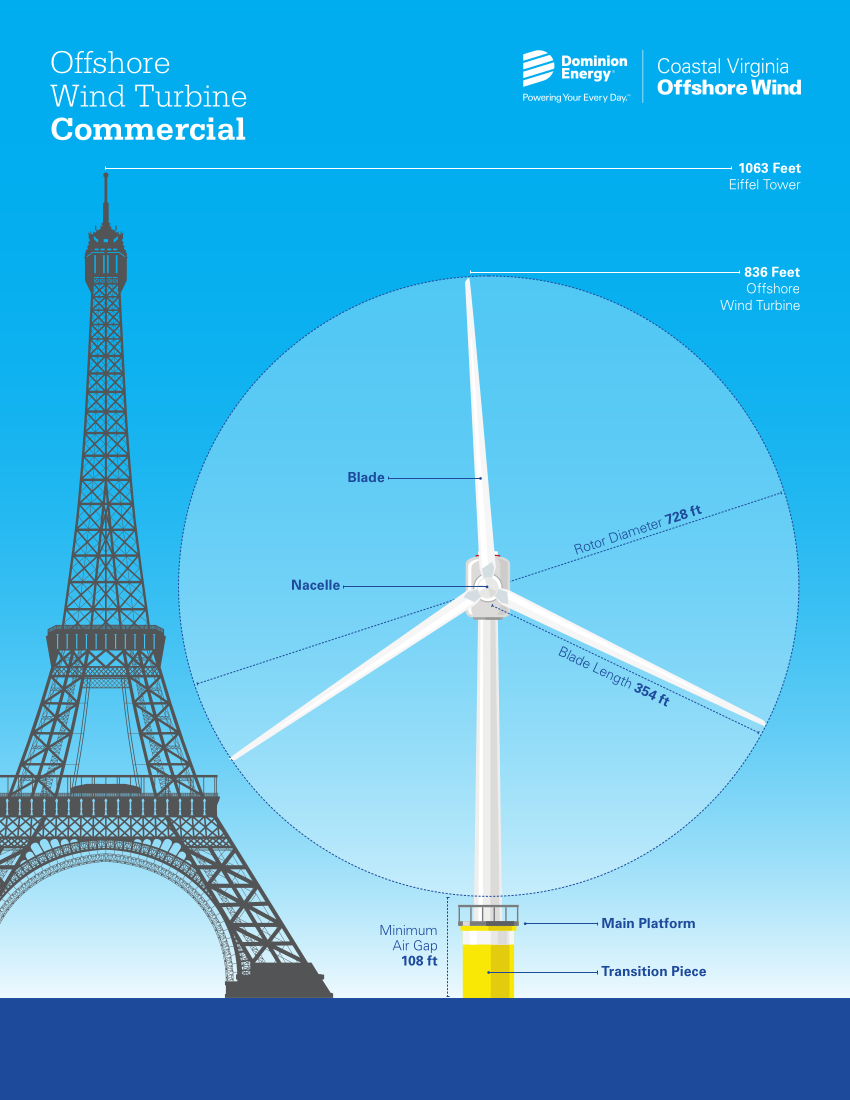

As planned, Dominion then announced it would build two 6-megawatt turbines, each 500-feet tall, on the research lease. In theory, information from those turbines would help the privately-owned utility plan the construction of a commercial wind facility adjacent to the research site.

The Federal government had sold the rights to build a wind-powered facility on an adjacent 113,000 offshore acres in 2013. There were eight qualified bidders, but only two companies actively bid. As expected, Dominion Energy won the auction. Its price of over $14/acre was well above the minimum opening bid at $2/acre. Dominion Energy planned up to 200 turbines to fully develop the wind potential on the 113,000 acre parcel.10

the Virginia Offshore Wind Technology Advancement Project (VOWTAP) leased offshore blocks for two 6-megawatt (MW) wind turbines, after determining potential impacts from ship traffic

Some environmental groups such as the Sierra Club feared Dominion Energy would avoid developing its offshore lease and stretch out development as long as possible. Delay could minimize innovation and thus reduce the potential for building offshore wind turbines, which might compete with the traditional coal-fired, gas-fired, and nuclear-fueled power plants in which Dominion has invested heavily. If the utility had to shut down the fossil-fueled and nuclear-powered generating plants before their planned life expectancy, the utility's customers or investors would still have to pay the unamortized costs for those stranded facilities.

That "delay offshore wind" conspiracy theory assumed Dominion Power would prefer to build more generating plants fueled by natural gas, rather than develop the technology required to generate electricity by offshore wind. The utility had invested heavily in natural gas, including the Atlantic Coast Pipeline to bring natural gas into Virginia, and anticipated substantial profits from that business.

Dominion's announcement in April, 2015 that it was postponing plans to build the two test offshore turbines due to unexpectedly high construction costs - initial bids were twice the cost of Dominion's $230 million estimate, and rebidding cut that overrun by only 50% - led to accusations by the Virginia League of Conservation Voters that the utility was "dragging its feet."

In 2016, the US Department of Energy withdrew its $40 million commitment to provide Federal funding. The cancellation was based on the inability of Dominion Power to guarantee completion of the offshore wind project by 2020.11

the six sub-blocks leased for a two-turbine research project was adjacent to the site leased for a 300-turbine commercial offshore wind project

Source: Bureau of Ocean Energy Management (BOEM), Outer Continental Shelf Renewable Energy Leases - Map Book

If all the proposed turbines were constructed on the offshore blocks leased by the Federal government, final costs for installing 300 turbines and cables to transfer 2,000MW electricity onshore to the grid at Virginia Beach could equal the estimated $15-20 billion cost of building a third nuclear reactor at Lake Anna.

A third reactor would generate roughly the same amount of electricity as the proposed offshore wind turbines, but electricity from the reactor could be dispatched reliably into the grid 24 hours/day. The commercial wind-powered facility would generate electricity intermittently based on wind patterns, and might produce only 40% of its maximum ("nameplate") capacity.12

from left to right: the three typical fixed bottom substructures for wind turbines are monopile, jacket, and inward battered guide structure (also known as a twisted jacket) and the three typical floating substructures are semisubmersible, tension leg platform, and spar

Source: US Department of Energy, National Offshore Wind Strategy (2016) (Figure 3-3)

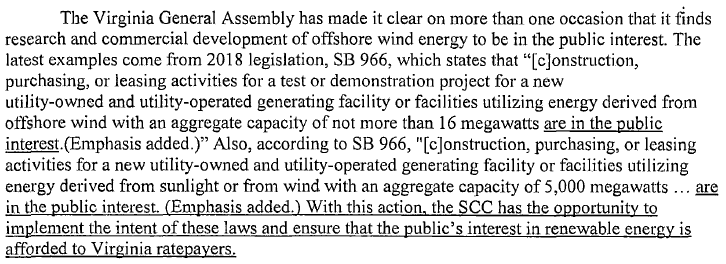

To stimulate development of offshore wind, the General Assembly declared in 2018 that:13

One commentator suggested that the turbines may:14

The "in the public interest" language in legislation helps to bypass the process used by the State Corporation Commission (SCC) to determine the cost of generating electricity from different sources, and then require the utility to charge rates based on the lowest costs.

The cost of electricity from offshore may end up being substantially higher than the cost of electricity generated from gas-fired and nuclear-fueled power plants, but the General Assembly has authorized the State Corporation Commission to alter its normal review criteria and approve higher rates. The state legislature decided that subsidizing offshore wind as a renewable energy source was "in the public interest," even if the costs of generating that electricity via turbines were higher than generating electricity from alternative sources (including solar).

The "in the public interest" language was not new. The General Assembly had previously passed legislation declaring that construction of the coal-fired Virginia City Hybrid Energy Center, solar energy projects generating up to 500 megawatts, and a new pumped storage project were also in the public interest.

In addition, state law allows utilities to receive an enhanced rate of return higher than what is authorized for most of its capital investments, for both nuclear and offshore wind facilities:15

In response, Dominion Energy included the offshore wind demonstration project in its 2018 Integrated Resource Plan and teamed with Orsted Energy of Denmark, which already operated 1,000 offshore wind turbines. The utility filed a request in 2018 with the Virginia State Corporation Commission, requesting approval of the $300 million investment in building two turbines, each capable of generating 6MW of electricity.

Dominion planned to use excess earnings that it was accumulating, rather than ask the State Corporation Commission to approve a specific rate adjustment to fund the project. Until 2015, the General Assembly required that utility profits which exceeded the authorized rate of return must be returned to customers. Legislative changes in 2015 and again in 2018 authorized utilities to retain and then use excess earnings for projects that upgraded the electrical grid and generated renewable energy.

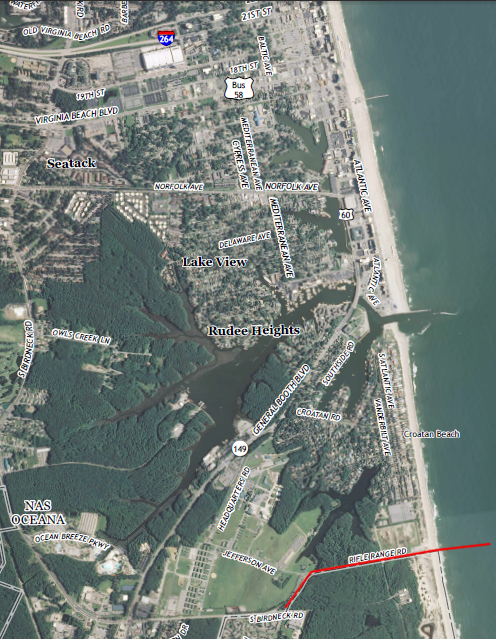

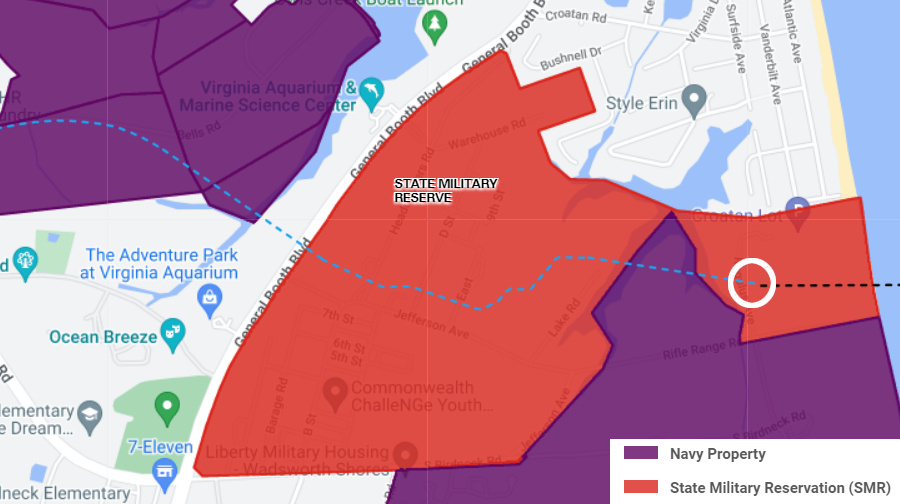

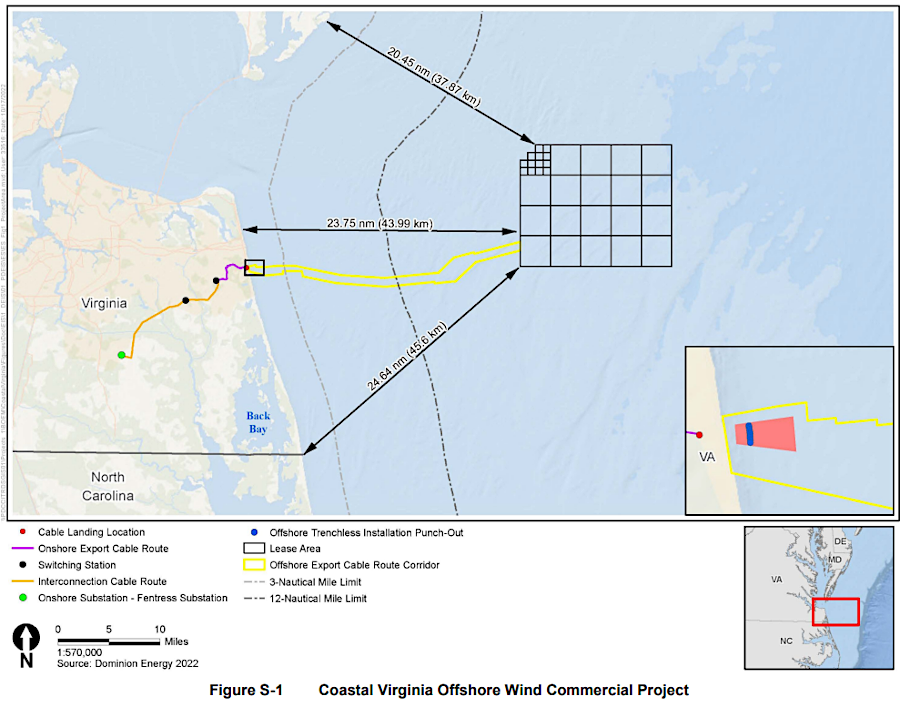

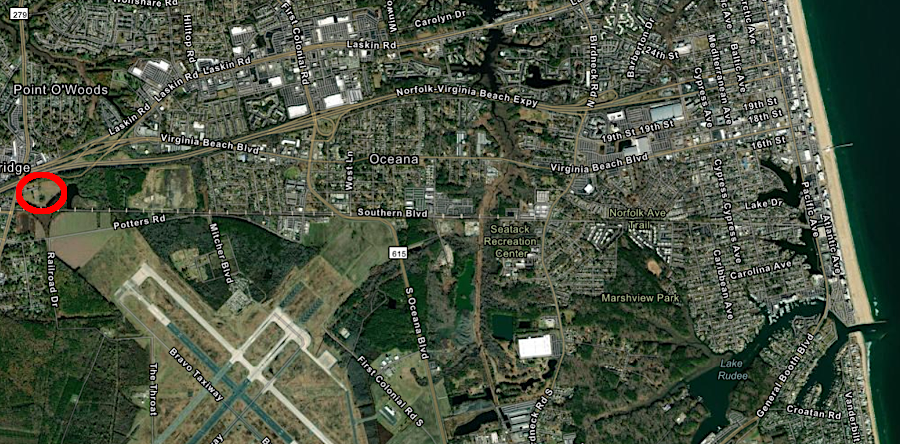

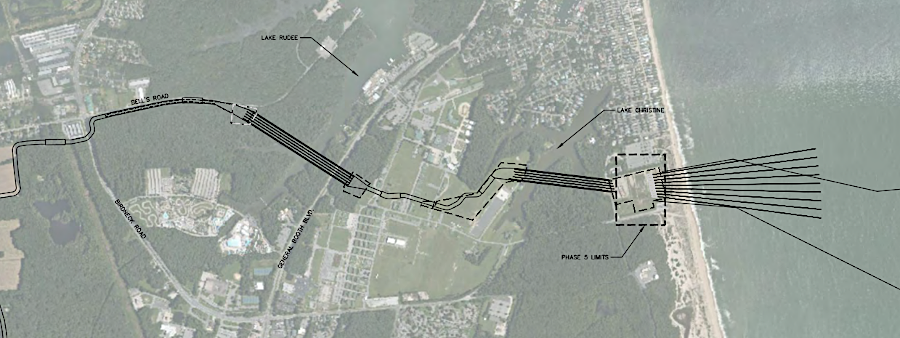

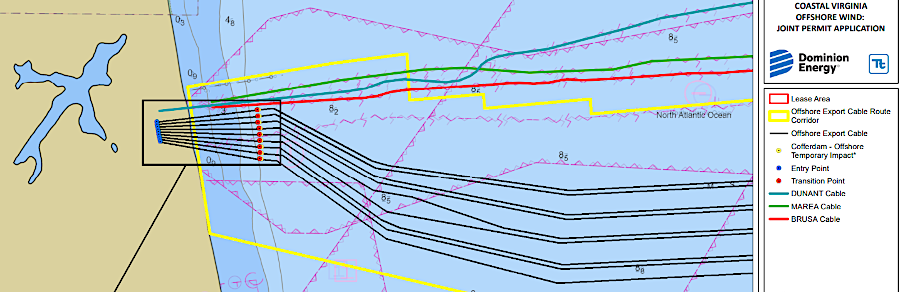

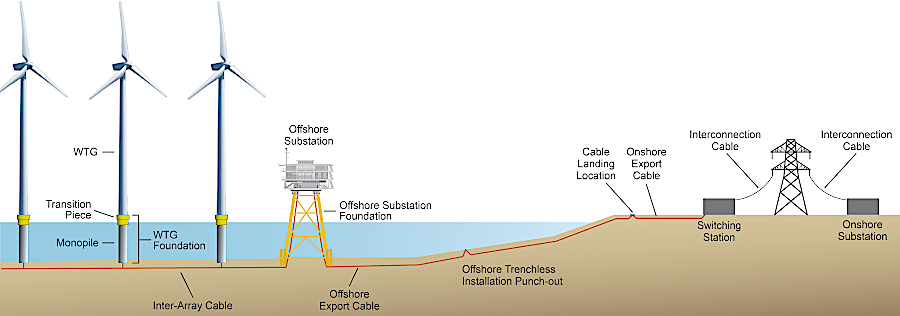

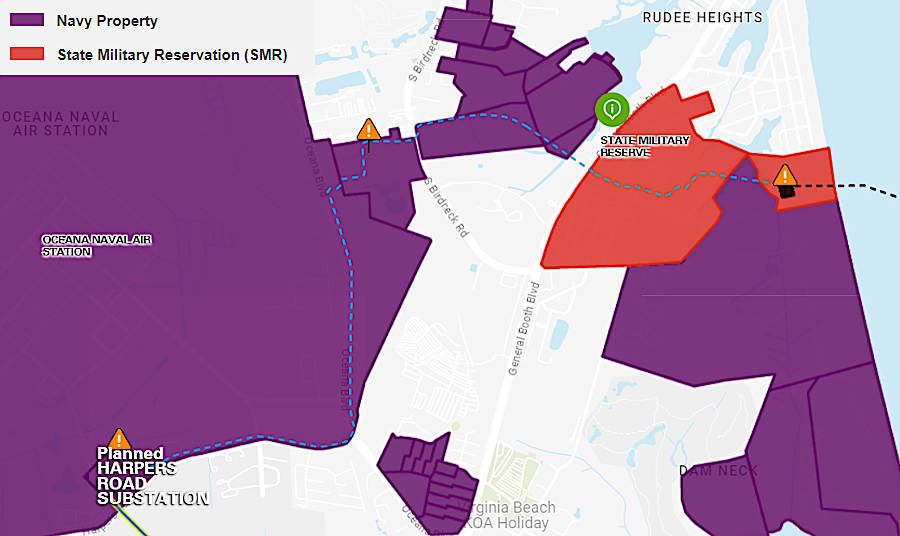

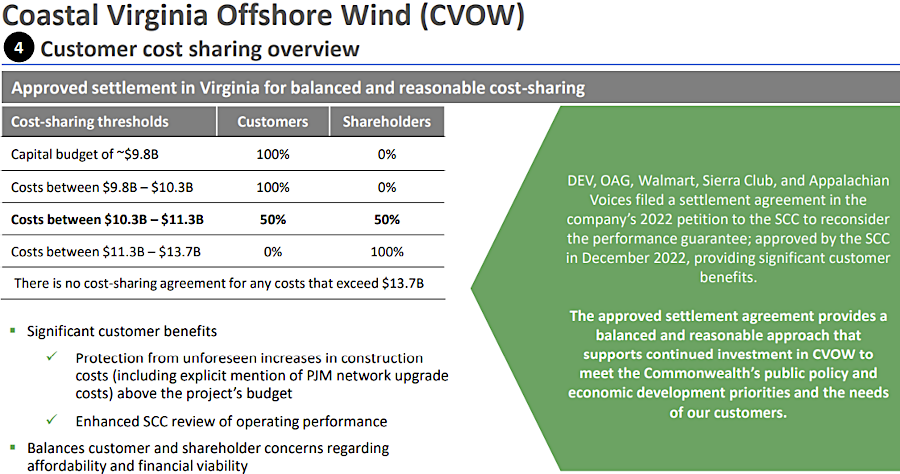

The first steps included surveying the seabed for the 27-mile route of the cable that would bring the electricity onshore at State Military Reservation/Camp Pendleton. Dominion Energy anticipated the turbines would become operational in 2021. They would operate for 25 years, even if the full-scale project was never constructed.

the cable transmitting electricity from wind turbines in the Atlantic Ocean would come onshore at State Military Reservation/Camp Pendleton, south of the resort area

Source: Dominion Power, Virginia Offshore Wind Technology Advancement Project - Preferred Cable Landfall and Interconnection Site

Base map from US Geological Survey (USGS), Virginia Beach 7.5x7.5 topographic map (2013)

The utility included only the demonstration project in its 2018 Integrated Resource Plan, which identified all construction projects planned for generating electricity. Dominion did not assume the demonstration project, which it renamed from "Virginia Offshore Wind Technology Assessment Project" to "Coastal Virginia Offshore Wind" (COVW), would lead to construction of a large-scale offshore facility capable of producing 2,000MW.

Dominion proposed to build a 34.5 kV AC submarine distribution cable to transmit only the electricity that would be generated by the two offshore turbines. If the utility chose to build 55 more turbines (each generating 8MW, for a total of 440MW) to expand the wind-fired power plant in the ocean, a separate cable would have to be constructed.16

electricity generated 27 miles offshore had to be brought to customers via a subsea cable

Source: Dominion Energy, Delivering Wind Power

Despite the utility's cautious approach, Governor Northam included full-scale development in his 2018 Energy Plan. Those plans are issued by each governor a year after their election. Gov. Northam supported generation of 2,000MW offshore by 2028, plus "medium-sized wind farms on ridge tops."17

Absent legislative authorization, it would be out of character for the State Corporation Commission to authorize higher rates to recover even the costs for a demonstration project, much less guarantee the standard percentage of profit for Dominion's investors. The State Corporation Commission rate approval process focuses on identifying the low-cost alternatives for electricity generation and transmission, and requiring regulated utilities to chose the most cost-effective options when building power plants and transmission lines.

the cable bringing electricity from the offshore turbines connects to the onshore grid at State Military Reservation/Camp Pendleton (white circle)

Source: GeoVoice, Coastal Virginia Offshore Wind

The State Corporation Commission controls costs by government decision, since there is almost no market competition in sales of electricity to end customers. Without the regulatory oversight, utilities with a monopoly over defined service areas could build excessively-expensive facilities, get a guaranteed rate-of-return on the extra infrastructure, overcharge customers who have no alternative provider for getting electricity, and create higher dividends for investors who buy the company stock.

Dominion Energy would not build a wind-fueled power plant, onshore or offshore, if the State Corporation Commission would not approve including the costs in the utility's rate base. The company was unwilling to finance construction of a generator of high-cost electricity if the state regulators did not allow Dominion Energy to earn an acceptable rate of return on the investment. The utility invested in facilities only if corporate profits would increase and the value of Dominion's stock would decline.

Dominion was slow to develop its offshore lease because it is expected that electricity generated by offshore wind would not be competitive with electricity generated from other fuel sources. Normally, the State Corporation Commission would reject rate increases high enough for Dominion Energy to justify investing in offshore turbines. One very real possibility was that Dominion would relinquish its Federal lease, and Virginia would never see any turbines in the Atlantic Ocean.

the Virginia Offshore Wind Development Authority emphasized to the State Corporation Commission that a high-cost wind facility was still "in the public interest"

Source: Virginia Offshore Wind Development Authority, Comments to State Corporation Commission on the Coastal Virginia Offshore Wind Project (October 1, 2018)

Whether offshore wind turbines would ever be economically competitive was questionable in 2018. The wind offshore is free - but it is equally free onshore. Building offshore wind farms involves even higher one-time costs than building wind energy facilities onshore. Onshore wind energy facilities require negotiating with local governments for zoning approval, a process that might be more complicated than getting leases from the Federal government, but the extra costs of offshore wind projects will be hard to justify.

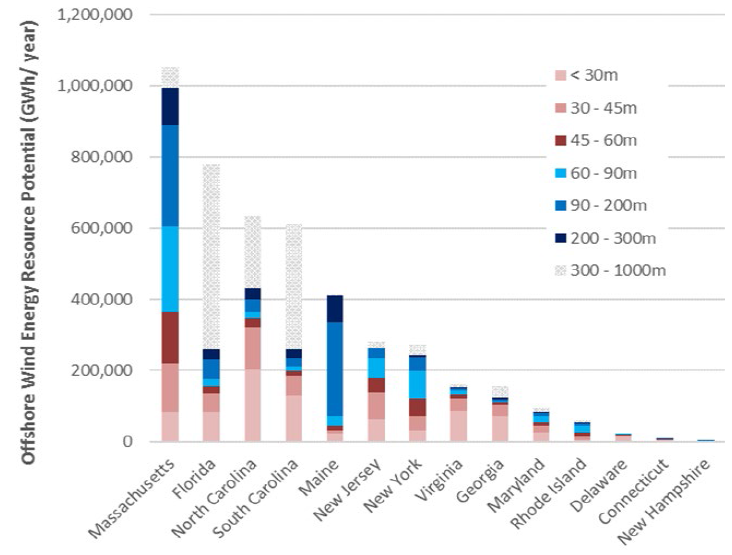

offshore wind resource energy potential, in terawatt-hours/year reflecting water depths above and below 60-meters

Source: National Offshore Wind Research and Development Consortium, Research and Development Roadmap (Figure 2)

The Virginian-Pilot newspaper editorialized in 2016 that pursuing offshore wind power was a waste of effort, because other renewable sources were more cost-effective.

The editorial noted the Energy Information Administration had calculated that by 2020, electricity generated by offshore wind will still cost 250% more than electricity generated by onshore wind turbines. In 2020, electricity from wind and solar was expected to compete with electricity generated by burning fossil fuels, except for offshore wind. Electricity from onshore wind farms was expected to cost no more than electricity produced at natural gas plants, and electricity produced by photovoltaic solar cells was predicted to cost only 10% more than what a state-of-the-art coal plant could produce.

According to the paper:18

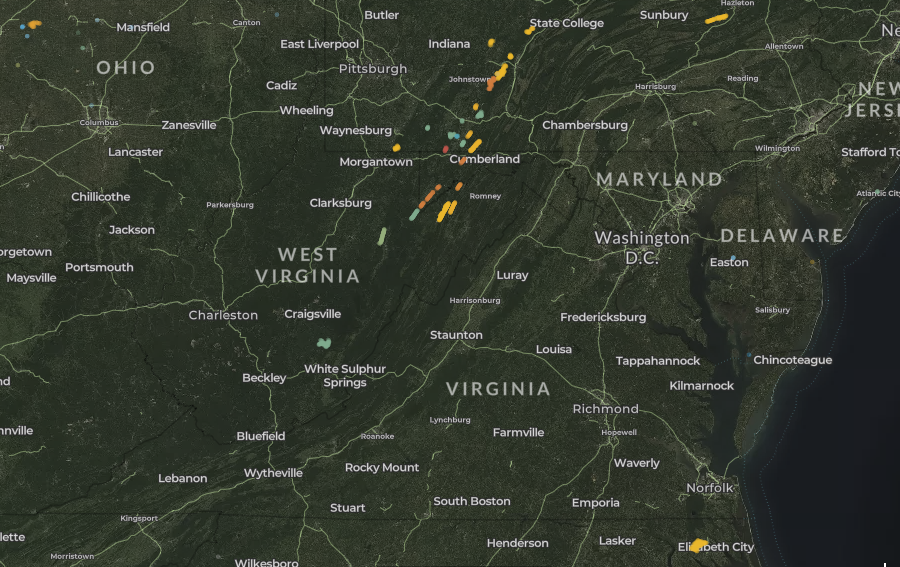

in 2018, the U.S. Wind Turbine Database identified no onshore or offshore wind turbines in Virginia

Source: U.S. Wind Turbine Database

The economics of building the Coastal Virginia Offshore Wind project were daunting even for constructing two demonstration turbines, but "public interest" as well as costs became key factors.

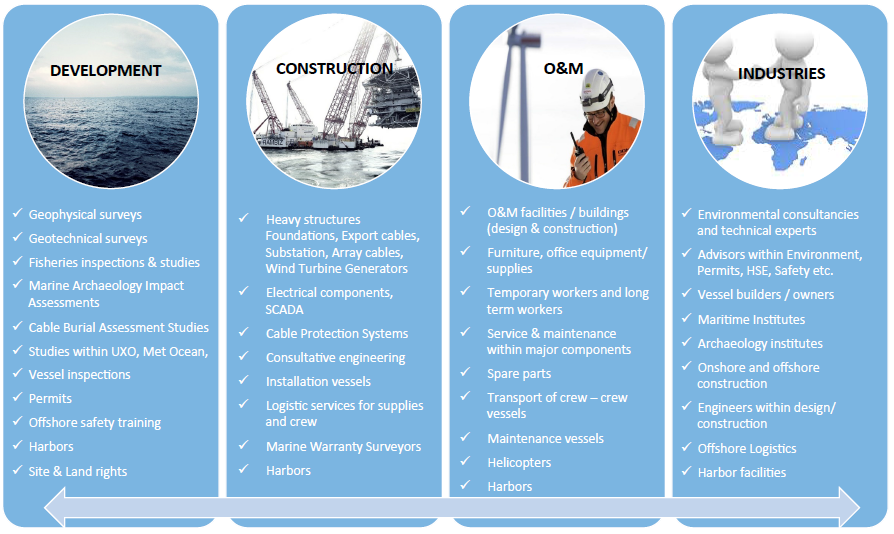

The Sierra Club sponsored a report in 2018 that suggested an investment in the initial infrastructure for wind turbines in the Atlantic Ocean might be justified in the long run, even though generation of electricity offshore might not be cost-effective. Other economic advantages to Virginia should be considered, by assuming construction could create:19

The report identified five main competitive advantages for building wind turbines off the Virginia coast, compared to neighboring states:20

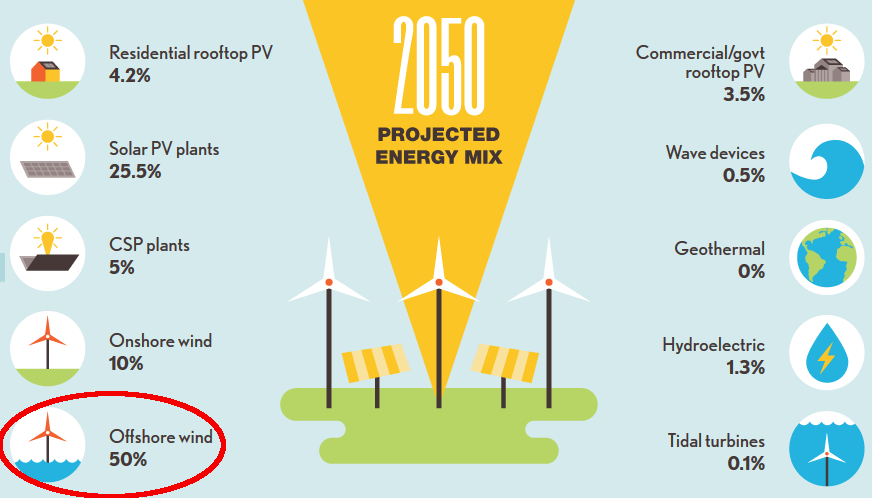

one visionary projection for generating 100% of Virginia's electricity from renewable sources assumed offshore wind could supply half of the demand

Source: The Solutions Project, Virginia

The Bacon's Rebellion blog offered the alternative argument, that the offshore wind project was far too expensive to be justified. The electricity from the two turbines would cost $0.77/kwh (kilowatt hour), which was 10 times the rate for the offshore wind project already in operation in Massachusetts at Block Island.

Writers and those commenting on that blog highlighted that offshore wind was a now-common technology, implemented successfully in multiple locations already, and the only real remaining research to be done for offshore wind was to determine how turbines responded to an Atlantic Ocean hurricane. The chances of a hurricane crossing over the demonstration site were small, so the research could require decades of waiting. If Dominion proceeded to build the rest of the turbines proposed for the site without waiting for a hurricane to strike the two research turbines, then the "demonstration project" would have minimal results to demonstrate.

a twisted jacket foundation will be less expensive for Dominion Power's two wind turbines, 26 miles offshore

Source: Department of Energy, Advanced Offshore Wind Tech: Accelerating New Opportunities for Clean Energy

The bloggers also questioned the economic claims that Hampton Roads might become a center for servicing offshore turbines. Each state along the East Coast was justifying their proposed offshore projects with the same argument. Clearly not every state would end up with a "hub" that created many new jobs for technicians, meteorologists, and shipping personnel.

In the end, the State Corporation Commission took its direction from the General Assembly's "in the public interest" language and waived its normal approach of requiring regulated utilities to build power plants with the best benefit/cost ratio. Adding the expensive facility to Dominion's rate base guaranteed higher company profits, rewarding investors while burdening the company's customers with higher-cost electricity.21

That ended up being the case. The State Corporation Commission approved the Coastal Virginia Offshore Wind (CVOW) project on November 2, 2018. The state agency noted that Dominion's customers (ratepayers), not the owners of stock, would be exposed to all the risk of cost overruns or complete failure, and there was no competitive bidding to manage the costs of construction.

Unlike all other offshore wind projects owned by the developer of the project, the Virginia General Assembly structured the Coastal Virginia Offshore Wind project so the state-regulated utility owned it. Dominion's customers, the 2.6 million Virginia ratepayers, were responsible for financing the construction. Stockholders assumed no risk.

Risks included a shortfall in energy production. Dominion Power assumed the turbines would generate 42% of their maximum capacity, accounting for low winds and downtime for maintenance. If the turbines ended up producing less, the dividends paid to the company's stockholders would not drop in parallel with the shortfall. Instead, if the offshore wind project was a poor investment of capital and electricity generated was overly-expensive compared to other sources, Dominion Power would still purchase 100% of that electricity at full cost and ratepayers were still obligated to pay 100% of the cost.

The state agency concluded that Dominion did not need the 12MW of energy coming from the offshore project, and the costs were so high it was not prudent to approve the investment - except the General Assembly had directed it to do so. If the entire project was constructed, the cost of energy from large-scale offshore wind would be 13.10¢/kWh, far higher than alternative sources.

The State Corporation Commission was clear that it would have rejected Dominion Energy's proposal, outside of the General Assembly's policy direction in the 2018 Grid Transformation and Security Act, because:22

The pilot project was planned as just a starting point; building two 6MW turbines was not the objective. A close observer of the State Corporation Commission's actions on renewable energy concluded:23

if numerous offshore turbines are constructed, cables could "inject" electricity into the onshore grid at alternative locations

Source: Dominion Virginia Power, Virginia Offshore Wind Integration Study (p.17)

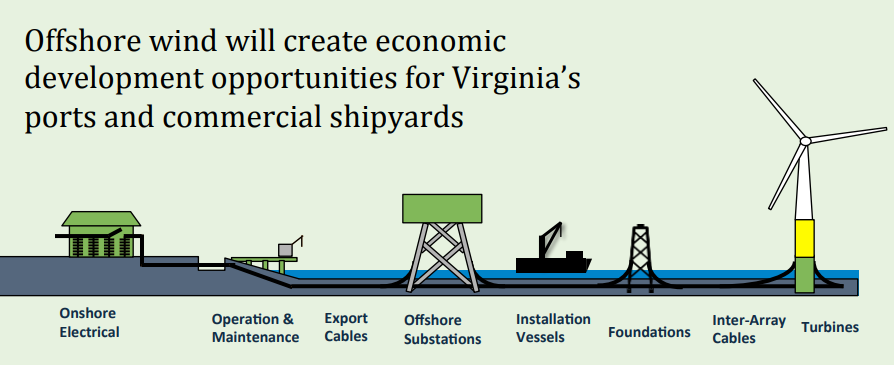

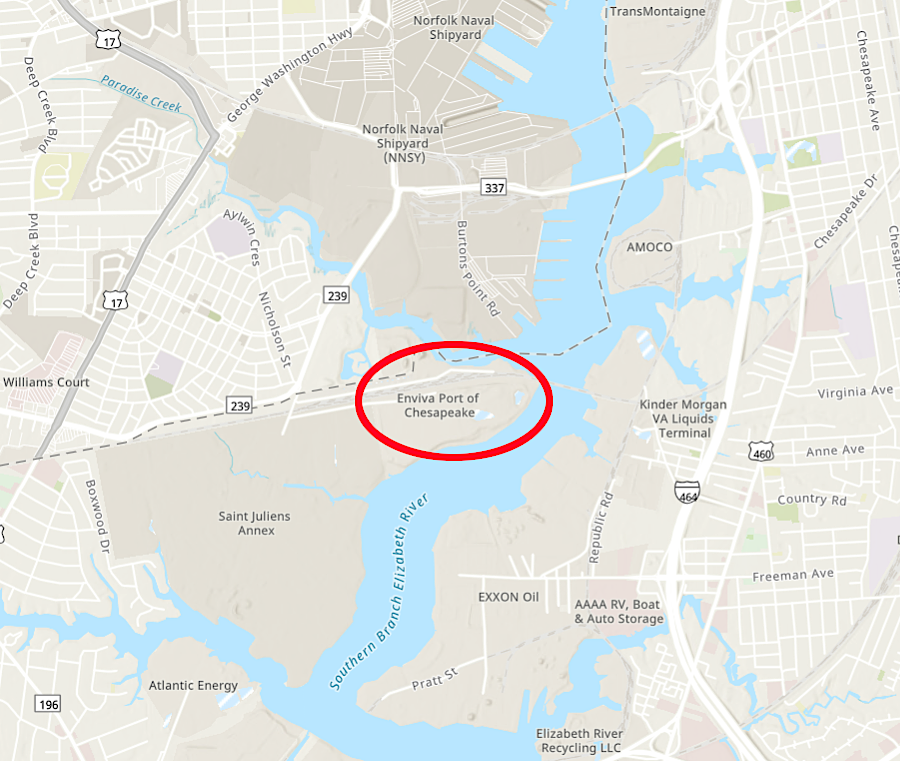

The Virginia Department of Mines, Minerals and Energy (now Virginia Department of Energy) studied the potential for Virginia to become the primary supply base for offshore wind operations. One analysis in late 2018 recommended a collaborative approach, rather than competing with nearby states, to establish a "multi-state regional supply chain cluster" of facilities.

The report concluded that Virginia had particular strengths for capturing economic benefits of support for offshore projects, including a pro-business climate, unmatched port infrastructure, and congestion-free navigation.

However, Virginia was projected to have only 10% of the installed wind generation capacity in 2030. Massachusetts was projected to have over 25%, justifying investment in the New Bedford Marine Commerce Terminal within that state for construction, assembly and deployment of wind turbines for offshore lease areas.

The distance from Hampton Roads/Cape Charles to the New England offshore turbines was a constraint, and Virginia had more potential to provide support to Mid-Atlantic offshore facilities off the coastline of Maryland, Virginia, North Carolina and South Carolina. More cooperation and less competition was required for Virginia to have that opportunity. Maryland has mandated that offshore projects in that state's lease areas use Maryland ports for construction, maintenance and service operations, though height restrictions from bridges could be a limiting factor.

The report concluded:24

the strongest offshore winds are in Federal waters, not in the state waters (Chesapeake Bay and within three miles of the coastline)

Source: WINDExchange, US Department of Energy, Virginia Offshore 90-Meter Wind Map and Wind Resource Potential

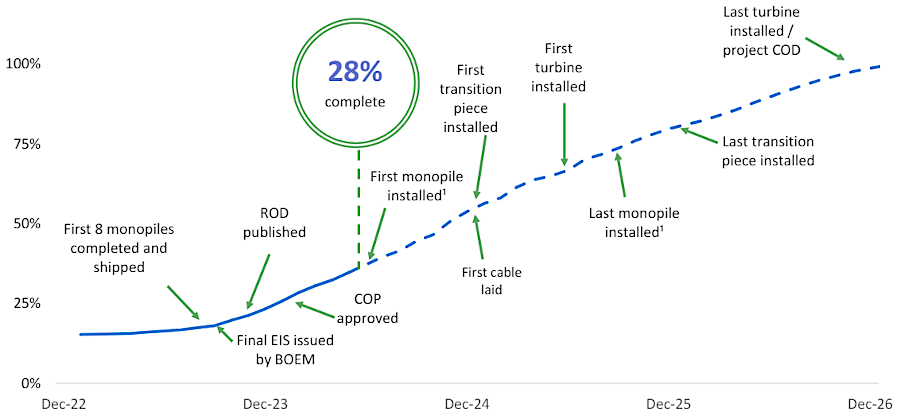

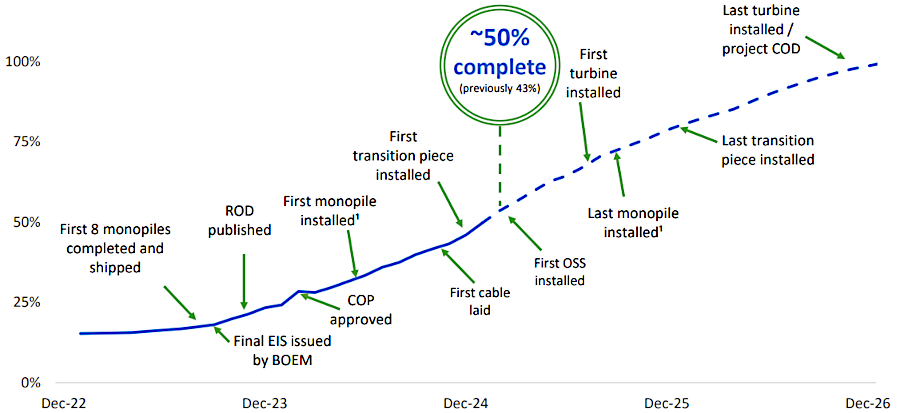

In 2019, Dominion Energy committed to build the entire Coastal Virginia Offshore Wind project without getting any information from the planned two test turbines. The utility had not included plans to expand beyond its two-turbine pilot project in its 2018 Integrated Resource Plan submitted to the State Corporation Commission, but at essentially the same time Dominion Energy did announce to Wall Street investors plans to spend an additional $880 million through 2023.

Later in 2019, the utility issued a press release announcing that it would build the first two turbines of the Coastal Virginia Offshore Wind project in 2020. That $300 million investment would generate only 12-megawatts, but would enable the company to be clear that it could implement the European approach to building towers in waters up to 125 feet deep.

Dominion Energy committed to expand to a 2,600-megawatt commercial offshore wind development. At the time, it planned over 220 turbines. They would be installed in three 880 megawatt phases to be completed in 2024, 2025, and 2026.

At the time, Virginia one of only nine states without any operating wind energy projects. One observer editorialized that the economics of wind energy flipped the utility's planning:25

only nine states - including Virginia - had no operating wind projects in 2019

Source: American Wind Energy Association, AWEA State Wind Energy Facts

Despite dreams of Virginia officials that Hampton Roads or Cape Charles could become a support hub for offshore wind energy projects, Orsted U.S. Offshore Wind chose to locate its first logistics center for servicing offshore wind farms at Baltimore. That 2019 decision had political benefits, since the company's Skipjack Wind project was located off the coast of the Maryland-Delaware border. Orsted was committed to creating 1,400 jobs in Maryland as part of the approval process for Skipjack Wind, and putting a logistics center in Baltimore counted towards that commitment.26

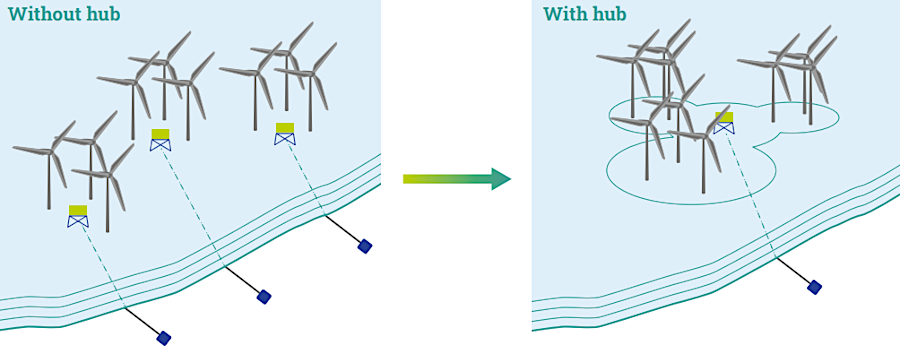

The company announced in late 2019 that its computer models for generating electricity from offshore wind facilities had been revised. The "lifetime load factor," the amount of electricity that would be generated by the turbines, was lowered 2%.

The turbines had been expected to generate up to 50% of their maximum potential, reflecting an assumption that the wind would not be sufficient to spin the blades effectively half the time. The 2% drop to 48% reflected an updated understanding of how each turbine creates turbulence and interferes with the efficiency of its neighbors. A 2% drop was economically significant, reducing projected revenue by tens of millions of dollars over the life expectancy of large wind farms.27

Even more significant was a recalculation by Dominion Energy of the cost for the full-scale Coastal Virginia Offshore Wind project. In March, 2019, the cost estimate was $1.1 billion. By November, the utility had revised it to $8 billion, and was still planning to finance 100% of it rather than share the costs, risks and profits with any partners. That placed 100% of the risk on ratepayers, assuming the State Corporation Commission approved increases in utility bills that would be needed to cover the costs.

The $8 billion price tag for the 2,640MW offshore project would make it the most costly electrical generating facility ever constructed in Virginia. In contrast, the recently-completed 1.6MW generating plant in Greensville County using natural gas cost $1.3 billion. The initial capital cost for that gas-based plant was $820,000 per megawatt, in contrast to the estimated $3 million per megawatt for offshore wind.

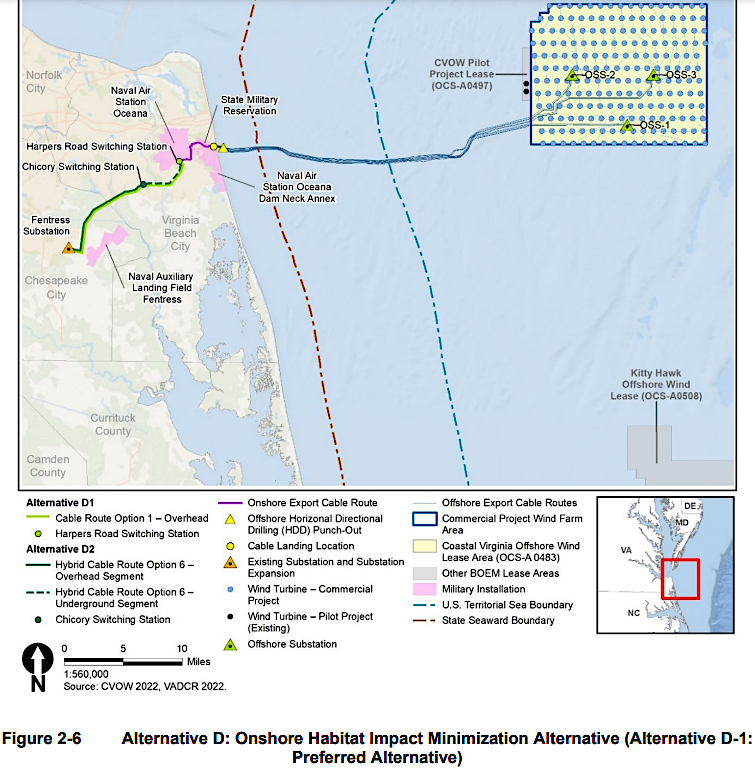

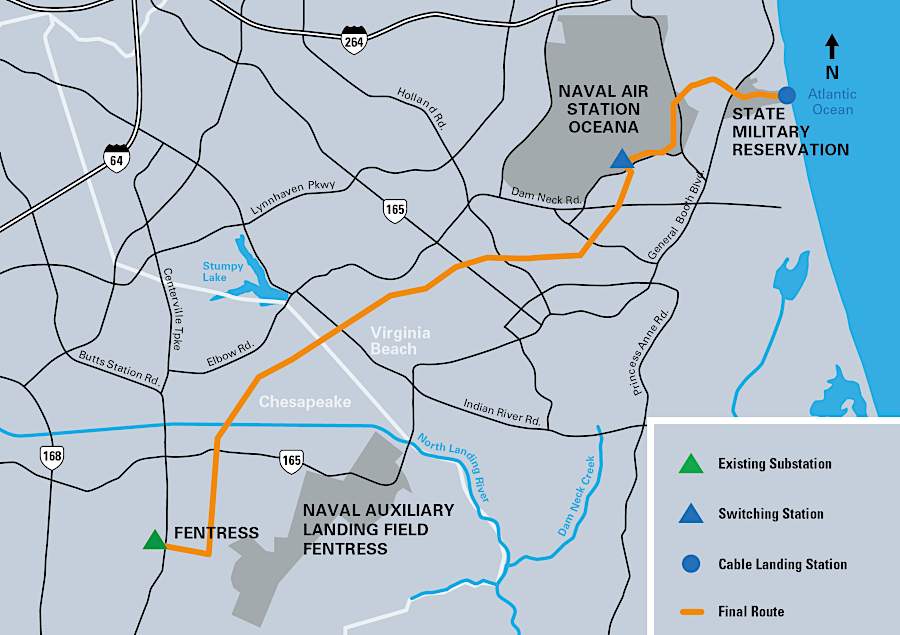

the Coastal Virginia Offshore Wind (CVOW) project stretched inland to the Fentress substation

Source: Bureau of Ocean Energy Management (BOEM), Coastal Virginia Offshore Wind Commercial Project Final Environmental Impact Statement (Volume 1, September 2023); Dominion Energy

The price tag jumped over 20% in late 2021. Dominion Energy announced a new cost estimate of $9.8 billion to complete the Coastal Virginia Offshore Wind project in 2026. The utility calculated that the estimated average extra cost to Dominion Power customers, $4 a month over the next 30 years, would not increase. The 176 turbines were projected to be more efficient because offshore winds were stronger than anticipated, plus federal tax credits could reduce the burden on ratepayers.

The standard incentive for Dominion Energy to minimize the cost of the Coastal Virginia Offshore Wind project had been eliminated by the General Assembly. Normally the utility had to convince the State Corporation Commission that a proposed new electricity generating plant would generate the most electricity at the lowest cost compared to alternatives, but state legislators made an exception for offshore wind.

The General Assembly had started mandating approval of high-cost projects in 2008, when the Virginia City Hybrid Energy Center in Wise County was defined by law to be in the public interest. At that time, the Levelized Cost of Energy (LCOE) over the lifetime of the project was predicted to be $93 per megawatt-hour. The legislature did not intervene in 2015 when Dominion Energy was considering construction of a $19 billion third nuclear power plant at Lake Anna. North Anna 3 would have produced electricity costing $190 per megawatt-hour.

At $9.8 billion, the Coastal Virginia Offshore Wind project was predicted to produce electricity costing $87 per megawatt-hour. Utility scale solar facilities were projected in 2021 to generate electricity at a Levelized Cost of Energy of $28-41 per megawatt-hour, obviously less expensive than offshore wind.

However, comparing the costs and benefits of the two forms of renewable energy required more than a simple cost comparison. One benefit of the offshore project was that winds were expected to strongest primarily in the evening when demand peaked, and in the winter when solar generation was limited by shorter day length.

The General Assembly provided more direction to the State Corporation Commission to approve a full-scale offshore wind project, even if the cost-effectiveness was poor compared to generation of electricity from other sources. The Virginia Clean Economy Act stated clearly:28

The private investor-owned utility, Dominion Resources, successfully lobbied Governor Northam and his staff for a change in the 2020 Virginia Clean Economy Act that increased the cost basis for the offshore project by $2.4 billion. The utility was authorized to set prices high enough to earn a roughly 10% profit on its infrastructure base. The legislature's approval of the high-cost wind energy project ensured the utility would generate increased profits, as well as 5,200 megawatts of electricity.

A calculation of the life cycle costs of the two facilities needed to account for free wind vs. the cost of natural gas, but the math did not suggest that offshore wind was the least-expensive generating option. Approval by the State Corporation Commission of the full-scale facility hinged on the policy direction of the General Assembly, rather than a standard assessment of least-cost options.

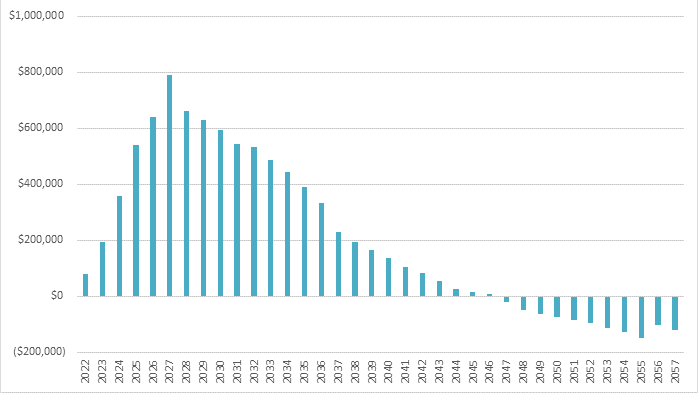

In 2022, as the State Corporation Commission was preparing to issue the final approval for the largest project ever proposed by a Virginia utility, Dominion recalculated the projected costs to be $9.65 billion. Assuming no cost overruns, paying for the project would require a monthly increase in average electric bills for Dominion's customers. That increase would rise to a peak of $14.21 per month in 2027.

Customers would pay an average of $170 more for electricity in 2027 in order to fund the construction of the offshore wind project. Customers would continue to pay for the project, with costs declining each year from the 2027 peak, for another 20 years. Between 2047-2057, customers buying electricity from Dominion would pay lower bills because Dominion had completed recovering costs for construction costs. Cost savings would last a decade, and in 2057 the turbines and towers were scheduled to be dismantled.

Dominion's customers will pay extra until 2047 to fund construction of the Coastal Virginia Offshore Wind project, with a peak of $170/year in 2027

Source: Bacon's Rebellion blog, What the Wind Project Costs You and Who Pays (by Steve Haner)

The Attorney General filed testimony noting that the capital costs for offshore wind would be 2-3 times the cost of building solar resources, and claiming the utility had sufficient capacity to meet demand at least through 2035 without the project.

The General Assembly's specific direction constrained the State Corporation Commission's option to reject the project based on poor cost effectiveness. So long as the Levelized Cost of Energy was below $125 per megawatt, the offshore wind facility was defined to be "in the public interest." The State Corporation Commission was obliged to approve a rate adjustment clause (RAC) would allow the utility to charge customers an extra $170/year to pay for the projected construction and operation of the Coastal Virginia Offshore Wind facility.

The financial risks of new offshore wind developments were high. However, unlike developers of offshore wind projects in New England New Jersey, Dominion Power was not trapped with a fixed sales price for offshore electricity based on fixed-price power purchase agreements.

If the cost of constructing and installing wind turbines off the coastline at Virginia Beach rose higher than expected, Dominion Energy was guaranteed that it could raise the price at which it sold electricity to ratepayers. Ratepayers were "captive" with an obligation to fund 100% of the project costs, while the utility was free to spend unlimited funding for the project without suffering any financial impact. Lower risk of default lowered the cost for Dominion Energy to borrow money for construction.

One critic of the proposal (back when costs were estimated at $8 billion) commented:29

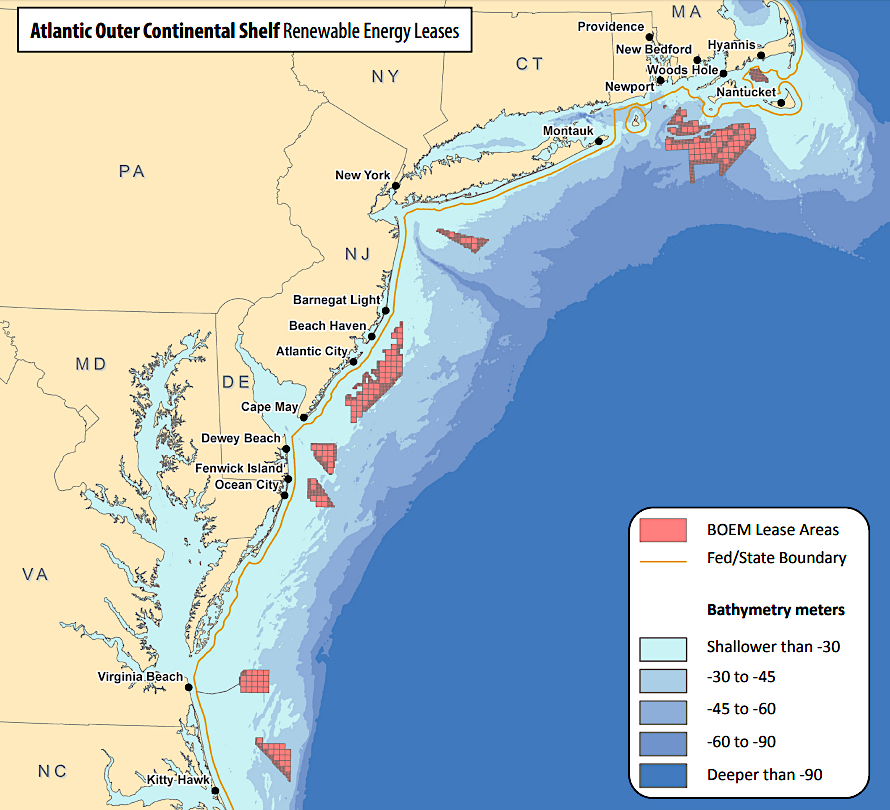

by 2020, the Federal government had leased multiple sites on the Outer Continental Shelf for offshore wind projects

Source: Bureau of Ocean Energy Management (BOEM), Outer Continental Shelf Renewable Energy Leases - Map Book

In its 2022 approval of the project, the State Corporation Commission included a performance guarantee to protect customers. If the wind turbines failed to generate at least 42% of annual net capacity over a three-year period and Dominion had to purchase replacement energy, the utility would have to absorb the costs of that replacement energy.

Dominion Energy immediately argued that the performance requirement was untenable and, unless removed by the State Corporation Commission, the project would be cancelled. In that case, $839 million already invested in the project would be stranded. In October 2022, the Virginia Attorney General (joined by environmental Appalachian Voices and the Southern Environmental Law Center, plus Walmart as a large purchaser of electricity) and Dominion Energy announced a deal that suggested the total price could reach $14 billion.

All performance standards were dropped. If the Coastal Virginia Offshore Wind project was abandoned at the end of 2023 and never generated any electricity, ratepayers were still obliged to pay Dominion Power's $4 billion costs up to that time.

Dominion Energy, unlike every other offshore wind developer in the United States, obtained a government-established guarantee that it could recover its projected costs plus half of any increased costs - up to 40% above initial projections. The utility was prescient. In 2023, eight multinational companies responsible for East Coast offshore wind projects in three states sought to cancel wind contracts or renegotiate deals in order to avoid major financial losses.

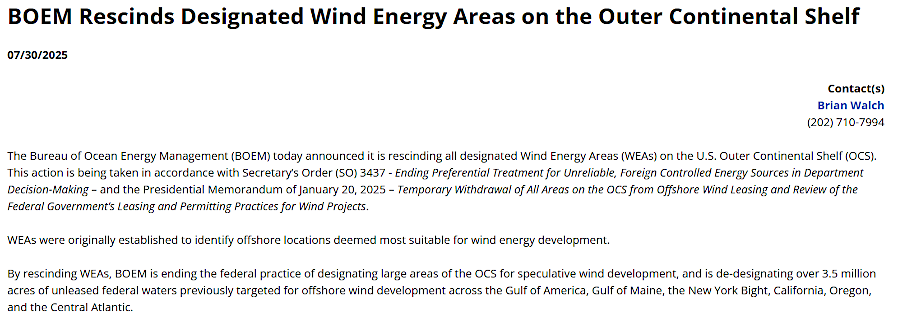

While the final approval by the State Corporation Commission in December 2022 provided no protection for customers against performance risk, ratepayers were somewhat protected from the projected increase in costs. The deal included:30

The State Corporation Commission decision in 2022 determined who would pay for a 40% overrun of capital costs, if they exceeded the projected $9.8 billion. If costs rose above $13.7 billion, then the state agency would have to establish a new formula.

During the 2020 session of the legislature, and in advance of the State Corporation Commission decision, Orsted agreed to lease a portion of the Portsmouth Marine Terminal for use until 2026, during construction of the Coastal Virginia Offshore Wind project. The initial commitment was for only 1.7 acres, but quickly was expanded to 40 of the 287 acres at the terminal. Dominion leased another 72 acres there in 2021.

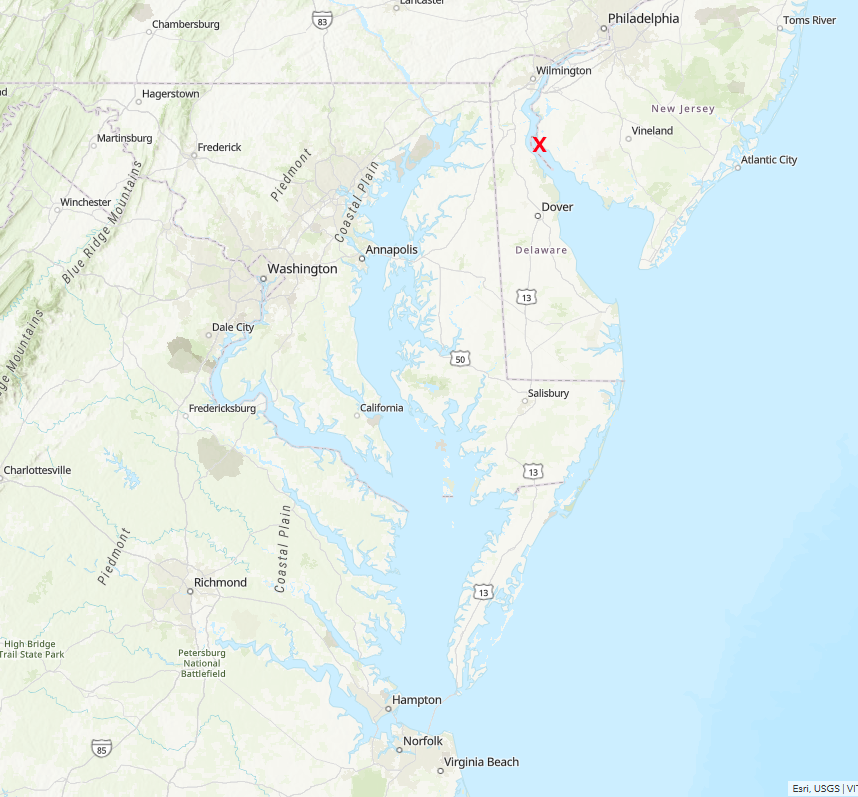

No port on the East Coast had the open space required to grow into an offshore energy megaport equivalent to Hull in the United Kingdom, or Bremerhaven in Germany. Planners anticipated that several places would develop the specialized infrastructure required for assembling turbines, while other ports will be able to support the operations required to service offshore wind farms.

The Port of Virginia planned for Portsmouth Marine Terminal (PMT) to be the support center for offshore wind. By 2020, competitors in other states included Brayton Point in Massachusetts; ProvPort and South Quay in Rhode Island; New London in Connecticut; Arthur Kill, the South Brooklyn Marine Terminal, and the Port of Coeymans in New York; Paulsboro in New Jersey, and Sparrows Point in Maryland.

there were no overhead obstructions at the Portsmouth Marine Terminal (PMT) to limit movement of monopoles that support turbines

Source: Port of Virginia, Creation of the Mid-Atlantic's Offshore Wind Logistics Hub Moves Forward at the Port of Virginia

Gov. Northam claimed the Coastal Virginia Offshore Wind project and other offshore wind energy development would create 14,000 jobs in Virginia in the construction, maintenance, manufacturing and other service-related industries.

The former president at Old Dominion University, a well-respected economist who focused on the Hampton Roads region, questioned that number. He noted that the funding for the project would come from all of Dominion Power's customers in Virginia, since their rates would rise to pay the $8 billion in costs:31

Jobs were expected to benefit more than just Hampton Roads. New College Institute (NCI) in Martinsville became the host institution for the Mid-Atlantic Wind Training Alliance in 2020. Technician training for climbing towers and servicing turbines was designed to meet standards prescribed by the Global Wind Organization. As one instructor told a student:32

assembling and installing turbines on offshore towers required specialized equipment and well-trained personnel

Source: Dominion Energy, The Largest Offshore Wind Farm In America

The Port of Virginia had to reinforce the ground at the Portsmouth Marine Terminal to support the weight of whatever turbines might be assembled there, in anticipation of that site becoming a key part of the supply chain for the offshore wind industry. State and local officials anticipated maritime activity in Hampton Roads could increase to levels not seen since World War II. The deputy director of the Department of Mines, Minerals and Energy was optimistic in 2020:33

However, the New Jersey Wind Port got a head start when the Danish green energy company Ørsted and the German manufacturer EEW committed $250 million to build a manufacturing facility for offshore wind turbines on the Delaware River at the Paulsboro Marine Terminal. First products planned were steel monopiles for offshore wind turbine foundations, including the "Ocean Wind" utility-scale wind project off the New Jersey coast.

The proposed 1.2-gigawatt Beacon Wind farm and the 2.1-gigawatt Empire Wind project were still in the planning phase in early 2022, but construction began of the 12 turbines, 132-megawatt South Fork Wind project off the east end of Long Island.

The governor of New Jersey said in 2020:34

Gov. Northam claimed full-scale development of wind energy projects in the Atlantic Ocean could generate 14,000 jobs for offshore and onshore construction and services

Source: Virginia Department of Mines, Minerals & Energy, Virginia's Offshore Wind Supply Chain and Service Industry Opportunity (July 25, 2018)

Back in 2017, the Bureau of Ocean Energy Management (BOEM) auctioned rights for the Kitty Hawk Wind Energy Area, 27 miles off the North Carolina coast near Kitty Hawk. The winning bidder, Avangrid Renewables, was a subsidiary of the Spanish company Iberdrola. It decided to lay cable from the planned 100 turbines to Sandbridge and build a substation at Corporate Landing Business Park in Virginia Beach, to connect to the electrical grid.

an offshore wind facility 27 miles east of Kitty Hawk will connect to the grid in Virginia Beach to distribute its electricity

Source: Bureau of Ocean Energy Management (BOEM), Outer Continental Shelf Renewable Energy Leases - Map Book

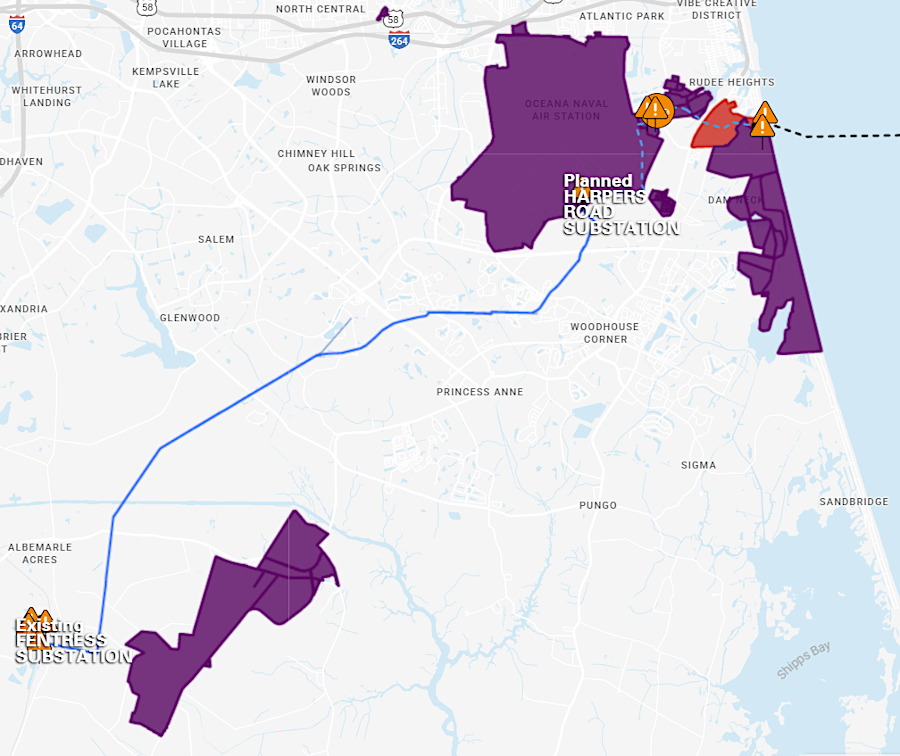

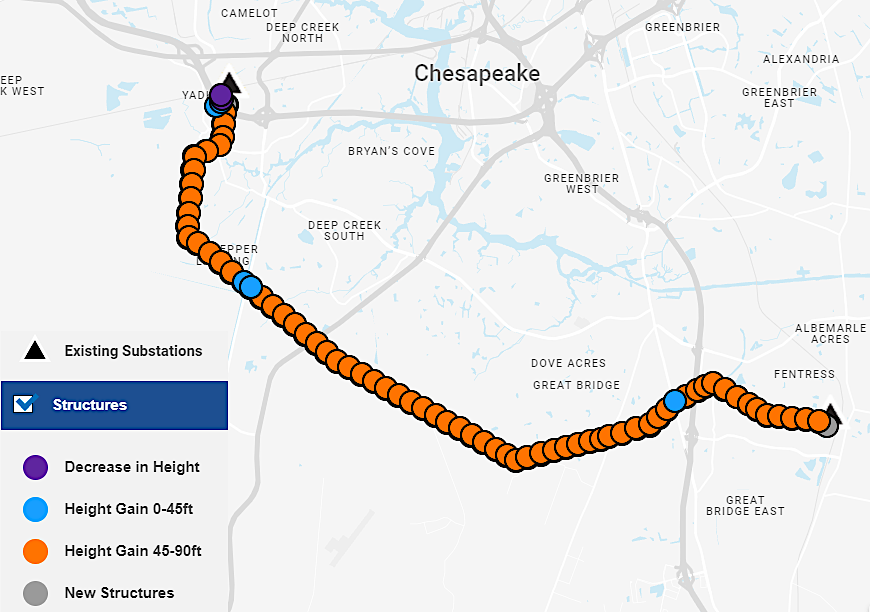

Dominion decided to use an underground cable to transmit electricity from the State Military Reservation/Camp Pendleton (where its subsea cable came ashore) to the Harpers Switching Station at Naval Air Station Oceana. From the connection to the PJM grid there, Dominion planned to build three 230-kilovolt lines to the Fentress Substation.

In a separate project but related to the delivery of additional electricity to the Fentress substation, the utility company panned to upgrade 14 miles of transmission lines linking the Fentress substation to the Yadkin substation in the City of Chesapeake. In a "wreck and replace" project, the one existing 500kV line on lattice structures would be replaced by two 500kV lines on taller monopoles. Two independent transmission lines, with upgraded wiring which could carry additional amperage, would more than double transmission capacity without requiring additional right of way.

Dominion planned a "wreck and replace" project to add a second 500kV line that would deliver offshore electricity to customers beyond the Fentress substation

Source: Dominion Energy, Yadkin to Fentress Transmission Line Project

Dominion Energy needed a wider, 140-foot right-of-way from Naval Air Station Oceana to the Fentress substation. The utility took advantage of a route planned for the Southeastern Parkway and Greenbelt road project. Land was available there after the road was cancelled, though the right-of-way still needed to be widened by up to 105 feet in some places.

Virginia Beach was paid $19 million for an easement across city property between State Military Reservation/Camp Pendleton and Fentress Substation in Chesapeake. Construction required removal of 38 acres of trees, and $1 million was also provided to replace them.

Total cost of right-of-way acquisition was $60 million. Dominion Energy negotiated a price for 95% of the 68 parcels crossed by the new transmission line. For four parcels, the utility had to go through the eminent domain process; a judge on the Virginia Beach Circuit Court determined the price.

The undersea power cable, bringing electricity from the offshore turbines to land, was projected to cost $1.3 billion. Dominion Energy estimated that the rate adjustment clause (RAC) required to fund the offshore project would cost customers $4 per 1,000 kilowatt hours (kWh).

The onshore component of upgrading the transmission grid to the Fentress substation was projected to cost $469 million, up to 17% of the total project cost. Dominion Energy decided that the amount of electricity to be brought to the onshore grid required construction of three separate transmission lines:35

Dominion planned to use the Southeastern Parkway and Greenbelt road right-of-way for its transmission line to Fentress

Source: Dominion Energy, Delivering Wind Power

New Jersey made a bid in 2020 to become the "Houston of American offshore wind." It committed to use 30 acres at Artificial Island on the Delaware River as the assembly point for the offshore turbines, and as a site for manufacturing plants. New Jersey officials suggested that as many as 1,500 jobs could be created there.

New Jersey also proposed becoming the point of entry for transmission lines bringing electricity from offshore facilities to the transmission grid. The state's largest utility partnered with Ørsted to propose a Coastal Wind Link. That transmission line, from multiple projects offshore of New Jersey planned to produce 11,000 megawatts by 2040, to three onshore connection points to the grid.

New Jersey proposed to create an offshore wind turbine manufacturing and assembly center at Artificial Island on the Delaware River

Source: ESRI, ArcGIS Online

The Virginia Coastal Offshore Wind project and all other offshore projects were planning to build their own connection to the grid, requiring multiple interconnection studies by PJM and fragmented upgrades for transmission capacity. The standard interconnection study approach had worked when just a few new power plants were proposed each year, but the scale of the transmission upgrade required by proposed offshore facilities was far greater.

Expanding the concept of Coastal Wind Link to multiple states would require allocating the transmission upgrade costs fairly to different projects regulated by different state agencies. That would be complex challenge, but the engineering and construction of transmission upgrades would be simplified is an offshore "backbone" was constructed.

The European Union planned to develop 384 GW of offshore wind capacity by 2050, expanding from the 20 GW available in 2024. To bring the electricity from turbines to customers onshore, the European Network of Transmission System Operators for Electricity (ENTSO-E) proposed designing a new underwater grid based on sea basins rather than national boundaries.

Five EU Offshore Network Development Plans (ONDPs) were published in 2024, one for each sea basin - North Seas, the Baltic, the Atlantic Ocean, the West Mediterranean, and for the East Mediterranean and Black Sea. "Hybrid" offshore wind farms were expected to connect to two or more countries. Cross-border cost sharing mechanisms, comparable to multi-state regulations in the United States, were needed to create long-term market reliability.

transmission costs for offshore facilities could be reduced, if regulations across political borders could be synchronized

Source: European Network of Transmission System

Operators for Electricity (ENTSO-E), TEN-E Offshore Priority Corridor: Atlantic Offshore Grids (Figure 5)

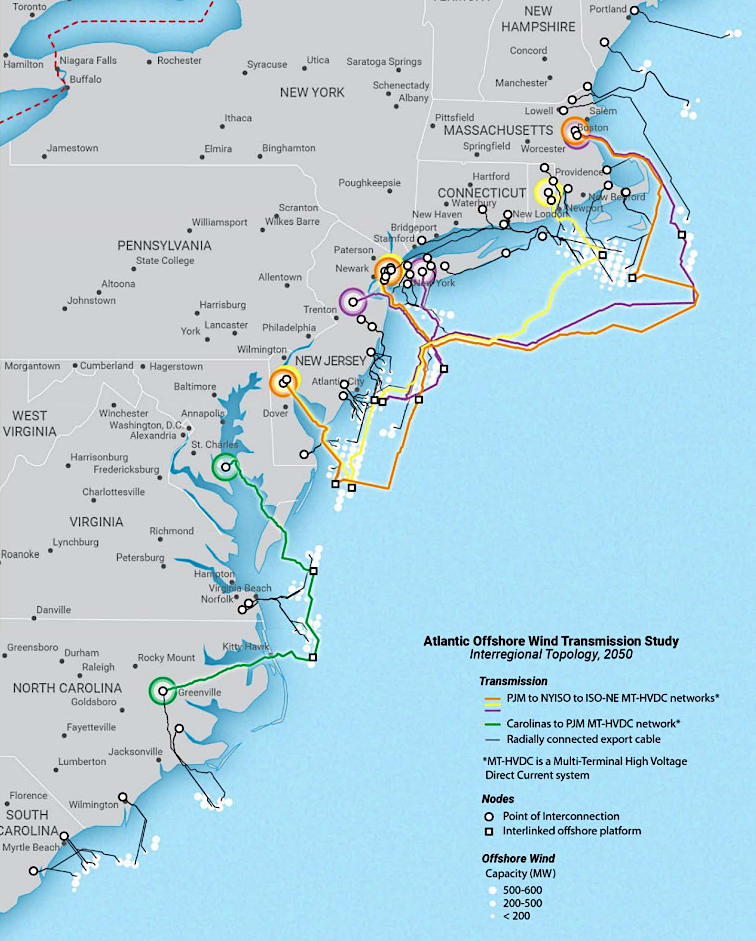

In 2024 the US Department of Energy evaluated for options for constructing a regional electricity transmission network offshore:36

an underwater transmission backbone connecting offshore wind facilities would be more cost-effective than individual connections to the onshore grid

Source: US Department of Energy, Atlantic Offshore Wind Transmission Study (Figure ES-4)

Despite the competition, in 2021 Virginia successfully recruited Siemens Gamesa to manufacture wind turbine blades at the Portsmouth Marine Terminal (PMT). The Port of Virginia agreed to lease the company over 80 acres for 10 years, with an option for two five-year renewals. That was in addition to 40 acres leased to Orsted, plus 72 more acres leased to Dominion Energy staging and pre-assembly of offshore tower foundations and turbines.

Dominion Energy had chosen the Spanish-German wind engineering company to build the 180 turbines needed for the Virginia Coastal Offshore Wind project. The company planned to build blades for 100 turbines annually, meeting demand for other offshore wind projects as well for Dominion Energy. The facility to construct new wind turbine blades at the Portsmouth Marine Terminal was the first of its kind in the United States.

For a bulk storage yard, a "laydown" site for equipment and vehicles to be used for five years during the construction phase, Dominion Energy leased an 18-acre parcel at the corner of London Bridge Road and Norfolk-Virginia Beach Expressway (I-264). That parcel had been purchased by the City of Virginia Beach to protect Naval Air Station Oceana from encroachment by new housing, but the site was suitable for some commercial development.

Dominion Energy leased an 18-acre parcel inland from the shoreline for storage of construction equipment for the Coastal Virginia Offshore Wind (CVOW) project

Source: ESRI, ArcGIS Online

The potential for creating a wind energy hub along the Elizabeth River increased in May 2022. Norfolk Southern Railway announced a 30-year lease of 111 acres, next to its coal docks at Lambert's Point. The docks would be redeveloped into Fairwinds Landing, a $100 million maritime operations and logistics center for the offshore wind energy industry. The site offered over a mile of waterfront, with a 30' deep channel and no bridges restricting shipment of tall turbines to offshore sites.

Fairlead Integrated, an electrical and mechanical product supplier, contracted to occupy much of the site and generate 500 jobs. The company expected to use the site to support both offshore wind energy operations and shipbuilding and repair operations. Material for aircraft carriers being constructed by Newport News Shipbuilding will be stored at Fairwinds Landing.

By 2023, Fairwinds Landing had grown into a $500 million redevelopment project to transform the Lamberts Point Docks. Economic development officials anticipated Norfolk becoming the long-sought hub for the offshore wind industry.

In 2023 Newport News Shipbuilding, the largest industrial employer in Virginia, started building parts of the future USS Enterprise aircraft carrier at Fairwinds Landing. It was the company's first "satellite campus" away from Newport News. Expansion was needed because the shipyard needed extra space for all the construction it had under contract.

At the end of 2023 the Federal government provided a $39 million grant to the Norfolk Economic Development Authority to fund a floating dock and infrastructure needed to load heavy-lift cargo for construction of offshore wind farms. The US Department of Transportation awarded the grant under its Port Infrastructure Development Program to enable Fairwinds Landing (the former Lambert's Point Docks) to serve as the Norfolk Offshore Wind Logistics Port

A nearby competitor for Fairwinds Landing was in Maryland. US Wind decided to use Sparrows Point, site of a massive steel plant until 2012, to prepare monopiles, bend steel plates, and assemble other infrastructure items needed to build the 300MW MarWin and 800MW Momentum Wind facilities off the Maryland Coast. The "Tradepoint Atlantic" site at Sparrows Point also attracted Orsted, which announced in April 2023 that it would build wind turbine foundations and other components there.

Norfolk Southern Railway leased Lamberts Point Docks, across the river from Portsmouth Marine Terminal (PMT), for a maritime operations and logistics center

Source: ESRI, ArcGIS Online

One model for Hampton Roads was the port of Esbjerg, a center of industry in Denmark for support of offshore operations.

State grants helped bring Siemens Gamesa to Portsmouth, in addition to the availability of land on the waterfront, a deepwater port, and the absence of overhead bridges limiting transport of tall towers by ship from land to offshore wind farms. The chairman and president of Dominion Energy made clear how Siemens Gamesa's choice of the Portsmouth Marine Terminal for a $200 million facility was significant:37

no bridges limited transport of tall, pre-assembled towers from Portsmouth Marine Terminal (red X) to offshore projects

Source: ESRI, ArcGIS Online

When the two test turbines were installed in June, 2020, the equipment was manufactured in Europe. The Jones Act prevented the ships delivering the towers, turbines, and blades from stopping at a US port before delivery to the installation site. That Federal law requires that only US-flagged ships can transport cargo between US destinations, including the Coastal Virginia Offshore Wind project site in Federal waters within the Exclusive Economic Zone.

The Offshore Marine Service Association, a trade group representing US firms that own and operate marine service vessels, argued that using ships not registered in the United States to collect offshore sediments was a violation of the Jones Act. That law, technically the Merchant Marine Act of 1920, had been passed after World War I. Forcing shipments between American ports to be carried via American-built and American-staffed ships was intended to maintain a shipbuilding and merchant marine capacity, reducing dependence on ships and sailors from foreign nations who might not be loyal to the United States in a future conflict.

The potential that offshore destinations might be exempt from the Jones Act was eliminated by the Garamendi Amendment to the Outer Continental Shelf Lands Act in 2021. It specified that "non-mineral energy" sites were "coastwise points" subject to the law. However, Federal courts have determined that the pristine seabed does not count as a coastwise point. Non-American ships can carry the first rocks used to protect the base of wind turbine structures on the Outer Continental Shelf. Once a layer of rock is placed on the pristine seabed, the Jones Act does come into force.

In 2019-2020, Dominion hired a Bahamian-flagged vessel with an Eastern European crew to collect geotechnical samples from the seabed where it planned to bury a subsea cable. The trade group filed a complaint with the U.S. Coast Guard and U.S. Customs and Border Protection. The Offshore Marine Service Association argued that delivery of research samples was equivalent to delivery of standard shipping goods, and only US-flagged ships could travel between American ports to resupply and then return with soil samples.

The towers were assembled in Nova Scotia, and three specialized European ships transported them from Halifax directly to the installation site to avoid conflict with the Jones Act. Delays for ships to go back and forth delayed installation. An equivalent project in Europe would have been completed in weeks, but Dominion Energy required a year to install its first two turbines.

The towers were transported in a vertical position, standing straight up. When installed in 2020, each tower stood 620 feet above the water - higher than the Washington Monument.

The lack of a specialized Pile, Foundation, and Wind Turbine Installation Vessel ("WTIV") vessel that met Jones Act requirements revealed the lack of industrial infrastructure for offshore energy. Shipping limitations revealed a clear contrast of reality vs. vision for stimulating economic development through offshore wind projects.

To solve the Jones Act problem, Dominion Resources invested in construction of a US-registered vessel at a Brownsville, Texas, shipyard. It would be available for installation of the hundreds of turbines for the full-scale project, including the next generation of 12-14MW turbines on towers over 800 feet high, and could also be leased to other companies building wind projects offshore.

It cost $300 million to install its first two towers at the offshore site, using ships operating from Nova Scotia. A one-way shipment from a foreign port to a site on the Outer Continental Shelf complied with the Jones Act, but by law the foreign-built ship could not transport the towers from an American port to the installation site.

Dominion Energy calculated that owning an American ship, and operating from a terminal at a Hampton Roads port, would reduce the costs to just $40 million each for the 200 planned towers (not including the initial cost of constructing the ship).

Dominion Energy used a ship from Canada to install the first two offshore wind turbines

Source: Dominion Energy, Project Timeline

Dominion named the new specialized ship "Charybdis." The company that designed ships for offshore wind farm construction had a tradition of naming them after mythical sea creatures.

Dominion planned to lease the ship for other offshore wind projects along the East Coast that will require initial installation of towers/turbines and continuing maintenance operations. Initial costs estimates of $500 million climbed to a projected $625 million, when the ship was 85% complete. Six months later, after deciding to strengthen the deck and reinforce the hull to carry heavier turbines, the estimate had climbed to $715 million. The cost of Charybdis was not included in the total cost of the Coastal Virginia Offshore Wind project.

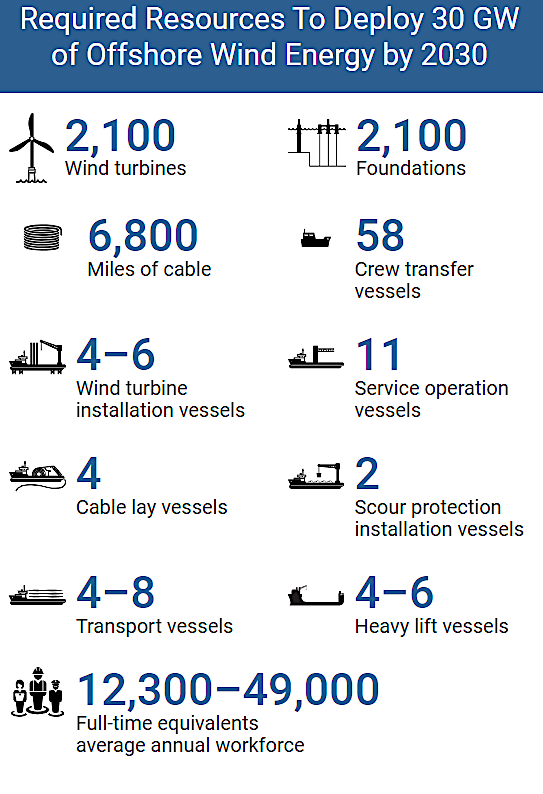

In calculating the supply chain requirements to build 30 GW of offshore capacity by 2030, the US Department of Energy estimated that 4-6 such wind turbine installation vessels were required.

up to six wind turbine installation vessels comparable to Charybdis were required to build 30 GW of offshore capacity by 2030

Source: National Renewable Energy Laboratory, Supply Chain Road Map for Offshore Wind Energy in the United States

WalMart, which filed objections at the State Corporation Commission to the risks and projected increase in the cost of electricity, noted that the ship's availability for the Virginia Coastal Offshore Wind project might be delayed because it was contracted for two other projects first.

Dominion Energy commissioned a new $625 million ship, the Charybdis, to comply with Jones Act requirements

Source: Dominion Energy, Charybdis Launch

A different specialized Service Operations Vessel (SOV), compliant with the Jones Act for offshore construction projects, was completed first. The EDO Edison was christened on May 11, 2024. It was contracted for use on the South Fork Wind, Revolution Wind, and Sunrise Wind projects in northeastern Atlantic Ocean waters. The ship was designed to house 60 wind turbine technicians near the offshore turbines.

illustration of how Charybdis will install 200 turbines

Source: Dominion Energy, Dominion Energy, Ørsted and Eversource Reach Deal on Contract to Charter Offshore Wind Turbine Installation Vessel

In 2022, there were just two operating offshore wind projects, one in Rhode Island and one in Virginia, but there were 35 gigawatts of projects in the pipeline. The director of offshore wind business development for the Hampton Roads Alliance emphasized that Virginia had significant advantages for siting manufacturing, construction, and service facilities for offshore wind projects, and:38

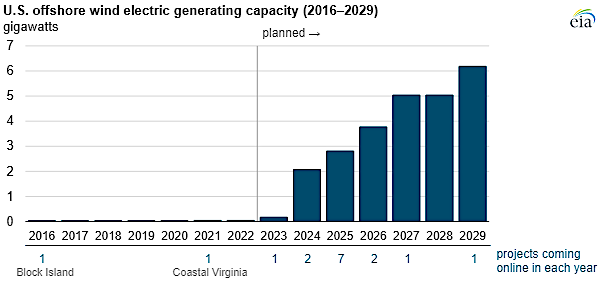

offshore wind projects finally started to expand in the third decade of the 21st Century

Source: US Department of Energy, Developers plan to add 6 gigawatts of U.S. offshore wind capacity through 2029

According to the Attorney General in 2022, however, the economic benefits of the Coastal Virginia Offshore Wind project were speculative and potentially overstated. Dominion Energy submitted to the State Corporation Commission a study of the project's economic development benefits. When the Attorney General's office asked to see documentation supporting claims that the project would create 1,100 jobs after construction of the 176 turbines was completed, the utility could provide no models or data because the report had been done by the Hampton Roads Alliance.

However, the potential for stimulating manufacturing was still clear. In addition to towers, blades, and turbines, offshore substations had to be produced to manage the flow of electricity. Dominion's Coastal Virginia Offshore Wind project required three 880MW offshore substations. They were manufactured in Spain and outfitted in Denmark, creating jobs and stimulating the economy in those two European countries. The offshore wind substation installed in 2023 at the South Fork Wind Farm off Rhode Island was made in Texas.39

offshore substations regulate the transport of electricity from turbines to the onshore destination

Source: pshab, wind-sea substation

One indicator of spinoff economic development was the construction in 2023 of a service operations vessel for workers maintaining and repairing the offshore structures. The "floatel" was intended to provide individual staterooms, food services, and even a cinema room for the technicians so they could stay on site for 15 days each month. Siemens Gamesa chartered the service operations vessel for 15 years, and planned to homeport it in Hampton Roads.40

The Coastal Virginia Offshore Wind project was the first that required a permit from the Federal government, which streamlined the permitting process for offshore wind projects in 2021. The Bureau of Ocean Energy Management and the US Army Corps of Engineers established a partnership for scientific review during the environmental assessment process.

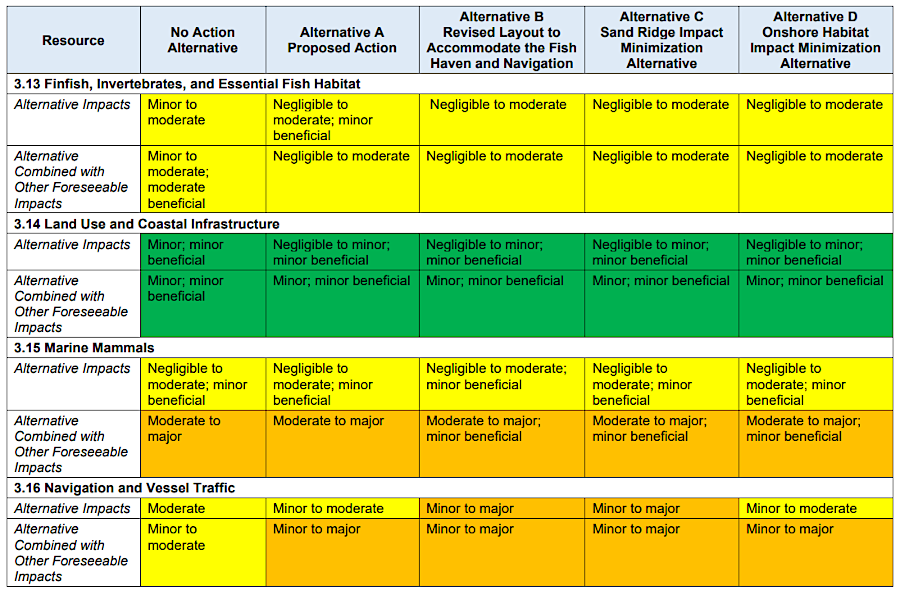

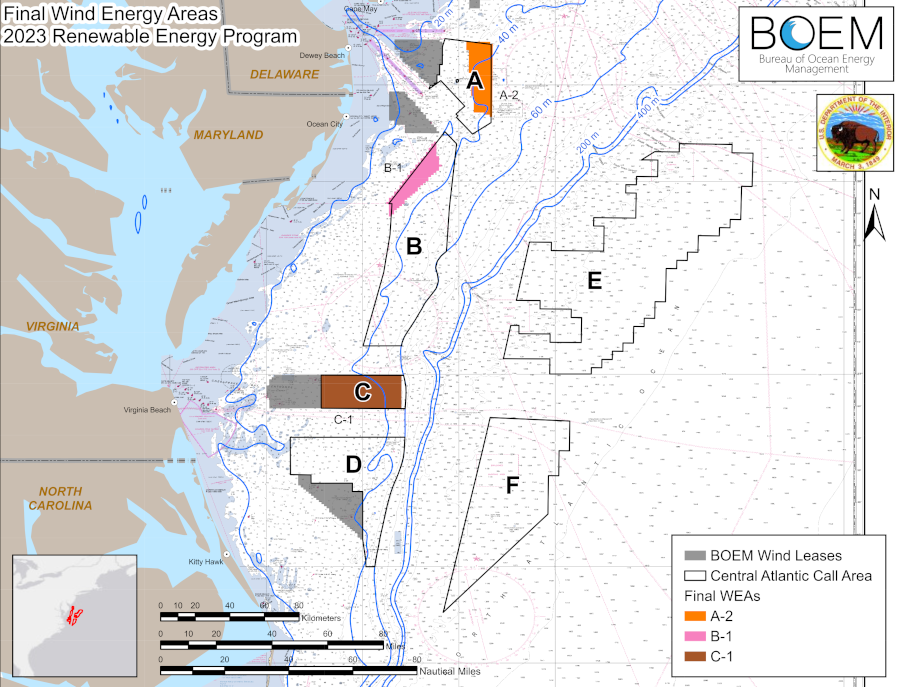

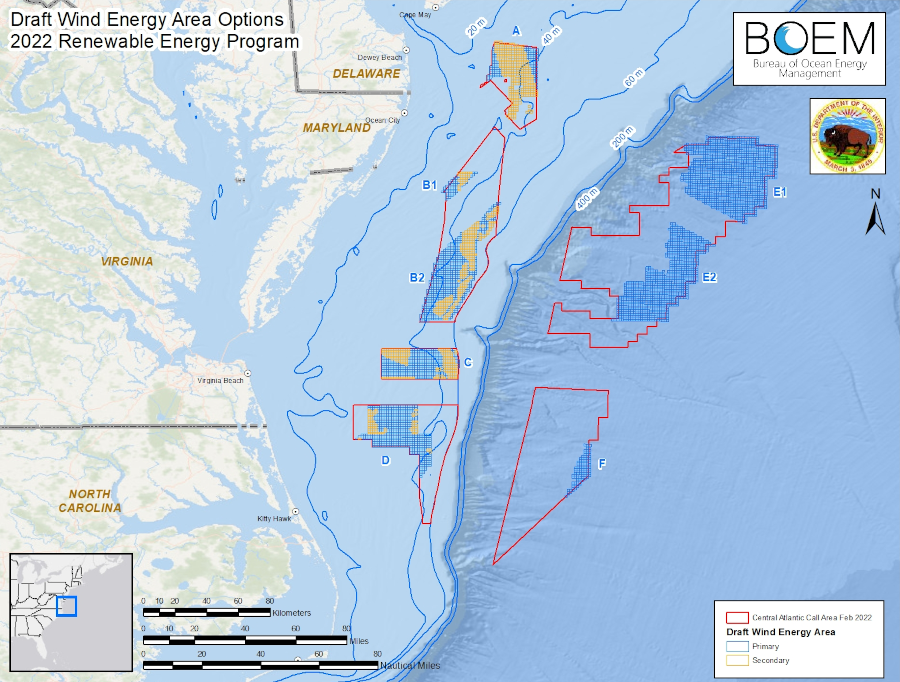

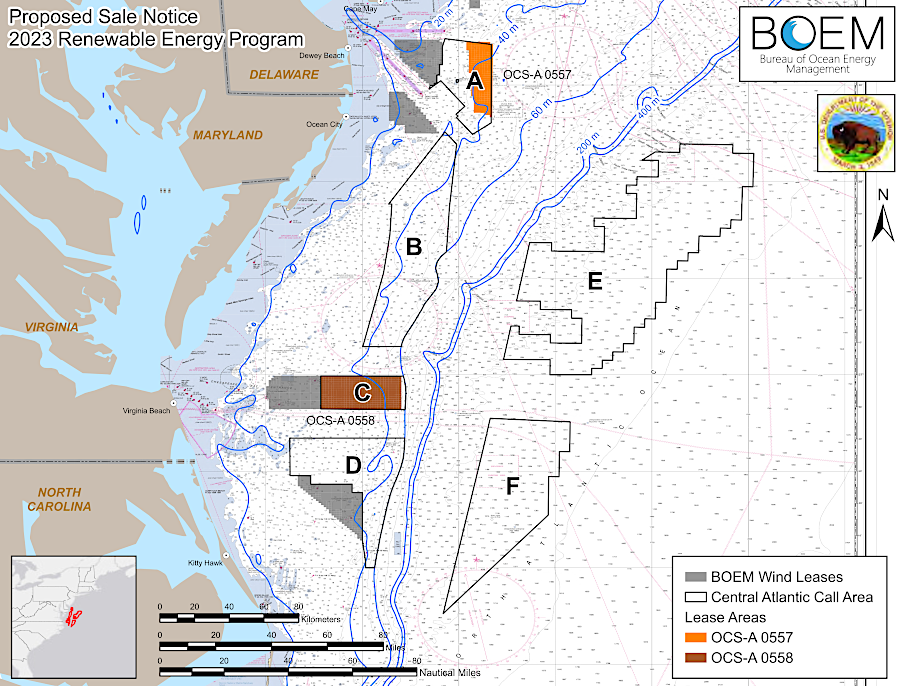

The potential for new offshore wind development increased when the Biden Administration established a goal of deploying 30,000 megawatts (MW) of offshore wind by 2030. The Department of the Interior committed to lease large swaths of Federal waters, recognizing that shipping and fishing interests would identify conflicts with proposed sites of new turbines. A draft Environmental Impact Statement (EIS) was issued by the Bureau of Ocean Energy Management (BOEM) at the end of 2022.

the Bureau of Ocean Energy Management designates Wind Energy Areas (WEA's)

Source: US Department of Energy, Offshore Wind Market Report: 2021 Edition (Figure ES-1)

the Bureau of Ocean Energy Management designated three Wind Energy Areas in the Central Atlantic in 2023

Source: US Department of Energy, Central Atlantic

the draft Environmental Impact Statement assessed impacts as negligible, minor, moderate, or major

Source: Bureau of Ocean Energy Management (BOEM) Dominion Energy

The 2022 National Offshore Wind Strategy concluded that here was enough offshore wind energy potential to equal the current demand for electricity. Since 80% of the demand was in coastal states and most onshore wind projects were in the middle of the North American continent, many offshore projects were expected to become cost-effective as the technology matured.