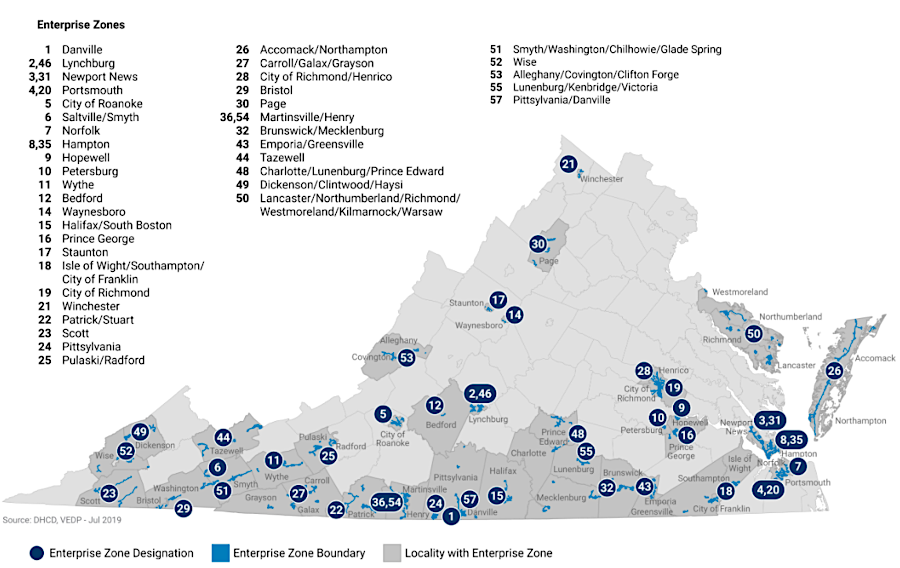

Virginia had 57 Enterprize Zones in 2019

Source: Virginia Department of Housing and Community Development, Virginia Enterprise Zone (VEZ) map

Virginia had 57 Enterprize Zones in 2019

Source: Virginia Department of Housing and Community Development, Virginia Enterprise Zone (VEZ) map

The Virginia Enterprise Zone program is designed to stimulate business development in economically distressed areas. Both new businesses and existing business are eligible. Incentives are provided to encourage business start-up, recruitment and expansion through state and local tax relief, local regulatory flexibility and infrastructure development. Job grants stimulate employment - but to take advantage of the business tax credits, the company has to be profitable.

The Enterprise Zone Act, passed in 1982 by the General Assembly, allows the governor to designate 60 zones. At the state level, Virginia offers a Job Creation Grant (JCG) and the Real Property Investment Grant (RPIG) for investors who create jobs and/or invest in real property within the boundaries of Enterprise Zones.1

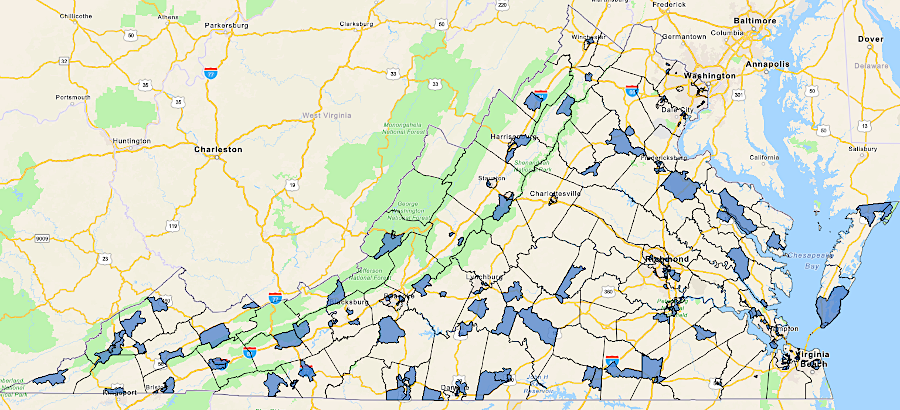

The US Congress passed the Federal Tax Cuts and Jobs Act of 2017 that authorized the establishment of Opportunity Zones to encourage investors to focus on opportunities at low-income urban, suburban and rural census tracts. Based on income, Virginia had 901 eligible census tracts. The law established a maximum of 212 tracts that the governor could nominate, and those would not change until 2028. In 2018 the US Department of Treasury accepted the 212 Qualified Opportunity Zones nominated by Governor Northam.2

Virginia created 212 Opportunity Zones in 2018, for a Federal progrram which incentivized revitalization

Source: Virginia Department of Housing and Community Development, OZ Interactive map